Why would a parent PLUS loan be denied?

What gets you denied a parent PLUS loan

If your Parent PLUS Loan was rejected, it may be because you don't meet the credit requirements. PLUS borrowers can't have an adverse credit history, such as being at least 90 days overdue in making a debt payment or completing bankruptcy in the last five years.

Can you be rejected a parent PLUS loan

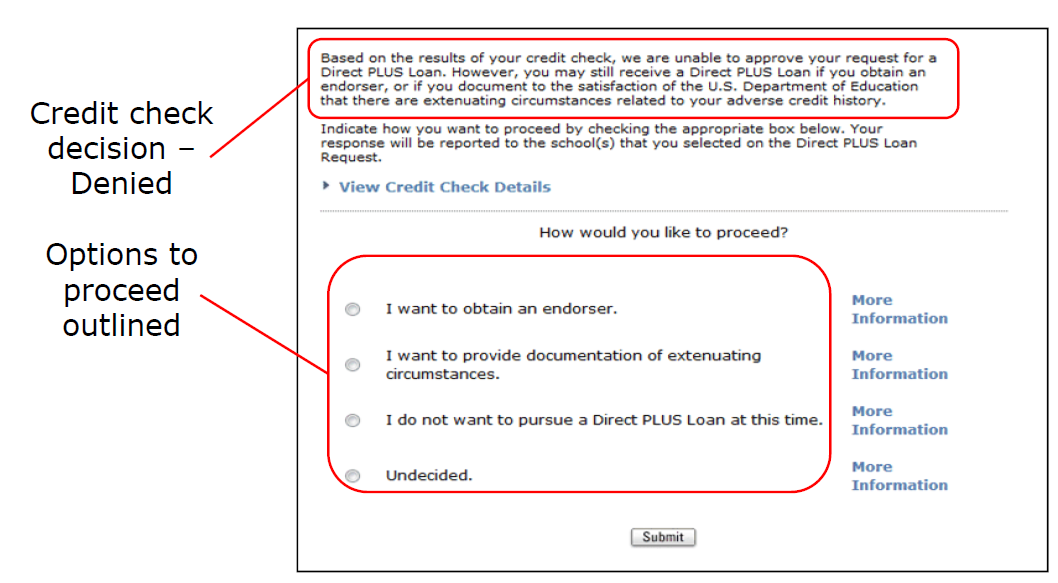

If you're a parent or graduate student seeking a Direct PLUS Loan, one of the requirements to qualify is that you must not have an adverse credit history. If your application is denied because of an adverse credit history, don't give up. You still have options.

Cached

What happens if my mom is declined for parent PLUS loan

If you've been denied a Parent PLUS loan because of an adverse credit history, you can qualify for the loan if you obtain an endorser. An endorser is like a cosigner. The endorser agrees to repay the PLUS loan if the parent defaults or is otherwise unable to repay the debt.

Cached

Does everyone get approved for a parent PLUS loan

To be eligible for a Direct PLUS Loan for parents, you must be a biological or adoptive parent (or in some cases a stepparent), not have an adverse credit history, and meet the general eligibility requirements for federal student aid (which the child must meet as well).

How are parent PLUS loans determined

The maximum PLUS loan amount you can borrow is the cost of attendance at the school your child will attend minus any other financial assistance your child receives. The cost of attendance is determined by the school.

Are parent PLUS loans income based

Income-based repayment plans for Parent PLUS Loans

Borrower must consolidate Parent PLUS Loans into a Direct Consolidation Loan. Payment will be the lesser of 20% of their discretionary income, or the amount they'd pay with a fixed payment over 12 years, adjusted to income.

What happens when you get approved for a parent PLUS loan

You will receive a confirmation email shortly. The school you selected will be notified within the next 24 hours. Though your credit has been approved, all other eligibility requirements must be met before your loan can be awarded. Your school will tell you what loans, if any, you are eligible to receive.

How many times can you apply for parent PLUS loan

A parent can obtain a PLUS Loan for each child in each school year. You can obtain additional PLUS Loans for any year that you have an eligible child in school.

What credit score do you need for a parent PLUS loan

While there is a credit check, there are no minimum score requirements. Potential borrowers just need to not have an adverse credit history. Origination fees. In addition to interest, Parent PLUS Loans also have an origination fee.

Can parent PLUS loans be income-driven

The Income-Contingent Repayment Plan is the only income-driven repayment plan available to parent PLUS borrowers, and to repay your parent PLUS loans under the Income-Contingent Repayment Plan, you must first consolidate the loans into a Direct Consolidation Loan.

What GPA do you need for a parent PLUS loan

Eligibility for Federal Parent PLUS Loans

Dependent student must be making satisfactory academic progress, such as maintaining at least a 2.0 GPA on a 4.0 scale in college. Parent and dependent student aren't in default on a federal student loan or grant overpayment.

Is there an income requirement for parent PLUS loan

The Parent PLUS loan application is based on the borrower's credit history; no loan officer will look at your income or other debt or otherwise evaluate whether you can afford to make the payments. It is your responsibility to make sure you aren't borrowing more than you can afford to pay back.

What is the discretionary income for parent PLUS loans

Income-contingent Parent PLUS loan repayment plan

The Department of Education defines discretionary income as your income minus 150% of the federal poverty guidelines for your state and family size. ICR is the only repayment plan that offers a loan forgiveness component.

How long does it take to approve a parent PLUS loan

How long does processing take Due to the value of PLUS applications at peak times (particularly summer and the start of the Fall term), PLUS loans can take 4 weeks for processing and for the loan to be posted on the student's financial aid summary.

What is the maximum amount of a parent PLUS loan

Loan Terms

Maximum Loan Amount: Your child's cost of attendance minus other financial aid. For example, if your child's cost of attendance is $6,000, and he or she receives $4,000 in other financial aid, you can borrow up to $2,000 in PLUS Loans.

Do you have to reapply each year for a parent PLUS loan

You must complete a Direct PLUS Application for each year you wish to receive a parent PLUS loan.

Are parent PLUS loans forgiven after 10 years

Parent PLUS Loans can be forgiven when you retire

Parent PLUS Loan borrowers can have their debt forgiven after 10 years of working full-time for the government, nonprofit, or other qualifying employers.

What GPA do you need for parent PLUS loan

Eligibility for Federal Parent PLUS Loans

Dependent student must be making satisfactory academic progress, such as maintaining at least a 2.0 GPA on a 4.0 scale in college. Parent and dependent student aren't in default on a federal student loan or grant overpayment.

What is the average amount of a parent PLUS loan

The average parent PLUS loan debt is $29,324.

What is the debt to income ratio for a parent PLUS loan

That means your total debt payments monthly, including any prospective mortgage, should be no more than 43% of your total monthly income.