Why is my Chase Sapphire not approved?

Why can’t i get approved for Chase Sapphire

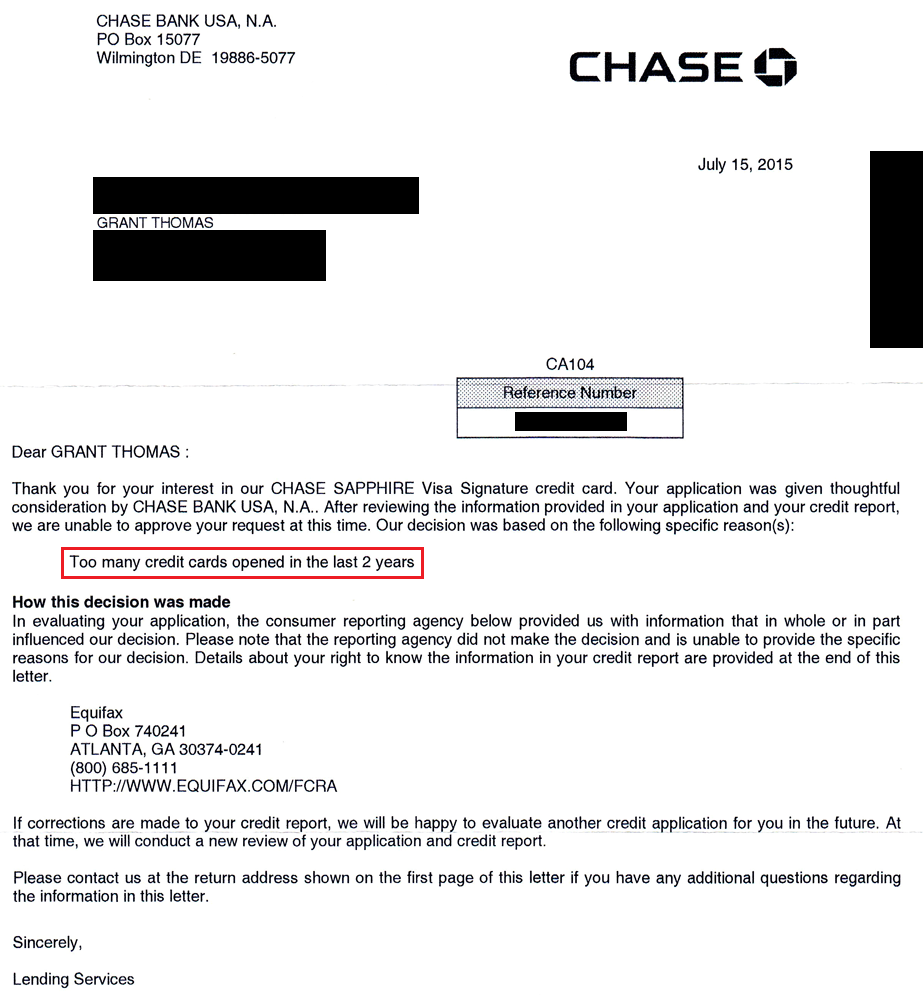

Your Chase 5/24 count. You won't be able to get this card if you're not under Chase's unpublished (but widely known) 5/24 rule. That means if you've opened five or more credit cards in the last 24 months (from any bank), your chances for approval are slim to none.

Cached

Is Chase Sapphire hard to get approved

The Chase Sapphire Preferred® Card is hard to get because you'll need good to excellent credit to have a chance at getting approved. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for Chase Sapphire Preferred.

Why would I not get approved for a Chase credit card

You probably won't be approved if you've opened 5+ credit accounts (from any bank) in the previous 24 months. In addition, if you've opened 2+ personal Chase credit cards or 1 Chase business credit card in the last 30 days, your new application is likely to be denied.

Cached

What salary do I need for Chase Sapphire Preferred

$30,000 per year

What does your credit score need to be for the Chase Sapphire Preferred card While there is no set score needed, we recommend you have a credit score of at least 670, a clean 2 years of credit history, and an income of at least $30,000 per year.

How much income do I need for a Chase Sapphire card

$30,000 per year

The Chase Sapphire Preferred income requirement is at least $30,000 per year, based on user reports. Chase doesn't publicly disclose the Sapphire Preferred Card's income requirements, but they are required by law to consider a new cardholder's ability to make the minimum monthly payments on their assigned credit line.

What salary do you need for Chase Sapphire

$30,000 per year

The Chase Sapphire Preferred income requirement is at least $30,000 per year, based on user reports. Chase doesn't publicly disclose the Sapphire Preferred Card's income requirements, but they are required by law to consider a new cardholder's ability to make the minimum monthly payments on their assigned credit line.

What is the typical Chase Sapphire credit limit

$10,000

Chase Sapphire Preferred® Card

If you're approved for this card, the reported minimum credit limit you can receive is $5,000. The average credit limit on this card is $10,000, and about 10% of cardholders report a credit limit that exceeds $20,000.

Why does Chase keep rejecting my application

You May Have Too Many Credit Accounts

Some issuers have explicit rules on how many cards they think is reasonable; one well-known one is the Chase “5/24” Rule. This rule discourages customers from applying if they've opened five or more accounts in the past 24 months since it's often an automatic rejection.

Does 7 10 days mean denial

7-10 Days Status Message

A 7-10 day message typically means that your application has been denied.

How do I get pre approved for Chase Sapphire

Existing Chase cardholders may receive preapproval offers by email or in their Chase accounts. Keep an eye out for offers when logging in to make payments or use reward points. You can also go to a Chase branch and speak to a representative to see if you are preapproved for any card offers.

What is the credit limit for Chase Sapphire

The Chase Sapphire Preferred credit limit is $5,000, at a minimum. But some cardholders can get a credit limit higher than that.

What is the minimum credit limit for Sapphire

The Chase Sapphire Preferred credit limit is $5,000, at a minimum. But some cardholders can get a credit limit higher than that.

Is Chase Sapphire good for beginners

The Chase Sapphire Preferred® Card is a great entry-level card if you're new to credit card rewards. The Chase Sapphire Preferred pairs well with other cards that earn Chase Ultimate Rewards® points. Read Insider's guide to the best rewards credit cards.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

What is the lowest credit limit for Chase Sapphire

$5,000

The Chase Sapphire Preferred credit limit is $5,000, at a minimum. But some cardholders can get a credit limit higher than that.

How often can I apply for Chase Sapphire

“One Sapphire Rule”

You cannot apply and get approved for a Sapphire card if you currently have an open one. You can have an open Chase Sapphire Reserve, Chase Sapphire Preferred® Card, OR a Chase Sapphire card, but not more than one at a time.

Why does Chase take so long to approve a credit card

Factors that need reviewing: Chase looks at your credit history, income, debt, housing status, and number of recently-opened cards, among other things, when deciding whether to approve your application. Approval time: Chase credit card applications are usually under review for 7-10 business days.

How long does it take Chase to make a decision

If you're applying over the phone or in person, and you've submitted all the correct information, you may also get a decision within minutes. Mail-in applications are the slowest option, taking several weeks sometimes. The key to a fast approval is to make sure your credit history is in good shape before applying.

What is the minimum credit score for Chase Sapphire card

Generally, you'll need to have a credit score of at least 700 in order to qualify for the Chase Sapphire Preferred® Card.

What is the starting credit limit for Chase Sapphire

$5,000

Chase Sapphire Preferred® Card

If you're approved for this card, the reported minimum credit limit you can receive is $5,000. The average credit limit on this card is $10,000, and about 10% of cardholders report a credit limit that exceeds $20,000.