Why do they run your credit for car insurance?

Do car insurance companies run your credit

Which insurance companies don't use credit scores All major car insurance companies — including GEICO, Progressive and State Farm — do a credit check during the quoting process. In fact, credit is one of the major rating factors used by underwriters when determining car insurance rates.

Cached

Why does insurance need your credit score

Insurance companies check your credit score in order to gauge the risk they'll take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

Cached

What does your credit score have to do with car insurance

How does credit affect car insurance prices Nationwide uses a credit-based insurance score when determining premiums. Studies show that using this score helps us better predict insurance losses. In fact, 92% of all insurers now consider credit when calculating auto insurance premiums.

Cached

Is car insurance a hard inquiry

Does getting insurance quotes affect your credit score No, there is no hard credit pull when you get a car insurance quote, so shopping around won't affect your credit score. A hard credit pull generally happens when you apply for credit, such as a mortgage or credit card.

Cached

Do insurance claims affect credit score

Insurance companies don't report information about your premium payments or claims (or lack thereof) to the national credit bureaus. Some insurers use credit checks to help set your premiums, however, and failure to pay insurance bills could lead to negative entries on your credit report.

Does Allstate use credit scores

It's important to understand that while Allstate uses certain elements from your credit history, we never see your credit score, and we're not evaluating your overall credit worthiness. We simply use elements from your credit report that have proven effective in predicting insurance losses.

What is an insurance score based on

Your insurance score is calculated from your credit report to determine how expensive you are to insure. Your credit score is calculated from the same report but to determine how likely you are to go delinquent on a debt.

What might make a car more expensive to insure

Common causes of overly expensive insurance rates include your age, driving record, credit history, coverage options, what car you drive and where you live. Anything that insurers can link to an increased likelihood that you will be in an accident and file a claim will result in higher car insurance premiums.

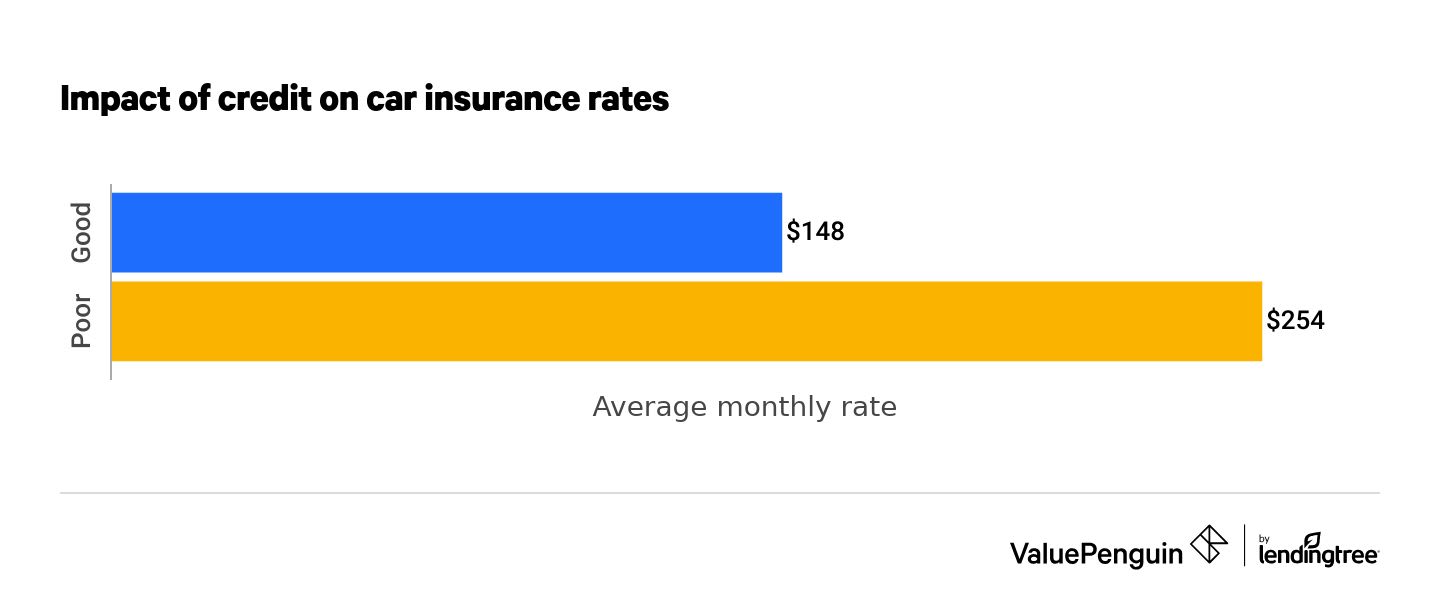

Can car insurance go up because of credit score

If you've ever applied for a credit card, leased a car or gotten a mortgage for a home, you know that credit scores count. You may be surprised to find out they can also affect your car insurance premiums much the same way your driving record, marital status and payment history can.

Will my car insurance go down if my credit score goes up

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states.

Do car insurance companies do a hard or soft credit check

Insurance quotes do not affect credit scores. Even though insurance companies check your credit during the quote process, they use a type of inquiry called a soft pull that does not show up to lenders. You can get as many inquiries as you want without negative consequences to your credit score.

What is a good insurance score

According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

What is the best credit score for insurance

What, then, is a good credit score to get a car insurance policy with competitive prices A score in the “good” range — between 670 and 739, according to the FICO scoring model — is generally considered to be the baseline for competitive pricing.

What is the range of insurance credit score

The higher your insurance score, the better an insurer will rate your level of risk in states where insurance scores are a rating factor. According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

Do insurance companies look at credit score

Although some insurance companies still look at your actual credit report, most insurance companies using credit information are using a “credit score.” A credit score is a snapshot of your credit at one point in time.

How high can an insurance score go

The higher your insurance score, the better an insurer will rate your level of risk in states where insurance scores are a rating factor. According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.

What are 3 factors that lower your cost for car insurance

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

Does the color of your car affect your insurance premium

You may have heard red cars are more expensive to insure. But, according to the Insurance Information Institute (III), the color of the car you drive does not affect the price of auto insurance. Here are some of the factors that help determine your auto premium and what to look for when shopping for car insurance.

Does Geico quote affect credit score

First things first—your credit score won't be impacted.

Insurance-related inquiries are NOT counted against your credit score. If you obtain your credit report from one (or more) of the major bureaus, you will be able to see the inquiry, but it will never lower your score or impact your ability to obtain credit.

Do insurance agents see your credit score

Although some insurance companies still look at your actual credit report, most insurance companies using credit information are using a “credit score.” A credit score is a snapshot of your credit at one point in time.