Why use payment gateway?

Why we should use payment gateway

Overall, payment gateways simplify the online payment process for your business and help you receive payments faster, more conveniently, and with better security. If you are considering receiving online payments, or want to enhance the method you are already using, then a payment gateway is what you're looking for.

What does payment gateway also help you to accept

A payment gateway is a service that authorizes credit card payments for both online and offline businesses. For eCommerce sites, it also ensures a secure payment flow by encrypting the customer's financial information before transferring it to the merchant's account.

Why do I need a merchant account and payment gateway

If a business wants to accept cards as a form of payment, it will need a payment gateway and merchant account because they work together to process and store payments from transactions.

What is the difference between PayPal and payment gateway

A payment gateway is software which facilitates, processes, and/or authorizes banking or credit card information to online retailers. It helps ensure that the customer has the funds to pay for the product so that you, the store owner, gets paid. PayPal is an example of a payment gateway which is popular in ecommerce.

What is the difference between payment gateway and payment app

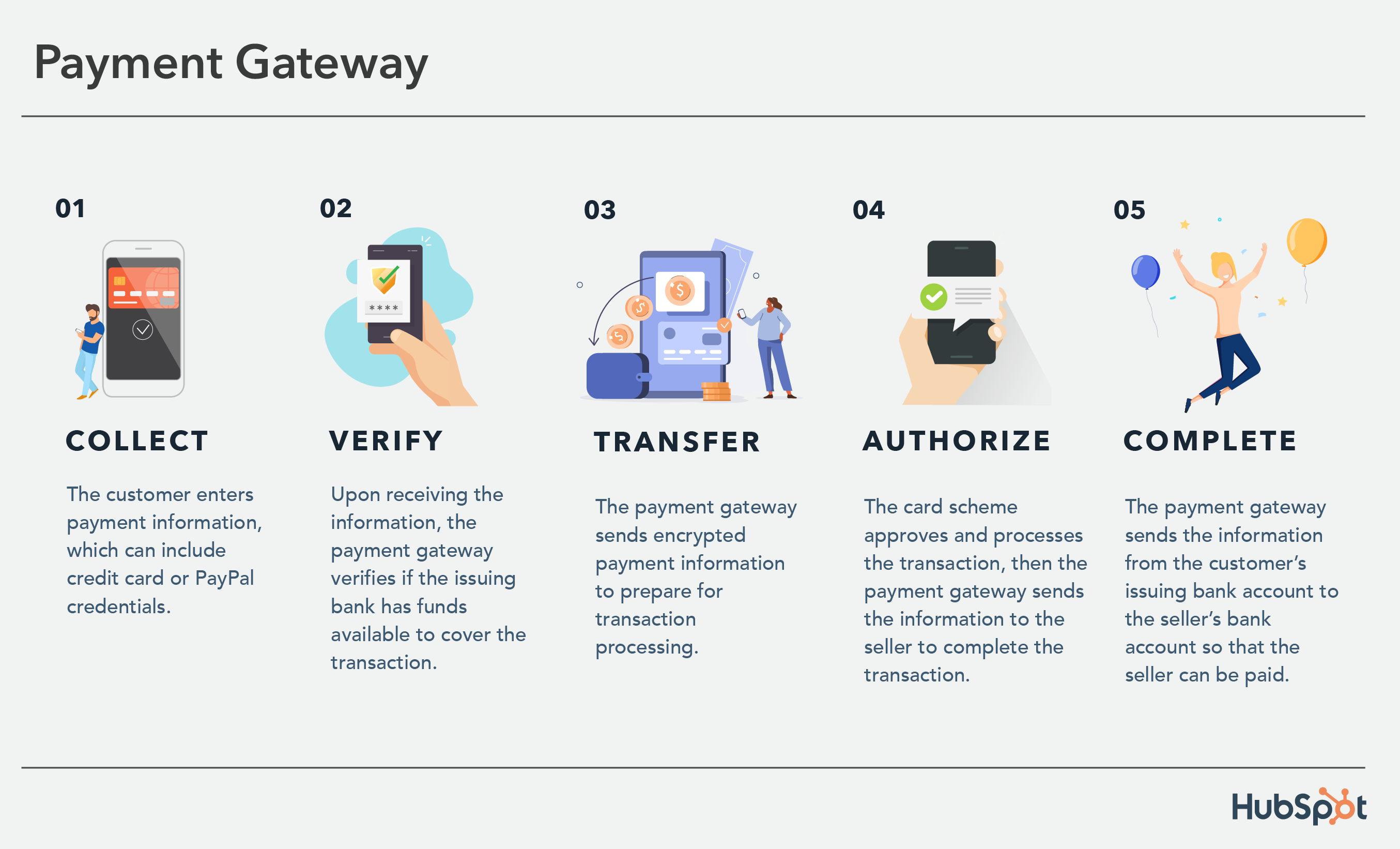

A payment gateway is a system that collects and verifies a customer's credit card information before sending it to the payment processor. A payment processor, on the other hand, is a service that routes a customer's credit card information between your point-of-sale system and the customer's card network or bank.

What is the difference between a merchant service and a payment gateway

In fact, the two serve totally different functions: a payment gateway facilitates online transactions and allows you to process them, while a merchant account is a holding account where those payments first land before being deposited into your regular bank account.

What’s the difference between a payment gateway and a payment provider

The difference is a payment processor facilitates the transaction and a payment gateway is a tool that communicates the approval or decline of transactions between you and your customers.

Is it mandatory to have a payment gateway

A payment processor sends transaction data between your merchant acquiring bank and a customer's issuing bank. It's required for all transactions, online or in person.

What are the advantages and disadvantages of payment gateway

Cons or Disadvantages of payment gateway:Fixed fee per month.Percentage fee per amount spent.Fixed fee per transaction.The user bank or the gateway bank will charge a merchant fee for allowing credit purchases. This ranges from 1-5% or more.

What are the disadvantages of payment gateway

