Why do people like lower interest rates?

What happens when interest rates are higher

Higher interest rates make loans more expensive for both businesses and consumers, and everyone ends up spending more on interest payments. The fed funds rate impacts how much commercial banks charge each other for short-term loans.

Cached

Do people spend more with lower interest rates

Lower interest rates stimulate economic growth by making it cheaper for businesses and consumers to borrow money to pay for things like office equipment and new cars. But low interest rates can also potentially encourage overspending and unwise investment, leading to unproductive economic activity and inflation.

Cached

Why do people invest less when interest rates are high

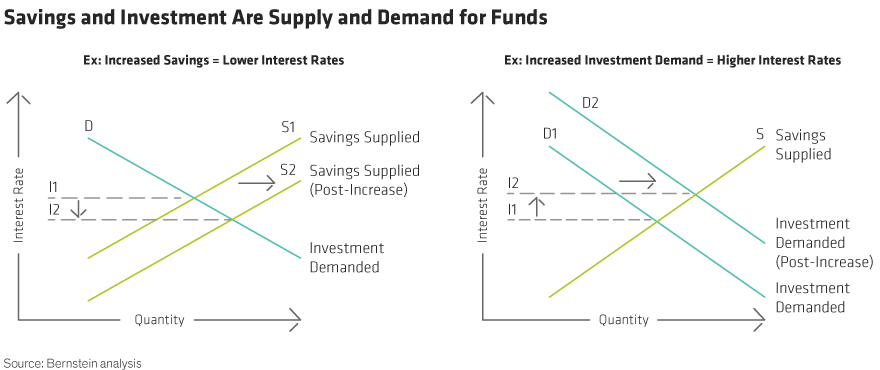

Typically, higher interest rates reduce investment, because higher rates increase the cost of borrowing and require investment to have a higher rate of return to be profitable. Private investment is an increase in the capital stock such as buying a factory or machine.

Who benefits from rising interest rates

There are some upsides to rising rates: More interest for savers. Banks typically increase the amount of interest they pay on deposits over time when the Federal Reserve raises interest rates. Fixed income securities tend to offer higher rates of interest as well.

Is it good or bad to raise interest rates

Higher interest rates may help curb soaring prices, but it also increases the cost of borrowing which can make everyday financial products more expensive, like mortgages, personal loans and credit cards.

Do investors like higher or lower interest rates

Investors and economists alike view lower interest rates as catalysts for growth—a benefit to personal and corporate borrowing. This, in turn, leads to greater profits and a robust economy.

Do banks prefer high or low interest rate

Key Takeaways. Interest rates and bank profitability are connected, with banks benefiting from higher interest rates. When interest rates are higher, banks make more money by taking advantage of the greater spread between the interest they pay to their customers and the profits they earn by investing.

Who benefits the most from inflation

Here are the seven winners who can actually benefit from inflation.Collectors.Borrowers With Existing Fixed-Rate Loans.The Energy Sector.The Food and Agriculture Industry.Commodities Investors.Banks and Mortgage Lenders.Landowners and Real Estate Investors.

Is it better to invest when interest rates are low

A decrease in interest rates by the Federal Reserve has the opposite effect of a rate hike. Investors and economists alike view lower interest rates as catalysts for growth—a benefit to personal and corporate borrowing. This, in turn, leads to greater profits and a robust economy.

Who will higher interest rates hurt

Rate hikes could make it more difficult for older Americans to retire and for current retirees to stay retired. Here's why: Dips in 401(k)s and IRAs. Interest rate hikes usually result in tumbling stocks (the S&P 500 is down about 20% from its 2023 peak), which can play havoc with retirement accounts.

Who benefits from interest rate hikes

The financial sector has historically been among the most sensitive to changes in interest rates. With profit margins that actually expand as rates climb, entities like banks, insurance companies, brokerage firms, and money managers generally benefit from higher interest rates.

What are the disadvantages of low interest rates

Lowering rates makes borrowing money cheaper. This encourages consumer and business spending and investment and can boost asset prices. Lowering rates, however, can also lead to problems such as inflation and liquidity traps, which undermine the effectiveness of low rates.

Do investors benefit from high interest rates

For investors whose primary objective is income, rising rates mean some fixed-income assets may offer attractive yields. Higher yields also tend to make bonds more attractive relative to riskier assets like stocks.

Is the lowest interest rate always the best

One of the more common methods that home loan applicants use to find the best loan program available is to compare interest rates, but choosing the lowest rate possible is not always the best option available. In fact, in some cases, it may be one of the least advantageous options when all factors are considered.

Is it better to have a high or low interest rate on savings

Savers benefit from rising interest rates because the money they have in savings accounts should earn greater returns. Although it does depend on what type of savings account you have.

Do rich people benefit from inflation

This happens because inflation hurts the lower incomes but actually enriches the higher incomes. Imagine a family making $30,000 with no assets seeing a 5 percent annual inflation rate. They see their expense rise by 5 percent (losing $1,800 in buying power due to the inflation) and have no way of making it up.

Who is most hurt by inflation

Low-income households most stressed by inflation

Prior research suggests that inflation hits low-income households hardest for several reasons. They spend more of their income on necessities such as food, gas and rent—categories with greater-than-average inflation rates—leaving few ways to reduce spending .

What are the pros and cons of low interest rates

Lowering rates makes borrowing money cheaper. This encourages consumer and business spending and investment and can boost asset prices. Lowering rates, however, can also lead to problems such as inflation and liquidity traps, which undermine the effectiveness of low rates.

How do you profit from falling interest rates

Take Advantage of Low Interest Rates to Borrow and Reinvest

Experienced investors might borrow money at a low rate and invest it in higher yielding securities. The profit is the difference between the higher return and lower return plus borrowing cost.

Who benefits from falling interest rates

So, if you're trying to catch up on credit card debt, lower rates can provide a little help. Your investments can also benefit from lower interest rates. Since lower rates incentivize borrowing, businesses can make investments in equipment, real estate, and other expansions that can help increase stock prices.