Why should you try to avoid a variable interest rate?

Why are variable interest rates bad

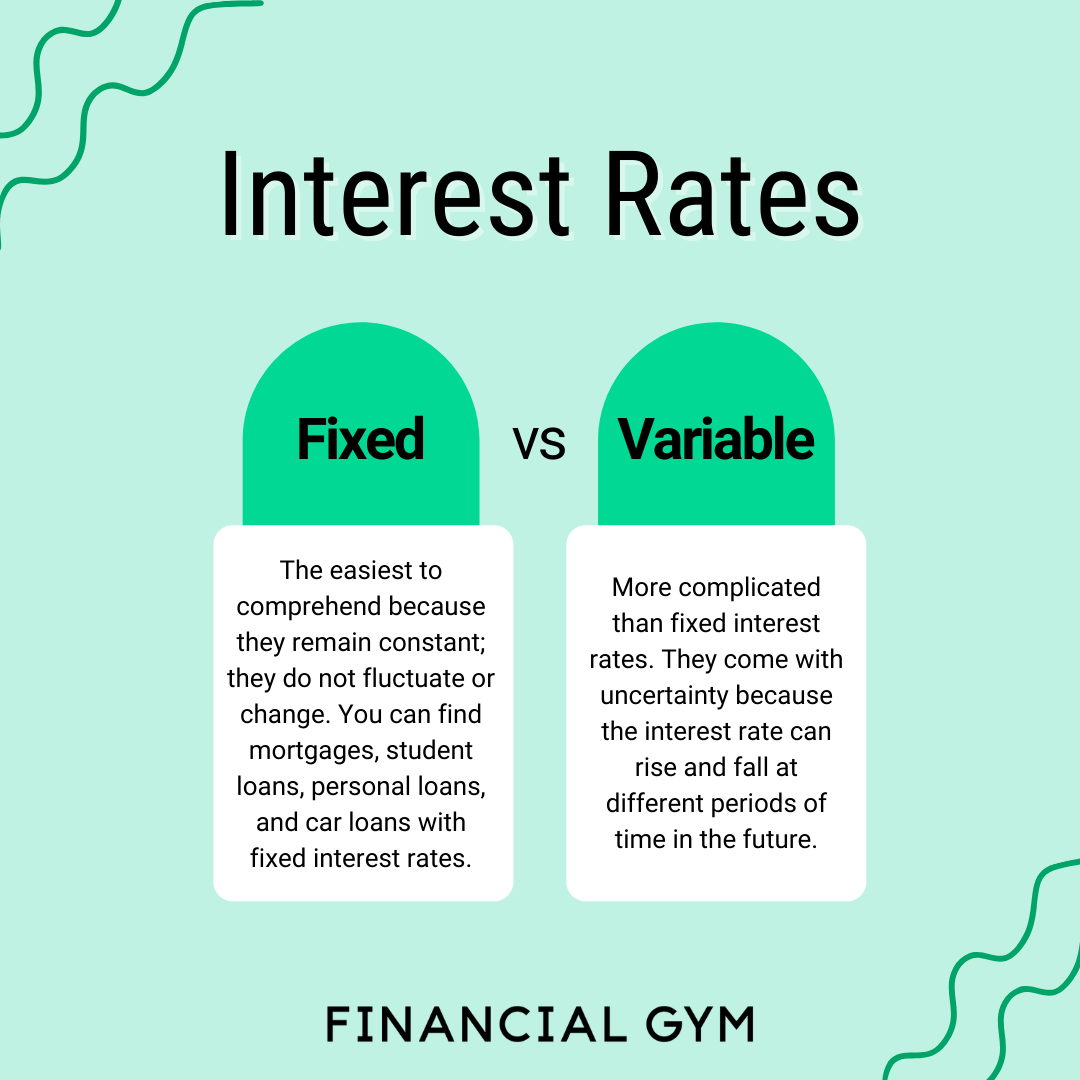

The biggest downside of variable-rate loans is the unpredictability. It is almost impossible to know what the future holds in terms of interest rates. While you could get lucky and benefit from lower prevailing market rates, it could go the other way and you may end up paying more by way of interest.

Cached

What are the pros and cons of a variable interest rate

Pros of variable rate mortgages can include lower initial payments than a fixed-rate loan, and lower payments if interest rates drop. The downsides are that the mortgage payments can increase if interest rates rise.

What is a disadvantage of a loan agreement that uses a variable interest rate

The disadvantage of variable rate home loans is the possibility that interest rates will jump. To offset this reality, the borrower enjoys three benefits that the fixed-rate loan holder does not receive. It's possible to pay off the variable rate mortgage sooner than 30 years.

