Why is my credit card so heavy?

Why are credit cards so heavy

The heaviest credit cards are metal rather than plastic, giving them an air of permanence and solidity. Just holding one in your hand can make you feel, well, good. Modern plastic credit cards weigh around 5 grams (5g). The heaviest metal card is more than five times heavier.

Cached

How much does a credit card weigh

about 5 grams

Plastic cards weigh about 5 grams, while most metal cards weigh somewhere between 13 to 18 grams.

Cached

Are some credit cards heavier than others

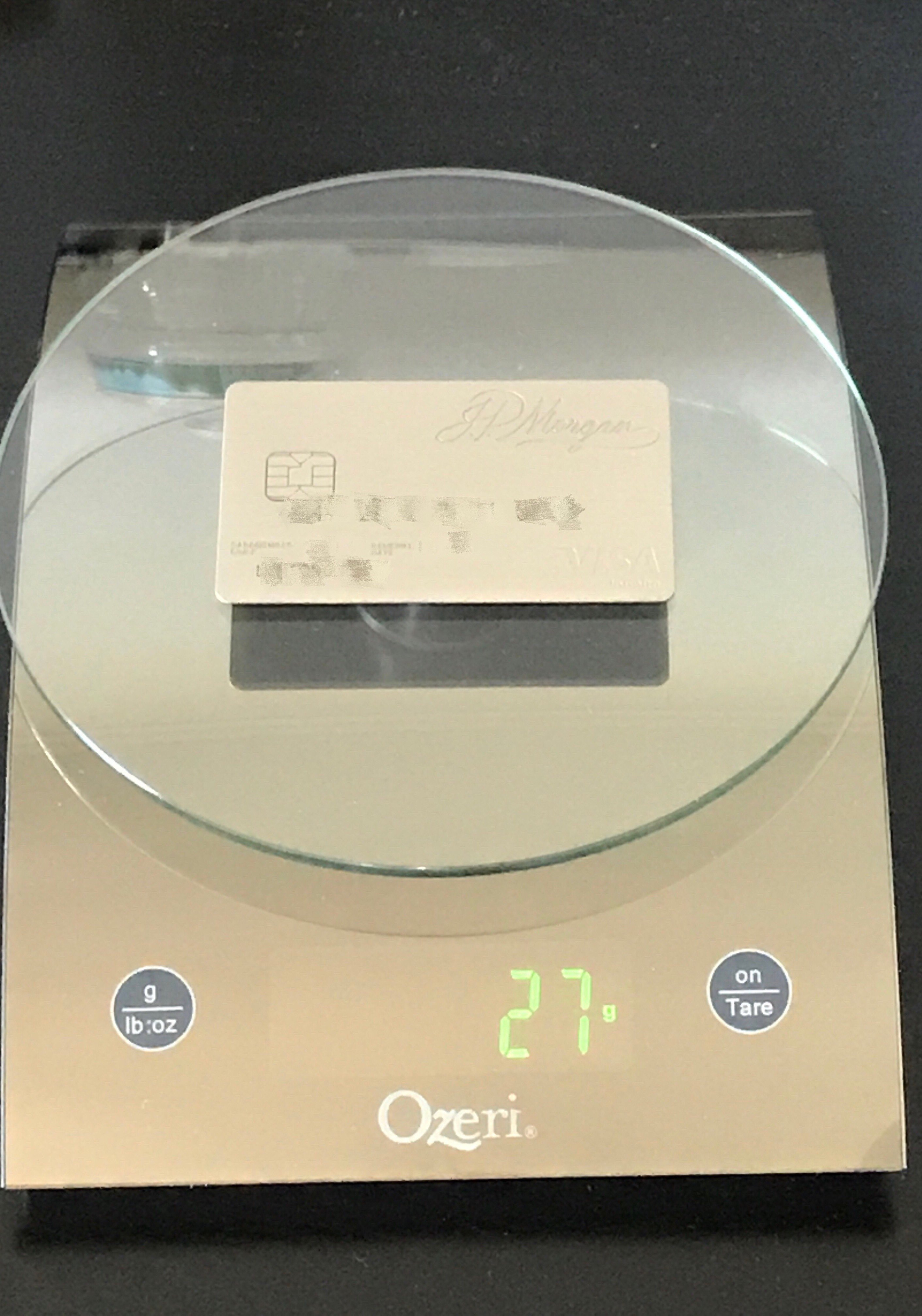

Some of the heaviest credit cards on the market, like the J.P. Morgan Reserve, are difficult to get for most consumers. Most widely available premium rewards cards are 12 grams or heavier. The Platinum Card® from American Express weighs 18.5 grams, while the Chase Sapphire Reserve® weighs 12.6 grams.

