Why is it hard to get a Chase credit card?

Why is it so hard to get a Chase credit card

While credit scores are very important, Chase credit card approval depends on several other factors, as well. For example, applicants need to have enough income to make payments on the card. Chase will also look at your monthly housing costs and existing debts when considering your application.

Cached

Is Chase Bank hard to get a credit card

You'll need good or excellent credit to get most Chase cards. However, there are plenty of options from other issuers to choose from. A good example is the OpenSky® Secured Visa® Credit Card. There's no credit check when you apply, so approval is almost guaranteed.

Cached

Why am I not getting approved for a credit card Chase

You probably won't be approved if you've opened 5+ credit accounts (from any bank) in the previous 24 months. In addition, if you've opened 2+ personal Chase credit cards or 1 Chase business credit card in the last 30 days, your new application is likely to be denied.

Which Chase credit card is easy to get approved for

Chase Freedom® Student credit card

The best Chase starter credit card is the Chase Freedom® Student credit card because it accepts applicants with limited credit history and reports to the three major credit bureaus on a monthly basis. Freedom Student also rewards cardholders with 1% cash back on all purchases, and it has a $0 annual fee.

What credit score is needed for Chase

For most Chase credit cards, you need at least good credit to be approved, which is a credit score of at least 670. A score of 740 or higher bumps you into the “very good” credit range and gives you an even stronger chance at approval. This score requirement is standard for most rewards credit cards.

Which Chase card is hardest to get

Chase Sapphire Reserve®

The hardest Chase credit card to get is Chase Sapphire Reserve® because it requires a credit score of at least 750 for high chances of approval. This means you need to have excellent credit to get the Chase Sapphire Reserve card, along with plenty of income.

Does Chase approve bad credit

Chase doesn't offer a credit card for bad credit, but you may be approved for the Chase Slate® card with a fair or better credit score. The Chase Freedom® Student credit card also considers applicants who have limited credit, but that is not the same as having bad credit.

Does Chase automatically approve credit cards

Chase approves most credit card applications instantly. As soon as you click submit, you should receive a decision within 60 seconds. However, some applications require further review.

What credit score does Chase require

For most Chase credit cards, you need at least good credit to be approved, which is a credit score of at least 670. A score of 740 or higher bumps you into the “very good” credit range and gives you an even stronger chance at approval. This score requirement is standard for most rewards credit cards.

What Chase credit card I can get with a 670 credit score

The Chase Sapphire Reserve® Card is a premium credit card with a $550 annual fee. As such, it's not surprising to find that its minimum credit score is in the 660 to 670 range.

What FICO score does Chase look at

If you're looking to improve all your scores, focus on building a good credit history. This may make checking your credit score a lot less stressful. Chase Credit Journey® uses the VantageScore® model to generate your credit score.

What credit score is needed for Chase credit card

For most Chase credit cards, you need at least good credit to be approved, which is a credit score of at least 670. A score of 740 or higher bumps you into the “very good” credit range and gives you an even stronger chance at approval. This score requirement is standard for most rewards credit cards.

What are the income requirements for Chase credit card

Chase does not have specific income requirements to get approved for this card. However, all banks compare your income against your debts as part of their application process. With a higher income and lower expenses, you're more likely to be approved for a larger credit limit.

Can I get a Chase credit card with a 550 credit score

Most Chase cards require a score of at least 600, which is about the dividing line between fair and poor credit.

What credit score does Chase use

What credit score does Chase Credit Journey use Credit Journey uses VantageScore 3.0® by Experian. Your lender (including Chase) may not use VantageScore 3.0, so don't be surprised if your lender gives you a score that's different from your VantageScore.

Which credit does Chase pull

Experian™

Which credit bureau does Chase use Chase Credit Journey® gives everyone (even those who aren't Chase customers) access to their credit score through Experian™.

What is Chase minimum credit score

670

For most Chase credit cards, you need at least good credit to be approved, which is a credit score of at least 670. A score of 740 or higher bumps you into the “very good” credit range and gives you an even stronger chance at approval. This score requirement is standard for most rewards credit cards.

