Why is it called an ACH?

Why is it called Automated Clearing House

An Automated Clearing House or ACH transaction is an electronic transaction that requires a debit from an originating bank and a credit to a receiving bank. Transactions go through a clearinghouse that batches and sends them out to the recipient's bank.

Cached

What is the difference between a direct deposit and an ACH

ACH transfers are electronic, bank-to-bank money transfers processed through the Automated Clearing House Network. Direct deposits are transfers into an account, such as payroll, benefits, and tax refund deposits.

What is ACH in layman’s terms

An ACH is an electronic fund transfer made between banks and credit unions across what is called the Automated Clearing House network.

Cached

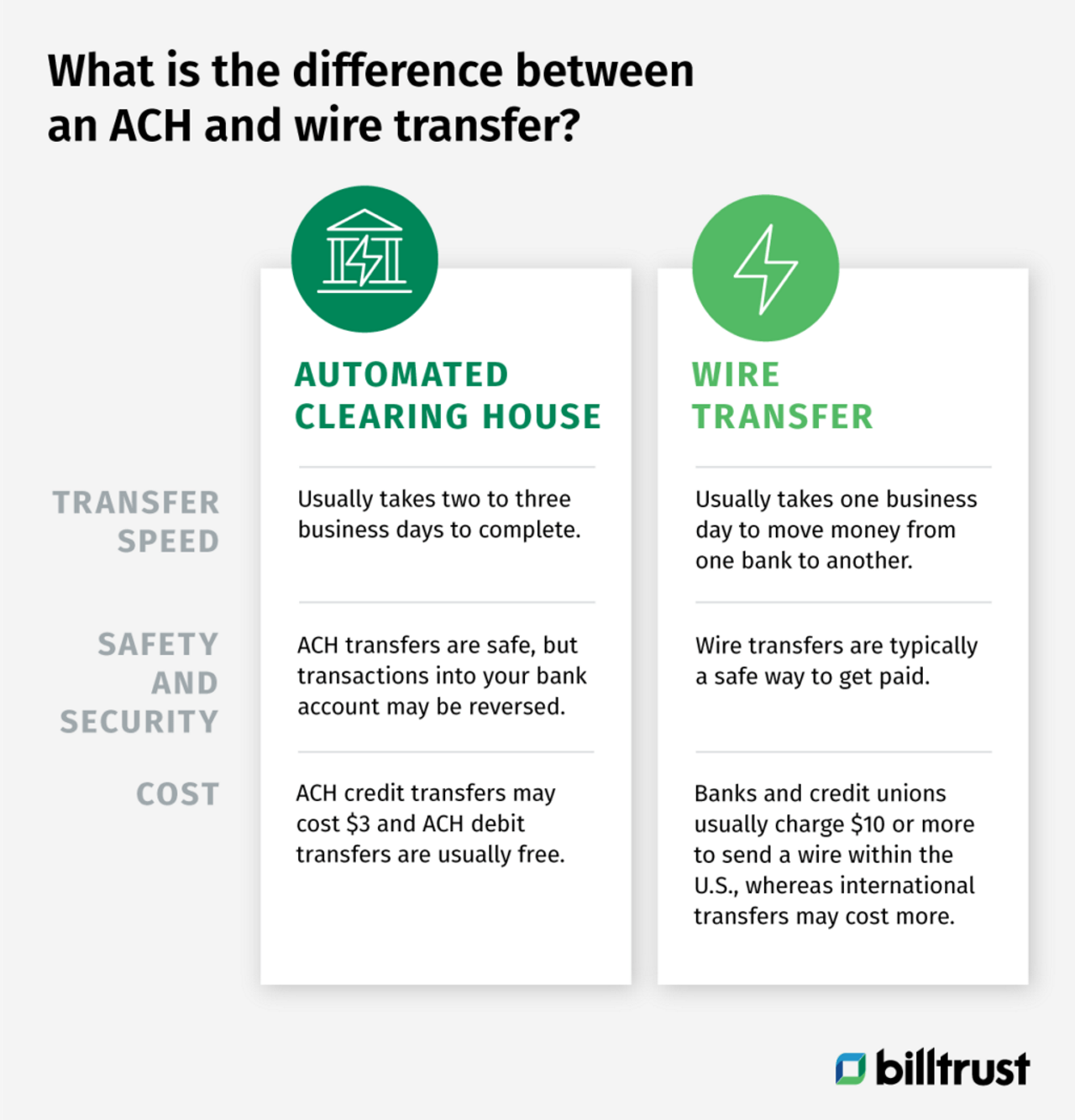

What is the difference between a wire transfer and an ACH

What Is the Difference Between ACH and Wire Transfers An ACH transfer is completed through a clearing house and can be used to process direct payments or direct deposits. Wire transfers allow for the direct movement of money from one bank account to another, typically for a fee.

What is the difference between The Clearing House and the Nacha

What's the difference between Nacha and ACH The Automated Clearing House (ACH) network is the American interbank funds-transferring system run by two national operators: The Clearing House and FedACH. Nacha is the governing body that oversees the ACH network.

What are the two types of clearing house

There are two main types of clearing house; those that are a division of the exchange itself and indistinguishable from the exchange which owns them, and those that are independent of the exchange with their own financial backing. These are commonly known respectively as horizontal or vertical silos.

Is an ACH considered a direct deposit

Is ACH Direct Deposit Direct deposits are a type of ACH payment – so yes, ACH is a direct deposit, but there are also other types of ACH payments. On the other hand, all direct deposits are ACH transfers.

What are the two types of ACH payments

There are two types of ACH transactions: direct deposit and direct payment.

What is the difference between an ACH and a debit transaction

Debit cards are considered to be processed in real-time, and therefore are available sooner. ACH payments need to be batched and processed, which means that the amount of time it takes for the money to be moved from one bank to another is longer.

What is the difference between ACH and debit

The main difference between an ACH credit and an ACH debit is that an ACH credit transaction is initiated by the sender of funds (typically a bank), whereas an ACH debit transaction is initiated by the receiver of funds, where the bank receives a payment request by the payee, and then sends the funds per request.

