Why does TurboTax not qualify for refund advance?

Who is eligible for the TurboTax refund advance

To qualify for a tax refund advance from Intuit TurboTax, you must file your federal tax return through TurboTax by February 15, 2023. You also need to meet the following requirements: Federal refund of $500 or more. At least 18 years old.

Cached

Why am I not eligible to pay for TurboTax with my refund

There are several situations where you won't be able to use the Pay With My Refund service, including: You're filing a paper return. You don't have a federal refund. Your federal refund isn't enough to cover the fees.

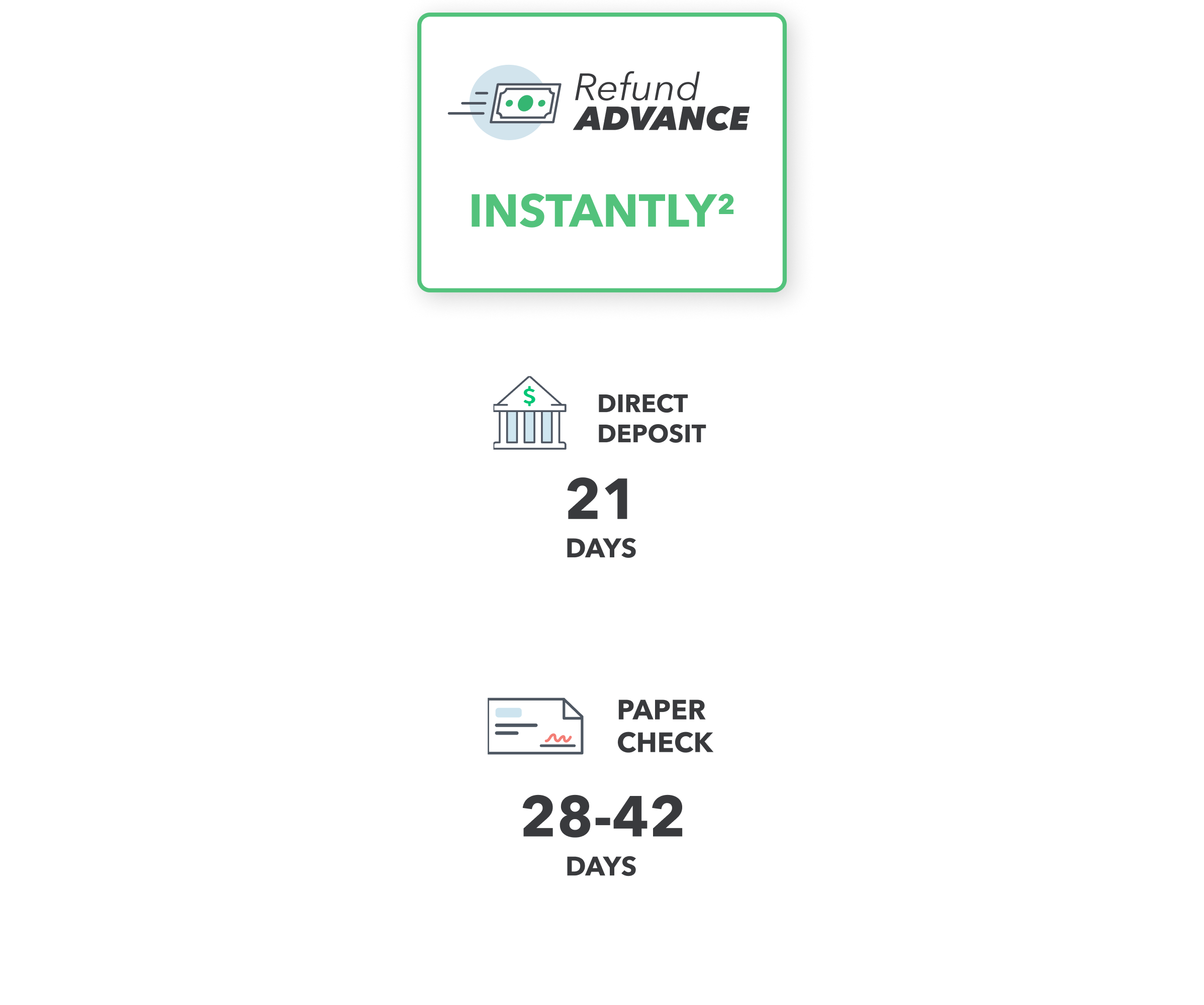

How soon can I get a refund advance from TurboTax

You'll get your Refund Advance funds typically within 15 minutes of the IRS accepting your e-filed tax return (estimated late January). You'll receive an email when your Refund Advance funds are available to spend. You'll receive a physical card in the mail in 7-14 days.