Cached

Is $1000 on a credit card bad

A $1,000 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest. The average credit card limit overall is around $13,000. You typically need good or excellent credit, a high income and little to no existing debt to get a limit that high.

Is it bad to use 90% of your credit card

90% – 99%: 90% credit utilization is a bad milestone for your credit score, as it means you've nearly maxed out at least one credit card account. And the more accounts in this boat, the further your credit score will sink.

Do rich people have a lot of credit cards

While millionaires are less likely to have a cash back card than the average American, they're more likely to have every other major type of credit card, including travel rewards cards, balance transfer cards, gas and grocery cards, and sign-up bonus cards.

Why is the American Express card heavy

Chip Lupo, Credit Card Writer

Yes, the American Express Platinum card is made out of metal. The American Express Platinum card is made of stainless steel and weighs 18.5 grams, compared to a traditional card made of plastic, which only weighs 5 grams.

Is a black card heavy

Mastercard Black Card: Heaviest credit card

The Mastercard Black Card is one of three cards offered by Luxury Card. The Black Card weighs 22 grams and is designed with a black-PVD-coated stainless-steel front and carbon back.

What is the heavy credit card called

Recap of the best metal credit cards

| Card name | Weight |

|---|---|

| Mastercard Titanium Card | 22 grams |

| Mastercard Black Card | 22 grams |

| Mastercard Gold Card | 22 grams |

| Delta SkyMiles® Platinum American Express Card | 15 grams |

How heavy is the Amex black card

about 14 grams

The American Express Black Card comes in personal and business variants. The physical card is made of anodized titanium and weighs about 14 grams (half an ounce), around that of a compact disc.

Is a 15k credit card limit good

Yes, a $15,000 credit limit is good, as it is above the national average. The average credit card limit overall is around $13,000, and people who have higher limits than that typically have good to excellent credit, a high income and little to no existing debt.

How much should I spend on a $5000 credit card

What's Your Credit Card Balance To Limit Ratio

| Credit Limit | Fair Utilization (40%) | Good Utilization (30%) |

|---|---|---|

| $500 | $200 | $150 |

| $2,000 | $800 | $600 |

| $3,000 | $1,200 | $900 |

| $5,000 | $2,000 | $1,500 |

How much should I spend if my credit limit is $1000

A good guideline is the 30% rule: Use no more than 30% of your credit limit to keep your debt-to-credit ratio strong. Staying under 10% is even better. In a real-life budget, the 30% rule works like this: If you have a card with a $1,000 credit limit, it's best not to have more than a $300 balance at any time.

How much should I spend if my credit limit is $5000

This means you should take care not to spend more than 30% of your available credit at any given time. For instance, let's say you had a $5,000 monthly credit limit on your credit card. According to the 30% rule, you'd want to be sure you didn't spend more than $1,500 per month, or 30%.

What is the rarest credit card in the world

the Centurion® Card from American Express

The rarest credit card in the world is likely the Centurion® Card from American Express, also known as the “Black Card.” This card is available by invitation only, and you will reportedly need to spend at least $250,000 per year on other Amex credit cards and have an income of $1 million+ to get it.

What card do millionaires use

One of the best credit cards for millionaires is from Chase. You may not have heard of the J.P. Morgan Reserve Credit Card from Chase. That's because it's only for customers who have at least $10 million in assets under management from J.P. Morgan Private Bank.

What is the hardest card to get in American Express

Centurion® Card from American Express

Why it's one of the hardest credit cards to get: The hardest credit card to get is the American Express Centurion Card. Known simply as the “Black Card,” you need an invitation to get Amex Centurion.

Why is the Amex Black Card so special

The Amex black card gets you free access to more than 1,400 airport lounges around the world, including Amex Centurion Lounges, Delta Sky Clubs when you're flying Delta, and Priority Pass airport lounges**. You can sit back and relax on the comfortable chairs while indulging in some good food and drinks.

Who qualifies for a black card

How much do you have to make to get Amex's black card There aren't any income requirements per se, but you most likely need to be a high spender on your Amex cards. If you're in the ballpark of $250,000 to $500,000 in annual spending across all your open Amex cards, you may qualify for the Centurion card.

How rare is a black card

How To Get a Black Card. Members of the 1% — or perhaps the 0.1% — may get an invitation for a black card, as some of these high-status cards are only available to consumers that the issuing bank deems worthy.