What happens when you have a variable interest rate

Fixed payments with a variable interest rate

If the interest rate goes up, more of your payment goes towards the interest, and less to the principal. If the interest rate goes down, more of your payment goes towards to the principal. This means, you pay off your mortgage faster.

Is it better to go variable or fixed

Advantages of variable rate mortgages

The main benefit of variable rate mortgages is that if interest rates are particularly low, you could pay less for your mortgage than you would if you'd opted for a fixed rate deal. You'll never be paying over the current market interest rates.

Is a variable rate still a good idea

If you value certainty, and plan on staying in your home for a while, the extra cost and risk of prepayment penalties associated with a fixed-rate mortgage could be worth it. If you don't mind the uncertainty, a variable-rate mortgage could save you money if rates drop in the middle of your mortgage term.

Is variable interest rate good or bad

Rising interest rates can greatly increase the cost of borrowing, and consumers who choose variable rate loans should be aware of the potential for elevated loan costs. However, variable rate loans are a good option for consumers who can afford to take the risk or who plan to pay their loan off quickly.

Is it better to get fixed or variable interest rate

Is a Variable or Fixed Rate Better In a period of decreasing interest rates, a variable rate is better. However, the trade off is there's a risk of eventual higher interest assessments at elevated rates should market conditions shift to rising interest rates.

Should I get a variable rate or fixed

If you value certainty, and plan on staying in your home for a while, the extra cost and risk of prepayment penalties associated with a fixed-rate mortgage could be worth it. If you don't mind the uncertainty, a variable-rate mortgage could save you money if rates drop in the middle of your mortgage term.

Should I change from variable to fixed rate

You need predictability and stability

If you value predictability and stability, switching to a fixed rate loan may be the right choice for you. With a fixed rate loan, your monthly payments will be consistent, making it easier to budget and plan your finances.

Is it worth getting a variable-rate mortgage

Advantages of variable rate mortgages

The main benefit of variable rate mortgages is that if interest rates are particularly low, you could pay less for your mortgage than you would if you'd opted for a fixed rate deal. You'll never be paying over the current market interest rates.

Is it better to go fixed or variable rate

Is a Variable or Fixed Rate Better In a period of decreasing interest rates, a variable rate is better. However, the trade off is there's a risk of eventual higher interest assessments at elevated rates should market conditions shift to rising interest rates.

Do I want a fixed or variable rate

You might prefer fixed rates if you are looking for a loan payment that won't change. With a variable-rate loan, the interest rate on the loan changes as the index rate changes, meaning that it could go up or down. Because your interest rate can go up, your monthly payment can also go up.

Why is fixed interest rate better

A fixed interest rate avoids the risk that a mortgage or loan payment can significantly increase over time. Fixed interest rates can be higher than variable rates. Borrowers are more likely to opt for fixed-rate loans during periods of low interest rates.

Can you change from a variable rate to a fixed rate

Can you switch from a tracker or variable mortgage to a fixed rate Yes. Changing your mortgage from a variable to a fixed-rate deal is arguably a more popular option when mortgage rates are in flux, as you can benefit from the guaranteed mortgage payments that a fixed rate can offer.

Will mortgage interest rates go down in 2023

“[W]ith the rate of inflation decelerating rates should gently decline over the course of 2023.” Fannie Mae. 30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast. National Association of Realtors (NAR).

Is it best to go fixed or variable

Both have their merits. The cost of fixed price tariffs will depend on the conditions of the energy market. Fixed deals become less attractive if wholesale prices are high because suppliers have to charge more. Although a variable tariff may offer the cheapest prices at the outset, it might not in the future.

Is it better to pay down fixed or variable

If you want to pay off your loan faster, you might opt for a variable rate over fixed. It's more flexible, letting you make unlimited extra repayments at no cost. If you have a fixed-rate loan now, you're not stuck with it forever. Once the fixed term ends, you can roll it over to variable and make extra repayments.

What is the disadvantage of a variable mortgage

One of the biggest disadvantages of variable rate mortgages is that your payments can change over time, making it harder to budget. If you want peace of mind that your payments will remain the same for a set period of time, you may prefer to the security of a fixed rate mortgage.

Why is a fixed interest rate almost always better

A fixed interest rate avoids the risk that a mortgage or loan payment can significantly increase over time. Fixed interest rates can be higher than variable rates. Borrowers are more likely to opt for fixed-rate loans during periods of low interest rates.