Is refund advance worth it

Traditional refund advance loans often carry origination fees or other fees that turn them into high-interest loans. You may see these loans advertised at Cash Advance shops or on yard signs in neighborhoods. In general, these “traditional” refund advance loans are a rip-off.

Cached

Why didn t TurboTax offer me an advance

You will not be eligible for the loan if: (1) your physical residence is located outside of the United States, a US territory, a PO box or a prison address, (2) your physical residence is in one of the following states: IL, CT, NE, or NC, (3) you are less than 18 years old, (4) the tax return filed is on behalf of a …

Why won t TurboTax give me an advance

Your approved amount is based on the size of your federal refund and your tax information, along with other factors. You may not receive the maximum Refund Advance amount if one of these factors doesn't meet the qualifying standards of the lender.

Can I get an advance on my tax refund with TurboTax

TurboTax Refund Advance is one such program available to select TurboTax customers who use the software to file their tax returns. If you qualify, you can receive a portion of your anticipated refund — between $250 and $4,000 — once the IRS accepts your return.

Why is TurboTax charging me to pay with my refund

If you select Pay with My Refund to pay your TurboTax Fees, there's a processing fee charged by the third-party bank that handles the transaction. Once your e-filed return is in pending or accepted status, it's too late to remove Pay with My Refund.

Why would I be denied for a tax refund advance

You have bad credit.

That means that your tax refund must be large enough after you take out interest rates and fees, as well as any tax prep fees, to pay off the loan. All kinds of things could reduce the amount you actually receive, including tax law changes and offsets (more on those in a moment).

Does TurboTax still do advances

There are $0 loan fees and 0% APR for obtaining a Refund Advance. Separate fees may apply if you choose to pay for TurboTax with your federal refund. Paying with your federal refund is not required for the Refund Advance loan. Additional fees may apply for other products and services.

How to get a $10,000 tax refund

CAEITCBe 18 or older or have a qualifying child.Have earned income of at least $1.00 and not more than $30,000.Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children.Living in California for more than half of the tax year.

Why would you get denied for a refund advance

Your approval is based on the size of your federal refund and your tax information, along with other factors. You may not receive the Refund Advance if one of these factors doesn't meet the qualifying standards of the lender.

Where can I borrow against my tax refund

You can get a tax refund loan from your tax preparation service, including H&R Block, Jackson Hewitt and TurboTax. You might find other local tax preparation services near you, but it's important to do your homework.

How much does TurboTax take out of your refund

#1 Best Selling Tax Software: Based on aggregated sales data for all tax year 2023 TurboTax products. Deduct From Your Federal Refund: A $40 Refund Processing Service fee applies to this payment method.

How do you get denied for the tax advance loan

Your approval is based on the size of your federal refund and your tax information, along with other factors. You may not receive the Refund Advance if one of these factors doesn't meet the qualifying standards of the lender.

Can a tax preparer get me more money than TurboTax

This is part of the value proposition of a tax professional. They may charge a good amount more than TurboTax to file your taxes, but they will often save you more money, time, avoid headaches.

How do I get a large federal tax refund

6 Ways to Get a Bigger Tax RefundTry itemizing your deductions.Double check your filing status.Make a retirement contribution.Claim tax credits.Contribute to your health savings account.Work with a tax professional.

Can you get a refund advance with EITC

The people who most commonly receive tax refund loans are taxpayers who file early in the tax season and claim the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). Under federal law, the IRS cannot provide tax refunds right away for people who claim these credits.

How can I get a loan against my tax refund

Many tax preparation companies—including H&R Block, Jackson Hewitt and Liberty Tax—let their customers borrow against an upcoming U.S. tax refund. While these companies have many brick-and-mortar locations, they also have an online presence, so you can apply for a loan in person or online.

Will TurboTax let you borrow money

If you've e-filed your federal return with TurboTax this year, you can apply for a loan to receive money in as little as one minute the IRS accepts your return*, while you wait to receive the rest of your return–known as a Refund Advance**.