Why dont we qualify for earned income credit?

Why do I not qualify for the Earned Income Credit

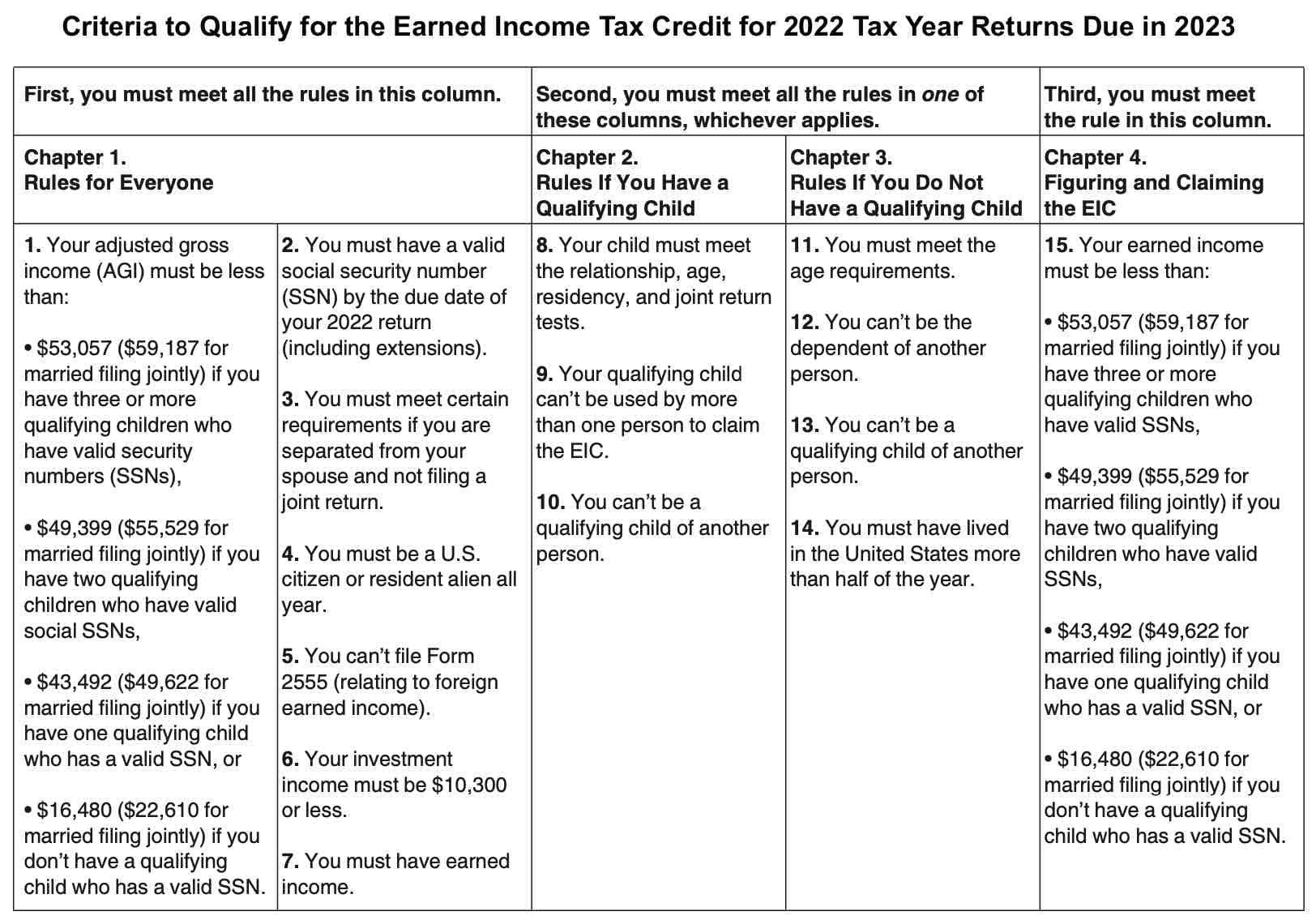

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2023. Have a valid Social Security number by the due date of your 2023 return (including extensions)

Cached

Why wouldn’t I qualify for Child Tax Credit

You do not need income to be eligible for the Child Tax Credit if your main home is in the United States for more than half the year. If you do not have income, and do not meet the main home requirement, you will not be able to benefit from the Child Tax Credit because the credit will not be refundable.