Which is safer ACH or wire transfer

ACH transfers are a bit safer for senders. Unlike most wire transfers, funds can be reversed in cases of fraud or payment error. The criteria for reversals is usually determined by banks. Wire transfers have little disadvantage for the recipient.

Can ACH and wire routing number be the same

Not necessarily. Both transactions require a 9-digit number, but you will have to verify with the financial institution where you are sending the funds, if the ABA number for ACH or wires are the same, or which routing number should be used for a wire transfer and for the ACH.

What does NACHA mean in banking

Nacha stands for the National Automated Clearing House Association.

Does NACHA require an ACH policy

The NACHA rules and requirements oversee every ACH payment and provide exact guidelines for securely storing, accessing, and transmitting sensitive customer information.

What is the difference between a clearing house and a clearing broker

What is the Difference Between a Broker and a Clearinghouse A broker is a person or entity through with customers can access the financial markets and place trades. The clearinghouse handles the back office operations after the trade is placed, ensuring the trade is cleared.

Is JP Morgan a clearing house

Members of The Clearing House include JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc., Bank of New York Mellon Corp., Deutsche Bank AG, U.S. Bancorp and Wells Fargo & Co.

What is the difference between ACH and check payment

The main differences between ACH vs check payments are cost, security, and speed of delivery. ACH transfers are electronic whereas checks are physical documents that are manually sent – making ACH transfers a safer and more efficient payment method.

What is the difference between ACH and routing

And while they do have similarities — and an ACH routing number is an ABA routing number — there are differences between ACH and ABA routing numbers: ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers.

Why use ACH over wire

ACH transfers are most often used for smaller and more frequent transactions, while wire transfers are generally used for high-value transactions. ACH transfers are much higher in volume. The ACH network processed over $72 trillion in transfers in 2023, across 29 billion transactions.

Is it safe to give account and routing number for ACH

Be stingy with your banking information to avoid bank scams. Know that less is best when it comes to sharing info: Avoid giving your account and routing numbers to people you don't know. Another tip to prevent fraud: Go for multi-factor authentication when banking online.