Why is manufacturing overhead a credit?

Is manufacturing overhead a credit

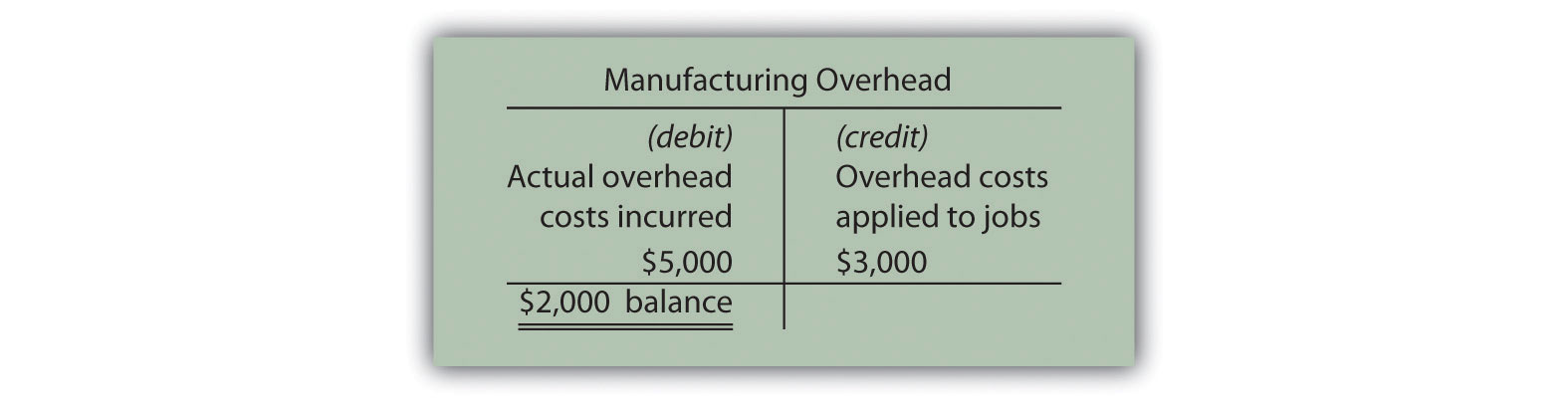

Manufacturing Overhead Account

The overhead account is debited for the actual overhead costs as incurred. The overhead account is credited for the overhead costs applied to production in the work-in-process account.

Is manufacturing overhead a debit or credit

debited

As the overhead costs are actually incurred, the Factory Overhead account is debited, and logically offsetting accounts are credited.

Cached

What does a credit to manufacturing overhead account represent

A credit to the factory overhead account represents actual overhead costs.

Why is manufacturing overhead an asset

Is Manufacturing Overhead An Asset Manufacturing overhead costs become an asset adding value to inventory because it is necessary to produce goods. Manufacturing overhead includes the costs associated with manufacturing processes, including labor, rent, and utilities.

Does manufacturing overhead increase with debit

Factory Payroll and Factory Overhead are temporary accounts that act like assets/expenses meaning Debit will increase and Credit will decrease. Both accounts are zeroed out at the end of the period so they will not appear on a financial statement.

How do you account for manufacturing overhead

First, you have to identify the manufacturing expenses in your business. Once you do, add them all up or multiply the overhead cost per unit by the number of units you manufacture. To get a percentage, divide by your monthly sales and multiply that number by 100.

What is shown on the credit side of manufacturing account

We write the amount of cost of production on the credit side of the Manufacturing A/C and carry it down to the debit side of the Trading Account.

Is Overapplied overhead a debit or credit

When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the overapplication. Doing so results in the actual amount of overhead incurred being charged through the cost of goods sold.

Why is manufacturing overhead debited

A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. If, at the end of the term, there is a credit balance in manufacturing overhead, more overhead was applied to jobs than was actually incurred.

Is Overapplied debit or credit

When overhead has been overapplied, the proper accounting is to debit the manufacturing overhead cost pool and credit the cost of goods sold in the amount of the overapplication. Doing so results in the actual amount of overhead incurred being charged through the cost of goods sold.

Is overhead control account a debit or credit

Factory Overhead Control Account:

It is debited by the amount of indirect material, indirect labour and indirect expenses incurred. This account is credited by the amount of overhead recovered.

What does a credit balance in the manufacturing overhead account at the end of the year

A credit balance in the Manufacturing Overhead account at the end of the year means that overhead was underapplied. Indirect materials are not charged to a specific job but rather are included in the Manufacturing Overhead account.

Does a credit balance in the manufacturing overhead account mean overhead was enter either overapplied or underapplied

If manufacturing overhead has a debit balance, the overhead is underapplied, and the resulting amount in cost of goods sold is understated. The adjusting entry is: If manufacturing overhead has a credit balance, the overhead is overapplied, and the resulting amount in cost of goods sold is overstated.

What happens when overhead is Overapplied

Sometimes the estimate is more than the actual amount and sometimes it's less than the actual amount. Overapplied overhead happens when the estimated overhead that was allocated to jobs during the period is actually more than the actual overhead costs that were incurred during the production process.

What is the journal entry for manufacturing overhead

To allocate manufacturing overhead, Work-in-Process Inventory is debited and Manufacturing Overhead is credited. Work-in-Process Inventory is treated as an current asset, and increase the assets of the company and Manufacturing Overhead is decreased, which increases equity of the company.

When manufacturing overhead has a debit balance

If, at the end of the term, there is a debit balance in manufacturing overhead, the overhead is considered underapplied overhead. A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied.

What type of account is manufacturing overhead control

Manufacturing overhead costs are called indirect costs because it's hard to trace them to each product. These costs are applied to the final product based on a pre-determined overhead absorption rate.

What heads debit or credit in accounting

Debits are recorded on the left side of an accounting journal entry. A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account. Credits are recorded on the right side of a journal entry.

What account is credited when overhead cost is applied to work in progress

manufacturing overhead control account

Answer and Explanation: What account is credited when overhead cost is applied to Work in Process The credited account is the manufacturing overhead control account or manufacturing overhead account.

Do you debit or credit Underapplied overhead

Underapplied overhead is normally reported as a prepaid expense on a company's balance sheet and is balanced by inputting a debit to the cost of goods sold (COGS) section by the end of the year.