What is the income limit for EIC

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2023 as a working family or individual earning up to $30,000 per year.

Can you get the earned income credit with no earned income

To claim the Earned Income Tax Credit (EITC), you must have what qualifies as earned income and meet certain adjusted gross income (AGI) and credit limits for the current, previous and upcoming tax years.

How do I know if I was disallowed EIC

If the IRS rejected one or more of these credits: EITC, CTC, ACTC or AOTC, you may have received a letter stating that the credit was disallowed. If you wish to take the credit in a future tax year, you must recertify by filing Form 8862 with your tax return.

How do I get a $10000 tax refund 2023

How to Get the Biggest Tax Refund in 2023Select the right filing status.Don't overlook dependent care expenses.Itemize deductions when possible.Contribute to a traditional IRA.Max out contributions to a health savings account.Claim a credit for energy-efficient home improvements.Consult with a new accountant.

Why would the IRS deny Child Tax Credit

Most errors happen because the child you claim doesn't meet the qualification rules: Relationship: Your child must be related to you. Residency: Your child must live in the same home as you for more than half the tax year. Age: Your child's age and student or disability status will affect if they qualify.

What are three requirements to qualify for earned income credit

Who is eligible for the earned income creditYour investment income must have been $10,300 or less in 2023.You must have at least $1 of earned income (pensions and unemployment don't count).You must not have to file Form 2555, Foreign Earned Income; or Form 2555-EZ, Foreign Earned Income Exclusion.

Can a single person qualify for EIC

In 2023, for example, single, heads of household and married filers with one child must have earned at least $10,400 to be eligible for the full credit, according to the IRS. Those earnings can be from wages, salaries, tips or other forms of pay where federal income taxes are withheld, according to the IRS.

How does earned income credit work

The Earned Income Tax Credit (EITC) is a federal tax credit for working people with low and moderate incomes. It boosts the incomes of workers paid low wages while offsetting federal payroll and income taxes.

Can you get an EIC if you don’t owe taxes

EITC is a refundable tax credit, which means that even if you don't owe any tax, you can still receive a refund.

What is not considered earned income by the IRS

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits. For tax years after 2003, members of the military who receive excludable combat zone compensation may elect to include it in earned income.

What triggers an EITC audit

You may trigger an audit if you're spending and claiming tax deductions for a significantly larger amount of money than most people in your financial situation do.

What is the most common EITC error identified by the IRS

Claiming a child who is not a qualifying child for the EITC – This error occurs when taxpayers claim a child who does not meet all four tests for a qualifying child. This is the most common EITC error.

When to expect tax refund 2023 with EITC

The IRS expects most EITC/ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb. 28 if they chose direct deposit and there are no other issues with their tax return.

How do I know if I qualify for earned income credit

The Earned Income Credit income limits

Your earned income and AGI (for 2023) must be less than these limits: With no qualifying children: Maximum AGI $16,480 (filing Single, Head of Household, Widowed, or Married Filing Separately); $22,610 for Married Filing Jointly)

What happens if I didn’t get Child Tax Credit on my taxes

To claim your 2023 Child Tax Credit, you must file a 2023 tax return by April 18, 2025. If you filed a 2023 tax return but didn't get the Child Tax Credit and were eligible for it, you can amend your tax return. Contact your local Volunteer Income Tax Assistance (VITA) site to see if they file 2023 tax returns.

How do I claim the Earned Income Tax Credit

Forms to File

You must file Form 1040, US Individual Income Tax Return or Form 1040 SR, U.S. Tax Return for Seniors. If you have a qualifying child, you must also file the Schedule EIC (Form 1040 or 1040-SR), Earned Income Credit to give us information about them.

Does everyone qualify for earned income credit

Who Qualifies. You may claim the EITC if your income is low- to moderate. The amount of your credit may change if you have children, dependents, are disabled or meet other criteria. Military and clergy should review our Special EITC Rules because using this credit may affect other government benefits.

Can I claim EIC if I have no dependents

If you don't have a qualifying child, you may be able to claim the EITC if you: Earn income below a certain threshold. Live in the United States for more than half the tax year. Meet the age requirements.