Will a soft pull affect buying a house?

Does a soft pull affect buying a house

Unlike a hard pull, a soft pull won't impact your credit score. Your mortgage lender wants to make sure that both credit reports match, and if they don't, you may need to provide additional documentation or send your loan application through underwriting a second time.

Cached

Do lenders care about soft pulls

When the soft pull comes back, lenders have a better understanding of a customer's creditworthiness. This allows them to determine how well the consumer is managing their credit and their potential risk. From there, lenders can pre-approve them for a mortgage or line of credit.

Cached

Does soft pull affect credit mortgage

A soft inquiry does not affect your credit score in any way. When a lender performs a soft inquiry on your credit file, the inquiry might appear on your credit report but it won't impact your credit score.

Cached

Do soft inquiries affect approval

Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type. The other type of inquiry is a “hard” inquiry.

Cached

Do soft pulls show on credit report

Hard and soft inquiries, sometimes referred to as credit checks, are requests to view your credit report by lenders, landlords, employers and companies that are authorized to do so. Both hard and soft inquiries will show up on your credit report.

What do lenders see when they do a soft pull

A soft credit check shows the same information as a hard inquiry. This includes your loans and lines of credit as well as their payment history and any collections accounts, tax liens or other public records in your name.

How long do soft pulls stay on credit

12-24 months

Hard inquiries are taken off of your credit reports after two years. But your credit scores may only be affected for a year, and sometimes it might only be for a few months. Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores.

Do mortgage lenders see soft inquiries

Soft inquiries or soft credit pulls

These do not impact credit scores and don't look bad to lenders. In fact, lenders can't see soft inquiries at all because they will only show up on the credit reports you check yourself (aka consumer disclosures).

Can mortgage lenders see soft inquiries

Soft inquiries or soft credit pulls

These do not impact credit scores and don't look bad to lenders. In fact, lenders can't see soft inquiries at all because they will only show up on the credit reports you check yourself (aka consumer disclosures).

Does a soft credit check affect anything

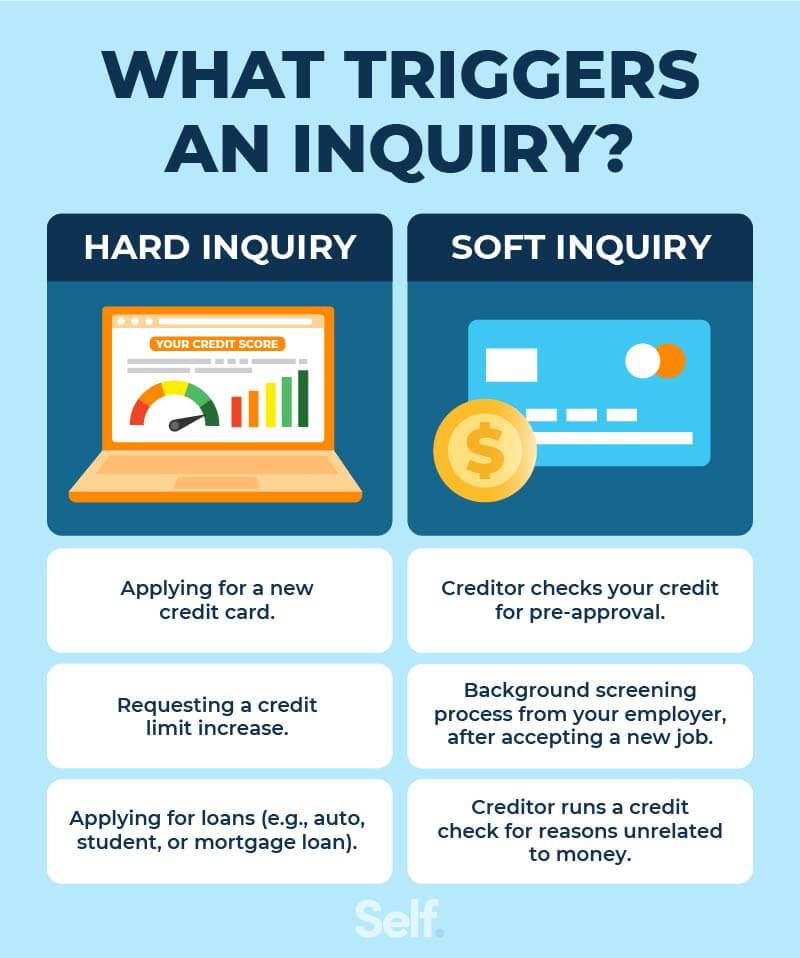

There are two types of credit score inquiries lenders and others (like yourself or your landlord) can make on your credit score: a "hard inquiry" and a "soft inquiry." The difference between the two is that a soft inquiry won't affect your score, but a hard inquiry can shave off some points.

Are soft pulls accurate

Soft credit inquiries have no impact on your credit score. If a lender checks your credit report, soft credit inquiries won't show up at all. Soft inquiries are only visible on consumer disclosures—credit reports that you request personally. The following types of credit checks are examples of soft inquiries.

How do I remove a soft pull from my credit report

Request removal of erroneous inquiries

If you find an inquiry on your credit report that you don't recognize, contact the creditor or the credit bureau to request its removal. You'll need to provide proof that the inquiry was unauthorized or fraudulent.

How many soft inquiries is too many

Soft inquiries don't drop your credit score, so there isn't a number that could be considered too much.

What is a soft inquiry before closing

Soft Credit Inquiry

This type of credit check is normally conducted by a mortgage broker to prequalify potential buyers before sending them to a lender. Soft inquiries only provide surface-level details, such as estimated credit score, address confirmation, open credit lines, and flags with no details.

What does soft credit check mean for mortgage

A soft inquiry, sometimes known as a soft credit check or soft credit pull, happens when you or someone you authorize (like a potential employer) checks your credit report. They can also happen when a company such as a credit card issuer or mortgage lender checks your credit to preapprove you for an offer.

How long does a soft credit pull last

12-24 months

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

How long does a soft pull stay on your credit

12-24 months

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Is having 10 inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

What is a soft credit pull before closing on house

Soft Credit Inquiry

This type of credit check is normally conducted by a mortgage broker to prequalify potential buyers before sending them to a lender. Soft inquiries only provide surface-level details, such as estimated credit score, address confirmation, open credit lines, and flags with no details.