Why is my VantageScore lower than my FICO score?

Is FICO score usually higher than Vantage

While VantageScore and FICO now use the same 300-850 range, VantageScore tiers run about 50 points lower than FICO tiers.

Cached

Is VantageScore 3.0 lower than FICO score

It was created to provide some consistency between the scores offered by the existing credit bureaus. If you're wondering, “why is my FICO score higher than Vantage” VantageScore runs about 50 points lower than FICO, despite using the same range.

Cached

Does the VantageScore have the same range as the FICO score

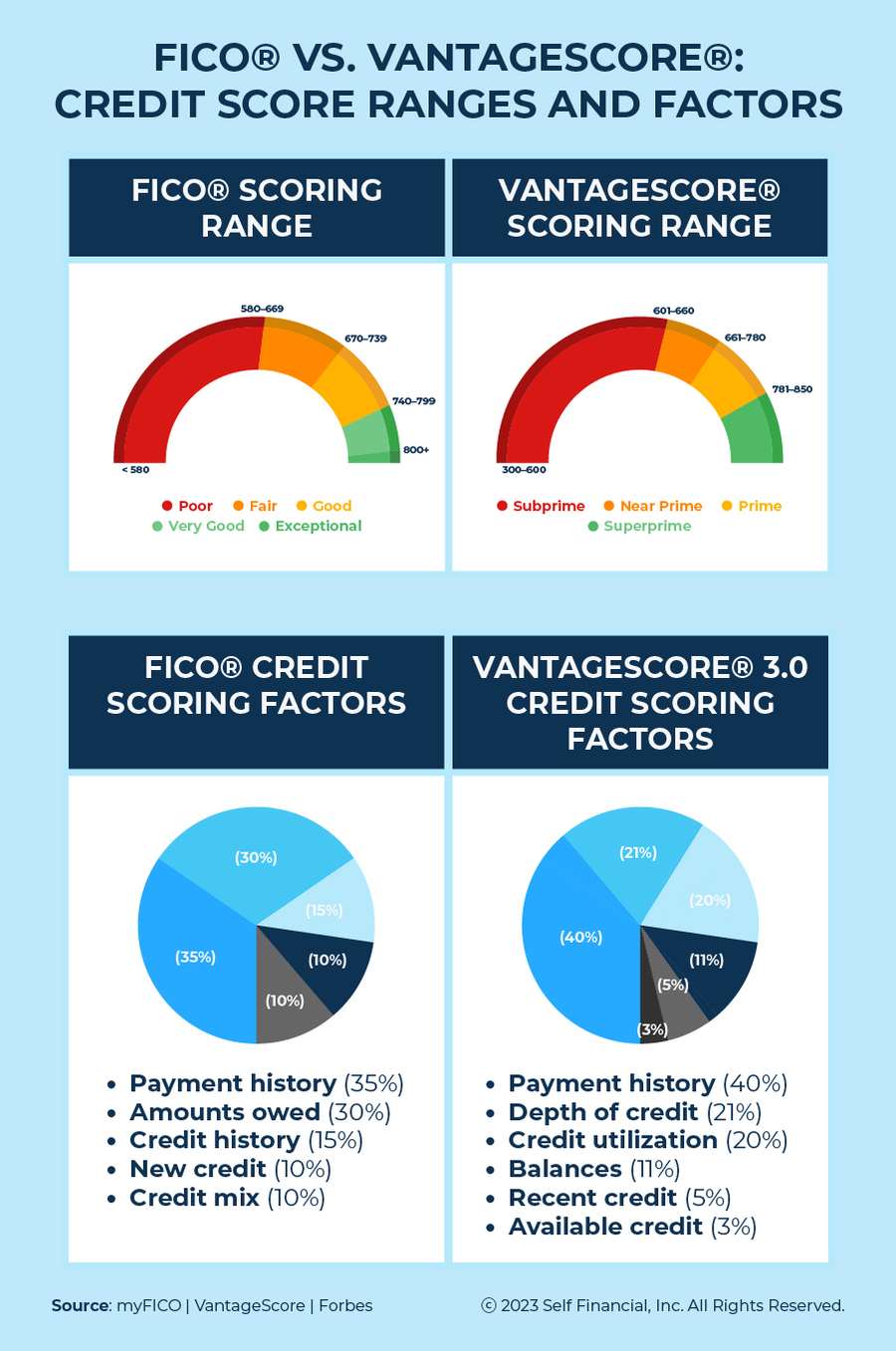

Both FICO and VantageScore assign higher credit scores to consumers deemed as lower-risk borrowers, and both currently range from 300 to 850. FICO scores are generally calculated using five categories of information contained in your credit reports, with varying weight given to each: Your payment history (35%)

Cached

How do I convert my VantageScore 3.0 to FICO score

There is no official method of converting a VantageScore to a FICO score. Because each scoring uses different criteria and methods of pulling data, it's nearly impossible to convert. However, keeping both scores in mind can give you a much more well-rounded understanding of your credit health.

Cached

Do banks look at FICO or Vantage

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates.

Do dealerships use FICO or Vantage

What credit score do auto lenders look at The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. We're going to take at look at FICO® since it has long been the auto industry standard.

Do any lenders use VantageScore

Overall 6 of the top 10 largest banks, 55 of the 100 largest credit unions and many of the largest Fintech's in the United States use VantageScore credit scores in one of more lines of business.

Do auto lenders use FICO or Vantage

What credit score do auto lenders look at The three major credit bureaus are Experian, TransUnion and Equifax. The two big credit scoring models used by auto lenders are FICO® Auto Score and Vantage. We're going to take at look at FICO® since it has long been the auto industry standard.

Do lenders look at FICO or Vantage

VantageScore and FICO share many similarities. But FICO is the score most widely used by lenders. So that's probably the best score to focus on if you want to have access to better loan interest rates. You can check your FICO score in a few different ways.

What’s more accurate Credit Karma or FICO

Credit Karma compiles its own accurate VantageScore based on that information. Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

What credit score do you need to buy a 50k car

A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.40% or better, or a used-car loan around 8.75% or lower.

Do any auto lenders use VantageScore

When you apply for an auto loan, a lender is likely to use one version of the following credit scores: FICO® Auto Score, Base FICO® Score, or VantageScore®. FICO® scores are used by 90% of top lenders and VantageScore® credit scores are used by nine of the 10 largest banks.

What is considered a good VantageScore

between 661 and 780

FICO and VantageScore are two popular credit-scoring companies. Scores from FICO and VantageScore typically range from 300 to 850. FICO says good credit scores fall between 670 and 739; VantageScore says good scores fall between 661 and 780.

What credit score do they look at when buying a car

The FICO score is the most widely used score for auto loans. The score ranges from 300 to 850. The score is calculated based on credit mix, payment history, amount owed, average credit history and available credit.

How close are FICO and Vantage scores

The base FICO® Scores range from 300 to 850, while FICO's industry-specific scores range from 250 to 900. The first two versions of the VantageScore ranged from 501 to 990, but the latest VantageScore 3.0 and 4.0 use the same 300-to-850 range as base FICO® scores.

What FICO score is needed to buy a house

620 or higher

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

How many points is Credit Karma off by

In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

Why is my FICO score 100 points lower than Credit Karma

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.