Why was I not approved for Chase preferred?

Why am I getting rejected for Chase Sapphire Preferred

The Chase Sapphire Preferred is considered a great beginner card, but you may not get approved if you don't have much credit history or only have one credit card to your name. I'd recommend applying for one of the best first credit cards or best credit cards for college students if you are brand-new to credit cards.

Cached

What are my chances of getting approved for Chase Sapphire Preferred

It depends! Most Chase Sapphire Preferred cardholders have a credit score of 720 or better. But your score alone does not fully decide whether or not you will be approved. If you have a strong credit score with a few years of credit history and a decent annual income, you stand a good chance of being approved.

Why did Chase Sapphire not approve me

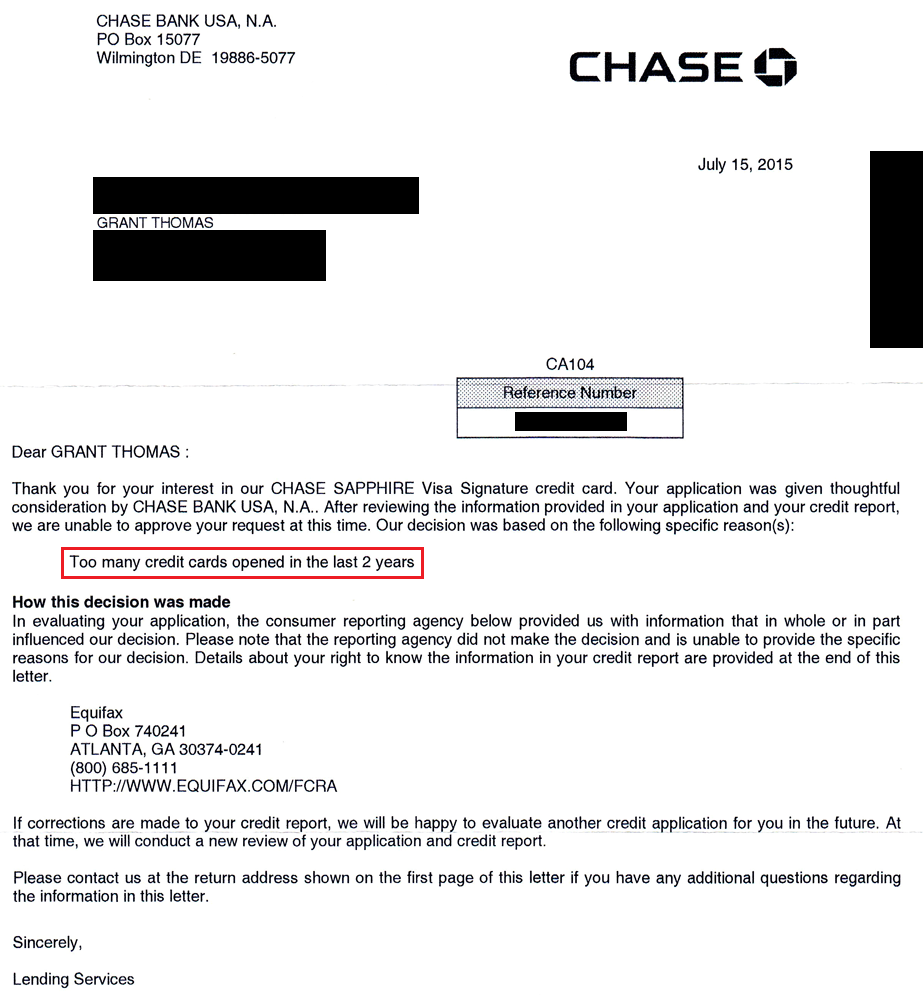

They will not approve you for a new card if you have applied for 5 or more new cards in the last 24 months. They think you have too many credit cards! Chase “2/30 Rule” – Chase will only approve up to two credit cards every rolling thirty day period. If you try for a third, they will not approve it.

