Why is my Experian score 100 points higher than Equifax?

Why is my Experian score so much higher than Equifax

However, the information they collect and how they report it can differ. For example, some creditors may supply information to one bureau but not the other. As a result, your Experian and Equifax credit reports may be different and the credit scores that are derived from them may differ, as well.

Why is my Equifax score 100 points lower than Experian

The three credit bureaus are different companies, and each one maintains its own credit report information. As such, it is likely that your three credit reports will be at least slightly different at any point in time.

Cached

Why is my credit score 100 points different on different sites

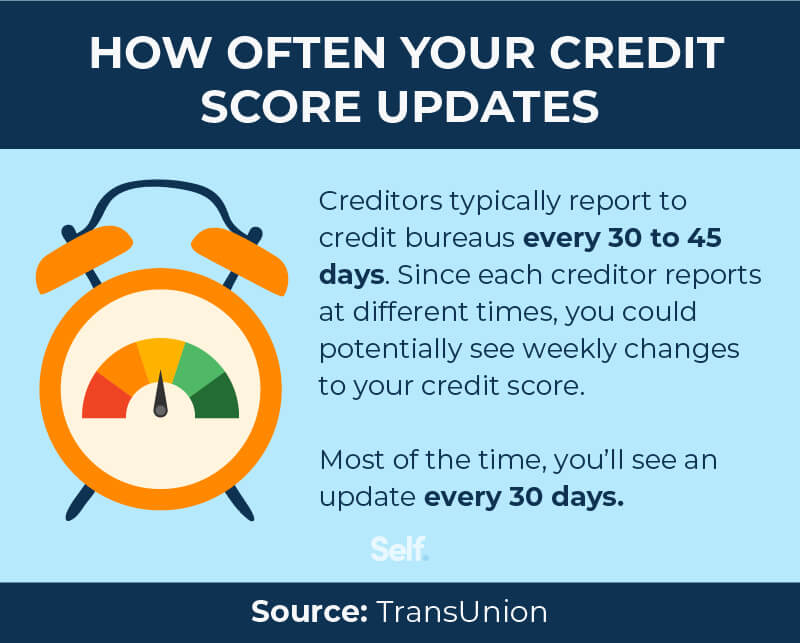

Lenders report credit information to the credit bureaus at different times, often resulting in one agency having more up-to-date information than another. The credit bureaus may record, display or store the same information in different ways.

Cached

Is Experian 100% accurate

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Which is more accurate Experian or Equifax

Experian gives a more detailed picture of a person's financial history, including payment timeliness and debt utilization. TransUnion offers more insight into a person's job history, whereas Equifax provides more information about mortgage history.

Is Experian the most accurate credit score

While Experian is the largest bureau in the U.S., it's not necessarily more accurate than the other credit bureaus. The credit scores that you receive from each of these bureaus could be the same, depending on which scoring model they use.

Which credit bureau is most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is Experian a true FICO score

FICO® Score 2 is the "classic" FICO® Score version available from Experian. FICO® Score 4 is the version of the classic FICO® Score offered by TransUnion. FICO® Score 5 is the Equifax version of the "classic" FICO® Score.

Do banks look at Experian or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Which is more reliable Experian or Equifax

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Does Experian give you your real credit score

While there are multiple credit scoring models, the FICO® Score☉ is one of the most commonly used by lenders and business to determine how reliable you will be in paying back a debt. You can get your FICO® Score for free from Experian.

Do lenders look at Equifax or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Do lenders use Experian credit score

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

How valid is Experian credit score

Experian Credit Score

A popular Credit Information Company, Experian is a well-known organisation that is approved by the Securities and Exchange Board of India (SEBI).

Is Experian your real FICO score

Experian and FICO aren't the same thing. Experian is a credit reporting agency that also offers consumer credit monitoring products. FICO is a scoring model. A service called myFICO offers similar consumer credit monitoring products to Experian.

Which of the 3 credit scores is usually the highest

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

Which credit score do most places look at

FICO scores are generally known to be the most widely used by lenders. But the credit-scoring model used may vary by lender. While FICO Score 8 is the most common, mortgage lenders might use FICO Score 2, 4 or 5. Auto lenders often use one of the FICO Auto Scores.

Which score is more accurate FICO or Experian

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

Which credit bureau is the most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.