Why is my CTC not showing up?

Why I haven’t received my Child Tax Credit payment

There are two ways to start the trace — by phone or by mail/fax. To make the request by phone, call the IRS 800-919-9835. If you'd rather send the request by mail or fax, send a completed Form 3911, Taxpayer Statement Regarding Refund. Note: If you file jointly, BOTH spouses must sign the form.

Cached

What if I never received my CTC payment

If you still haven't received your CTC payment, you can call the IRS at (800) 919-9835 or (800) 829-1040, or you can fill out Form 3911 and mail or fax the completed form to the appropriate address. Do not mail the form if you have already requested an IRS payment trace by phone.

Will CTC be deposited on the 15th

Families who got their refunds from the IRS through direct deposit will get these payments in their bank account around the 15th of every month until the end of 2023. People who don't use direct deposit will receive their payment by mail around the same time.

Is child tax credit delayed

The bigger and better child tax credit from 2023 is not extended to 2023. It is replaced by a new set of rules for taking the credit on 2023 returns.

Can I track my child tax credit refund

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

Why are CTC payments delayed

The IRS said checks were delayed for some taxpayers "who recently made an update on their bank account or address on the IRS Child Tax Credit Update Portal and affected payments to married filing jointly taxpayers where only one spouse made a bank or address change."

How do I check to see if my child tax credit is coming

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

Is there a December 15 child tax credit payment

Most eligible families received payments dated July 15, August 13, September 15, October 15, November 15 and December 15. For eligible families, each payment is up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17.

What time does IRS deposit CTC payments

For every child 6-17 years old, families will get $250 each month. For every child under 6 years old, families will get $300 each month. The 80% who get their refunds from the IRS through direct deposit will get these payments in their bank account on the 15th of every month until the end of 2023.

Does CTC delay refund 2023

Note: The IRS will delay processing by 2-3 weeks if an income tax return has the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC), which allows the IRS to verify that taxpayers qualify for the credits.

How long does it take for the child tax credit to be deposited

People who receive payments by direct deposit get their payments on the 15th of every month. (In August the payment will go out on August 13th since the 15th falls on a weekend.)

How do I check my CTC status

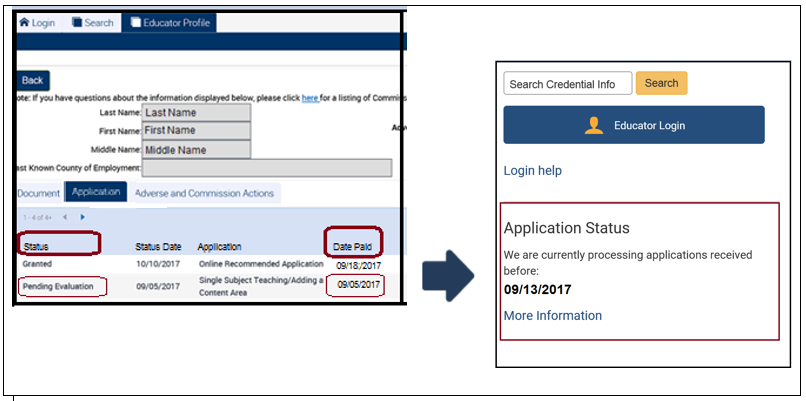

How can I monitor my application status online You can monitor the status of your application(s) over the web by logging into the CTC Online system. If you are unable to login, please visit Login Help for assistance.

How do I track my EIC payment

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.

Can I track my Child Tax Credit check

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

Why is my Child Tax Credit delayed

However, people who claim the refundable portion of the child tax credit will see delayed refunds, at least until February 28, IRS warns. That's because of procedures the agency has had in place for over five years to help prevent the issuance of fraudulent refunds pertaining to refundable tax credits.

What is the current status of the child tax credit

For the 2023 tax year (returns filed in 2023), the child tax credit is worth up to $2,000 per qualifying dependent. The credit is also partially refundable, meaning some taxpayers may be able to receive a tax refund for any excess amount up to a maximum of $1,500. Is the child tax credit taxable No.

Is the child tax credit coming October 15th

Families will see the direct deposit payments in their accounts starting October 15. Like the prior payments, the vast majority of families will receive them by direct deposit. For those receiving payments by paper check, be sure to allow extra time, through the end of October, for delivery by mail.

Did the monthly child tax credit end

The reason why is that the enhancements that Congress made to the child tax credit were temporary. They all expired on December 31, 2023, including the monthly payments, higher credit amount, letting 17-year-olds qualify, and full refundability.

How do I track my child tax credit deposit

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

What day will the CTC be deposited in December

Families will see the direct deposit payments in their accounts starting December 15. Like the prior payments, the vast majority of families will receive them by direct deposit.