Cached

Why would I not get approved for a Chase credit card

You probably won't be approved if you've opened 5+ credit accounts (from any bank) in the previous 24 months. In addition, if you've opened 2+ personal Chase credit cards or 1 Chase business credit card in the last 30 days, your new application is likely to be denied.

Cached

How do I get approved for Chase Preferred

Generally, you'll need to have a credit score of at least 700 in order to qualify for the Chase Sapphire Preferred® Card.

What is the average credit limit for Chase Sapphire Preferred

around $10,000

Chase Sapphire Reserve®

Only 3% received credit limits below $5,000. Credit Karma user data indicates the average Chase Sapphire Preferred® Card cardholder has a limit of around $10,000.

What is the highest limit on Chase Sapphire Preferred

If your income is sufficient and your credit history strong enough, you could end up with a credit limit of $100,000 (or more) on the Chase Sapphire Preferred card. One of our favorite travel credit cards also charges a relatively low annual fee for being such a credit powerhouse.

What is the average Chase Sapphire Preferred limit

$10,000

Chase Sapphire Preferred® Card

If you're approved for this card, the reported minimum credit limit you can receive is $5,000. The average credit limit on this card is $10,000, and about 10% of cardholders report a credit limit that exceeds $20,000.

Are Chase cards hard to get approved for

To qualify for the Chase Sapphire Preferred and Chase Sapphire Reserve, you'll likely need very good (740 or higher) to excellent credit (800 or higher). However, you'll likely have the best odds of approval for any Chase card if your credit score is in the very good to excellent range.

Which Chase card is easier to get approved for

Chase Freedom® Student credit card

The easiest Chase credit card to get is the Chase Freedom® Student credit card, but it's only available to students. Applicants can get approved for this card with limited credit.

Is Chase preffered hard to get

Generally, you'll need to have a credit score of at least 700 in order to qualify for the Chase Sapphire Preferred® Card.

What is the minimum income for Chase Preferred

$30,000 per year

The Chase Sapphire Preferred income requirement is at least $30,000 per year, based on user reports. Chase doesn't publicly disclose the Sapphire Preferred Card's income requirements, but they are required by law to consider a new cardholder's ability to make the minimum monthly payments on their assigned credit line.

Is Chase Preferred hard to get

The Chase Sapphire Preferred® Card is hard to get because you'll need good to excellent credit to have a chance at getting approved. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for Chase Sapphire Preferred.

What credit score and income do you need for Chase Sapphire Preferred

Generally, you'll need to have a credit score of at least 700 in order to qualify for the Chase Sapphire Preferred® Card.

What credit score do you need for Chase Preferred

700

Generally, you'll need to have a credit score of at least 700 in order to qualify for the Chase Sapphire Preferred® Card.

Is Chase Sapphire Preferred hard to get

The Chase Sapphire Preferred® Card is hard to get because you'll need good to excellent credit to have a chance at getting approved. Unless your credit score is 700 or higher and you have a lot of income, it will be difficult for you to get approved for Chase Sapphire Preferred.

Is Chase Sapphire a high end card

One of the best luxury credit cards is Chase Sapphire Reserve® because it offers an initial bonus worth up to $900 in travel booked through Chase, gives a $300 annual travel credit, and provides complimentary airport lounge access.

Which Chase card is easiest to get approved for

Chase Freedom® Student credit card

The easiest Chase credit card to get is the Chase Freedom® Student credit card, but it's only available to students. Applicants can get approved for this card with limited credit.

Does 7 10 days mean denial

7-10 Days Status Message

A 7-10 day message typically means that your application has been denied.

What is the minimum income for Chase Sapphire Preferred

$30,000 per year

The Chase Sapphire Preferred income requirement is at least $30,000 per year, based on user reports. Chase doesn't publicly disclose the Sapphire Preferred Card's income requirements, but they are required by law to consider a new cardholder's ability to make the minimum monthly payments on their assigned credit line.