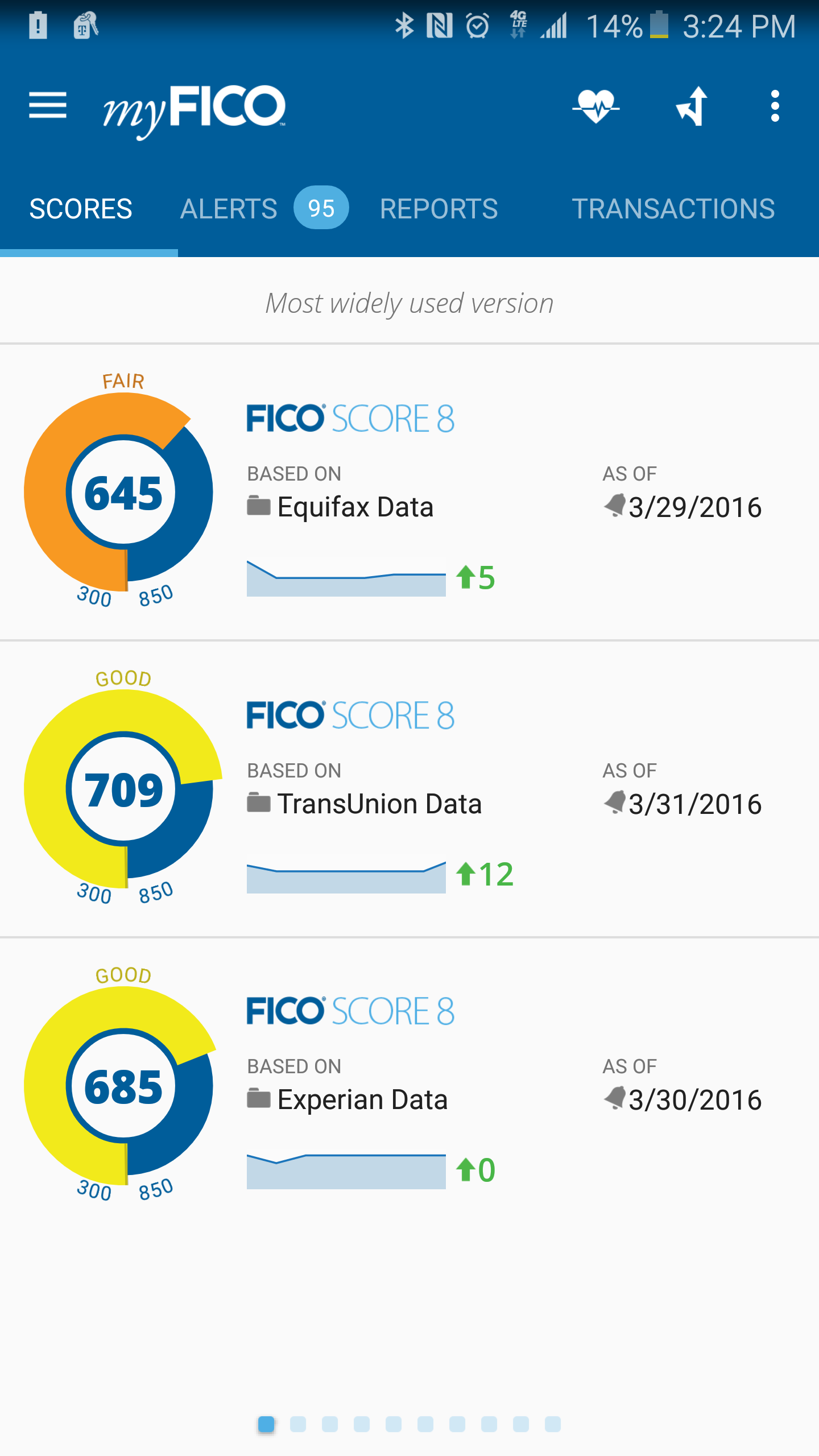

Why is my Experian score lower than TransUnion and Equifax?

Why is my Experian credit score lower than Equifax and TransUnion

In addition to data differences, credit bureaus update their information at different intervals. For example, TransUnion may update its information every 30 days, whereas Experian may update information every 60 days. That time difference can lead to different scores.

Cached

Which credit score is more accurate Experian or TransUnion

With multiple options available, you may be wondering which of these sources is the most accurate. Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

Cached

Why is my Equifax score so much higher than Experian

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureaus—which is also unusual.

Cached

Why does Experian give me a lower credit score

Credit scores can decrease for a number of reasons, including high balances, missed payments and closed accounts. You can review recent factors that may be affecting your credit score by checking your credit score for free with Experian.

Is Experian usually the lowest score

Which Credit Bureau has the Lowest Score The credit bureau that gives the lowest FICO or Vantage score tends to be the one that lenders use the most in your geographic area. Lenders typically slice the pie (between Equifax, Experian, and TransUnion) at the three-digit zip code level.

Which credit bureau is most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is Experian more important than TransUnion

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Do banks use Experian or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Do banks use Experian or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Which credit score is the most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Do lenders use Experian or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Is Experian the correct credit score

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

How accurate is Experian credit score

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Which credit bureau score is most important

What credit score do lenders use FICO scores are generally known to be the most widely used by lenders.

Is Experian more accurate than Equifax or TransUnion

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Is Experian accurate as TransUnion

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is Experian an accurate credit score

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

What is the most accurate site for credit score

Best Overall AnnualCreditReport.com

The Consumer Financial Protection Bureau confirms that AnnualCreditReport.com is the official website that allows you to access each of your credit reports from all three of the major credit bureaus—Equifax, Experian, and TransUnion—at no cost.

Which of the 3 credit scores is usually the highest

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

How accurate is Experian FICO score

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.