How much credit limit will Chase give you

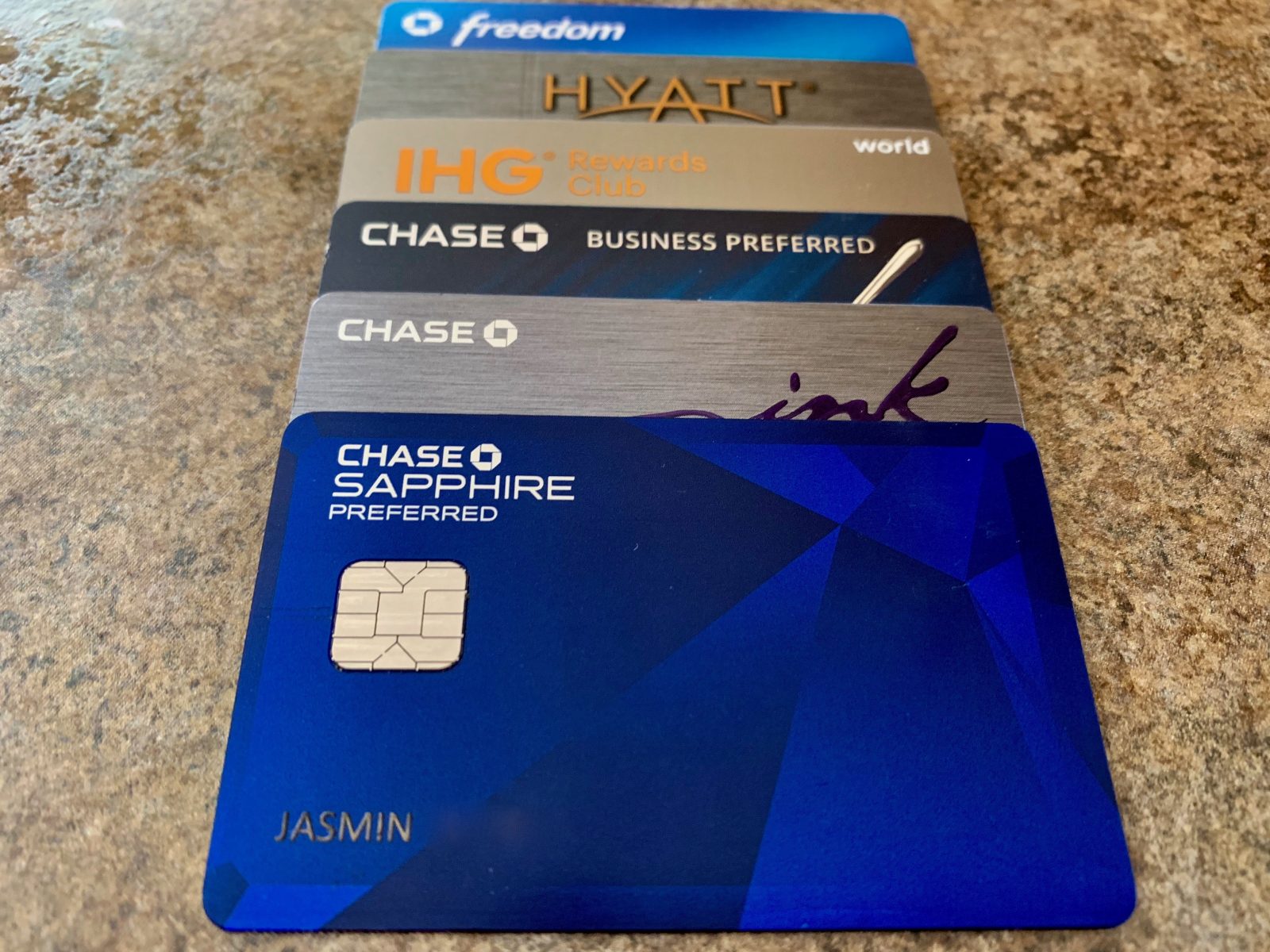

Types of Chase Credit Cards

| Card Name | Approximate Max Credit Limit |

|---|---|

| Chase Sapphire Reserve Card | $500,000 |

| Chase Freedom Unlimited Card | $24,000 |

| Chase Freedom Flex℠ Card | $24,000 |

| Ink Business Preferred® Credit Card Credit Card | $34,000 |

What does Chase consider very good credit score

740 to 799

Exceptional: 800+ Very Good: 740 to 799. Good: 670 to 739. Fair: 580 to 699.

Can I get a Chase card with 650 credit score

If you have an average credit score (around 650), you may have more options than someone with no credit history. You may be able to get approval for premium cards—which have additional perks and benefits—but these could come with a lower credit limit and higher interest rates.