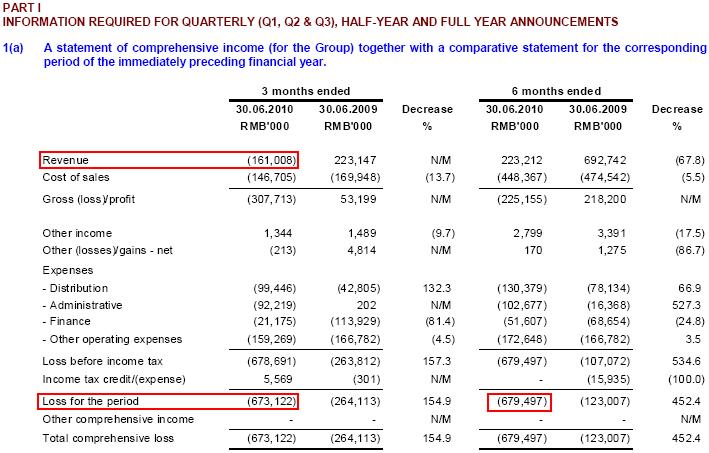

Why is revenue a negative?

What happens if revenue is negative

A negative net income means a company has a loss, and not a profit, over a given accounting period. While a company may have positive sales, its expenses and other costs will have exceeded the amount of money taken in as revenue.

Cached

What is positive vs negative revenue

A positive variance means that actuals and encumbrances are less than the amount budgeted (good). A negative variance means the account is over spent (bad). A revenue budget is used to represent projected revenue/income and is compared to revenue actuals received during the year to track progress.

Cached

Is revenue always positive

Though a company may have negative earnings, it almost always has positive revenue. Gross margin is a calculation of revenue less the cost of goods sold, and is used to determine how well sales cover direct variable costs relating to the production of goods.

What is revenue minus income

Revenue is calculated differently than income. While revenue is calculated by multiplying the total number of goods and services sold by their prices, income is calculated by subtracting expenses, costs, and taxes from total revenue.

Can revenue be a negative number

The revenues are reported with their natural sign as a negative, which indicates a credit. Expenses are reported with their natural sign as unsigned (positive), which indicates a debit. This is routine accounting procedure.

What is negative revenue called

What is net profit Net profit is the amount of money your business earns after deducting all operating, interest, and tax expenses over a given period of time. To arrive at this value, you need to know a company's gross profit. If the value of net profit is negative, then it is called net loss.

Can cost of revenue be negative

In rare cases, the total of initial stock value and purchases can be lower than the final stock value. If your number of returns exceeds sales for a certain accounting period or there is a correction on the overstated costs from a prior accounting period… it is possible to have a negative COGS.

What does revenue positive mean

Revenue positive means all state tax revenues generated directly and indirectly by the research and facilities of the institute are greater than the debt service on the state bonds actually paid by the General Fund in the same year.

Is revenue a minus cost

Gross profit is revenue minus the cost of goods sold (COGS), which are the direct costs attributable to the production of the goods sold in a company.

Can you have negative net revenue

Yes. If the calculation of net income is a negative amount, it's called a net loss. The net loss may be shown on an income statement (profit and loss statement) with a minus sign or shown in parentheses. A company with positive net income is more likely to have financial health than a company with negative net income.

What is revenue minus cost and expense

Net profit is the difference between a company's revenue and its expenses. It is calculated by subtracting a company's total costs from its total revenue. This figure represents a company's profit after all its costs have been paid.

Can revenue be a negative

In some rare cases, companies do report negative revenue. A negative value may be related to a change in accounting principles.. The accounting change alters the way the company places a value on money or assets. Despite changes in the books, the negative value may not represent a real decrease in revenue.

What is revenue minus cost of good

Gross profit

Gross profit, also known as gross income, equals a company's revenues minus its cost of goods sold (COGS). It is typically used to evaluate how efficiently a company is managing labor and supplies in production.

What is revenue minus your expenses and losses

Net income: Net profit can be defined as the amount of money you earn after deducting allowable business expenses. It is calculated by subtracting total expenses from total revenue.

How do you calculate negative revenue

You can calculate a negative profit margin using the same equation as the profit margin:Profit margin = (net income / total revenue) x 100.Net income = total revenue – total expenses.Total revenue = quantity sold x price.Linda's Lampshades sells decorative organic cotton lampshades.Its profit margin was:

What is negative profit called

Net profit is the amount of money your business earns after deducting all operating, interest, and tax expenses over a given period of time. To arrive at this value, you need to know a company's gross profit. If the value of net profit is negative, then it is called net loss.

Why is a decrease in revenue bad

A decrease in revenue is bad for a business. If revenue is decreasing, a business is at risk of not breaking even or having very low margins of safety and levels of profit.

What is a negative difference between revenue and cost

When costs exceed revenue, there is a negative profit, or lossThe difference between revenue and cost when the cost incurred in operating the business exceeds revenue..

What is revenue minus cost margin

Profit margin refers to the revenue a company makes after paying COGS. The profit margin is calculated by taking revenue minus the cost of goods sold. However, the difference is shown as a percentage of revenue. The percentage of revenue that is gross profit is found by dividing the gross profit by revenue.

What is the difference between profit and revenue

Revenue describes income generated through business operations, while profit describes net income after deducting expenses from earnings. Revenue can take various forms, such as sales, income from fees, and income generated by property.