What are the Limitations of Payment Gateways They are not mobile-friendly, not merchant-friendly, and don't facilitate recurring payments. They impose a fee when a chargeback occurs – a dispute for a certain online transaction raised by the purchaser who apprises the bank that has issued the card.

What percentage does PayPal take from payment gateway

PayPal's payment processing rates range from 1.9% to 3.5% of each transaction, plus a fixed fee ranging from 5 cents to 49 cents. The exact amount you pay depends on which PayPal product you use.

Is PayPal a payment processor or gateway

PayPal is also a payment gateway that allows users to send and receive payments online.

Is PayPal a merchant gateway

Need a merchant account PayPal Payments conveniently provides both a gateway and a merchant account. Call our sales team at 1-877-579-5977 for more information.

Do I need a payment gateway or processor

payment processor: Which do you need All businesses that accept credit cards, debit cards, prepaid cards or gift cards either online or in person need a payment processor. Only e-commerce businesses need a payment gateway.

What are the limitations of payment gateway

What are the Limitations of Payment Gateways They are not mobile-friendly, not merchant-friendly, and don't facilitate recurring payments. They impose a fee when a chargeback occurs – a dispute for a certain online transaction raised by the purchaser who apprises the bank that has issued the card.

What are the cons of payment gateway

Cons or Disadvantages of payment gateway:

Fixed fee per month. Percentage fee per amount spent. Fixed fee per transaction. The user bank or the gateway bank will charge a merchant fee for allowing credit purchases.

What is the difference between payment gateway and digital payment

Regardless of its type, a digital wallet is a payment method. A payment gateway or payment processor, such as PagBrasil, on the other hand, works as a channel for the payment transaction between the buyer and the seller.

What is risk in payment gateway

Payment gateways are something that you must watch carefully because they've been responsible for data loss that's caused companies to earn a bad reputation, receive fines for lack of compliance, and even file for bankruptcy.

Why is PayPal the best payment gateway

PayPal is probably the most well-known payment gateway for businesses across the globe, and for good reason. It offers fraud protection for sellers, over 100 currency exchanges, and responsive customer service to help you along the way. It's nearly impossible not to know about PayPal.

Is PayPal a gateway or processor

PayPal can be both a payment processor and payment gateway. If you want to use your own payment processor, you can just use PayPal's payment gateway Payflow. If you'd like both payment processing and payment gateway services, you can use the PayPal Commerce Platform. Learn more in our PayPal review.