Why is types of credit important?

Why is it important to have different types of credit

Why lenders like to see a variety of credit. When lenders are making a decision on what loans or interest rates to offer you, it helps them to see a steady payment record on a mix of credit types because it shows that you can manage the different obligations that come with borrowing all kinds of debt.

What type of credit is more important

FICO® Scores☉ are used by 90% of top lenders, but even so, there's no single credit score or scoring system that's most important. In a very real way, the score that matters most is the one used by the lender willing to offer you the best lending terms.

What are the 4 main reasons credit is important

Here are some of the major benefits of building credit.Better approval rates. If you have a good credit score, you're more likely to be approved for credit products, like a credit card or loan.Lower interest rates. The higher your credit score, the lower interest rates you'll qualify for.Better terms.Robust benefits.

What types of credit should I have

Having both revolving and installment credit makes for a perfect duo because the two demonstrate your ability to manage different types of debt. And experts would agree: According to Experian, one of the three main credit bureaus, “an ideal credit mix includes a blend of revolving and installment credit.”

Does having different types of credit helps improve your score

Credit mix counts for 10% of a person's FICO® credit score. Maintaining a mix of credit demonstrates that you can handle multiple types of loans. Along with the other elements above, improving your credit mix can help you reach excellent credit score status.

Why is credit the most important

If you have good credit, banks and lenders are more likely to approve your credit applications. This means when you apply for credit cards, loans or mortgages, you'll be more likely to be accepted and may spend less time waiting to hear the results of your application.

What are the 2 most important credit factors

The most important factor of your FICO® Score☉ , used by 90% of top lenders, is your payment history, or how you've managed your credit accounts. Close behind is the amounts owed—and more specifically how much of your available credit you're using—on your credit accounts. The three other factors carry less weight.

Why are the 3 C’s of credit important

Students classify those characteristics based on the three C's of credit (capacity, character, and collateral), assess the riskiness of lending to that individual based on these characteristics, and then decide whether or not to approve or deny the loan request.

What types of credit affect your credit score

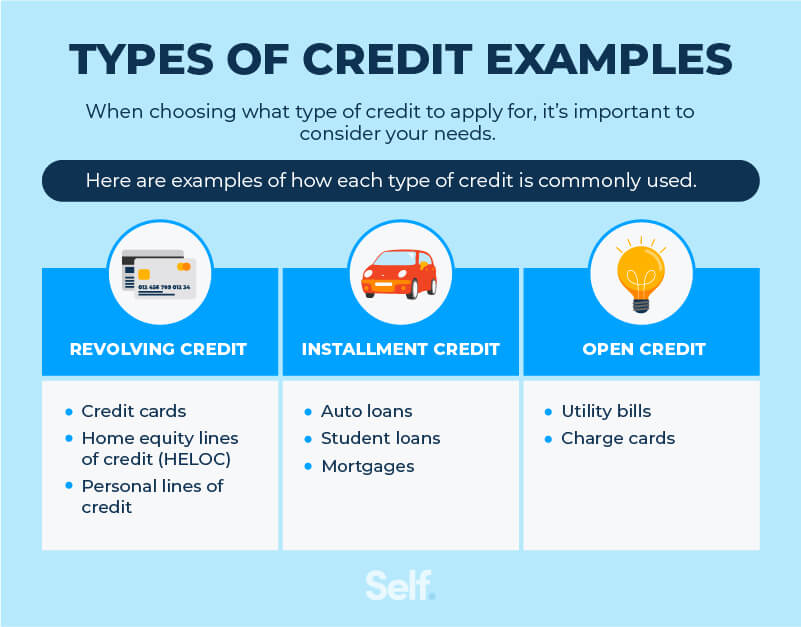

There are three general categories of credit accounts that can impact your credit scores: revolving, open and installment. Although having a variety of credit types can be good for your credit health, it's not the most important factor in determining your scores.

What does type of credit mean

The types of credit you have are known as your credit mix. They can include a mix of accounts from credit cards, retail accounts, installment loans, finance company and mortgage loans.

What makes your credit score go higher

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit.

Is 3 credit cards too many

How many credit cards is too many or too few Credit scoring formulas don't punish you for having too many credit accounts, but you can have too few. Credit bureaus suggest that five or more accounts — which can be a mix of cards and loans — is a reasonable number to build toward over time.

Is credit important why or why not

In addition to having higher credit approval rates, people with good credit are often offered lower interest rates. Paying less interest on your debt can save you a lot of money over time, which is why building your credit score is one of the smartest financial moves you can make.

Why is good credit important 3 reasons

A strong credit score — 760 and above — may give you important financial advantages, including access to more options, lower interest rates, and more lender choices.

What are the most important factors to remember about credit

Overall Payment History: Paying on time is most important. A number of late payments and/or delinquent amounts will decrease your credit score. Past and current collections and bankruptcies are also contributing factors.

What are 3 common types of credit

There are three types of credit accounts: revolving, installment and open. One of the most common types of credit accounts, revolving credit is a line of credit that you can borrow from freely but that has a cap, known as a credit limit, on how much can be used at any given time.

Why is credit condition important

The conditions of the loan, such as the interest rate and the amount of principal, influence the lender's desire to finance the borrower. Conditions can refer to how a borrower intends to use the money.

What are the 4 main types of credit

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

What are the 3 biggest factors impacting your credit score

The primary factors that affect your credit score include payment history, the amount of debt you owe, how long you've been using credit, new or recent credit, and types of credit used.

Does type of credit affect credit score

There are three general categories of credit accounts that can impact your credit scores: revolving, open and installment. Although having a variety of credit types can be good for your credit health, it's not the most important factor in determining your scores.