Will Apple Pay later require a credit check?

Do you have to have good credit for Apple Pay later

Apple Financing uses Experian and other credit bureaus to evaluate your Apple Pay Later application. If your credit score is low — for example, if your FICO9 score is less than 6206 or Lift Premium score is lower than 5807 — Apple Financing might not approve your application.

Cached

Will Apple Pay later affect my credit score

Another unique feature of Apple Pay Later is that it will report loan and payment history to credit bureaus, which could affect users' credit scores.

Why can’t i use Apple Pay later

To use Apple Pay Later, you must have an iPhone or iPad updated to the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update.

Do you need credit for buy now pay later

Key Takeaways

The majority of BNPL services allow consumers to pay in four installments. Many BNPL services don't require a hard credit check for you to qualify for them, so applying won't hurt your credit score.

How does Apple Pay later work

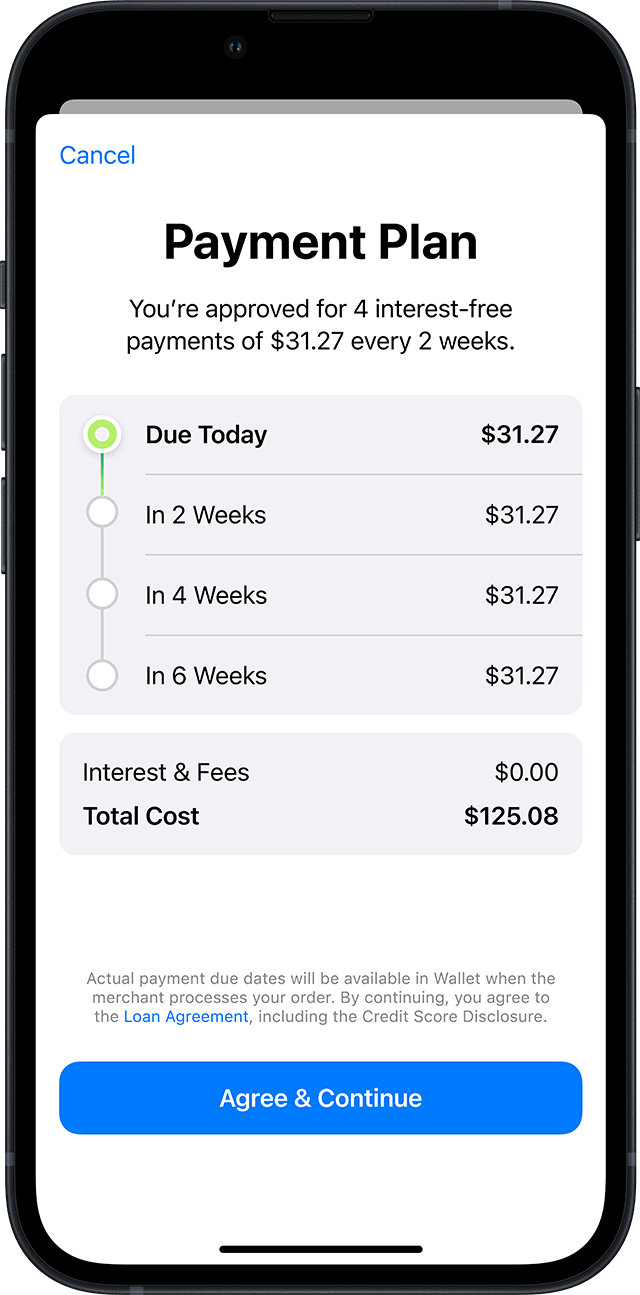

Apple introduces Apple Pay Later to allow consumers to pay for purchases over time. Designed with users' financial health in mind, Apple Pay Later allows users to split purchases into four payments, spread over six weeks with no interest and no fees.

What is the minimum for Apple Pay later

Users can apply for Apple Pay Later in the Apple Wallet. Available loan amounts range from $50 to $1,000. Though Apple hasn't disclosed a minimum credit score requirement, it will conduct a soft credit check as part of the application, which won't affect your score.

Who is eligible for Apple Pay later

Be 18 years of age or older. Be a U.S. citizen or a lawful resident with a valid, physical U.S. address that's not a P.O. Box. Set up Apple Pay with an eligible debit card on your device. You can only make Apple Pay Later down payments using a debit card.

What is the advantage of Apple Pay later

Benefits of Apple Pay Later for Consumers

With no interest or fees, users can easily manage their finances and make informed, responsible borrowing decisions. The integration of Apple Pay Later into the Apple Wallet allows users to effortlessly keep track of their loans and manage their payments.

Do you need SSN for Apple Pay later

To help protect your identity, you may be asked to provide additional information for verification, such as uploading the front and back of your government-issued identification, providing your full SSN, or entering a verification code sent to a phone number that Apple's identity verification service provider has …

What is the limit for Apple Pay later

$50 to $1,000

Users can apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay.

Which buy now, pay later does not do credit checks

The winner of the best BNPL app for those with bad credit is Perpay because it does not check credit history and uses your verified income to set your spending limits. After completing your Perpay profile, customers can access their spending limit and start shopping within 60 seconds of joining.

Can you do Afterpay with no credit

No credit check is required to use AfterPay, and no interest is charged. Customers can sign up for a free AfterPay account, shop at select online retailers, and then use AfterPay to make purchases.

Can everyone use Apple Pay later

In order to use Apple Pay Later, you will need to apply for and receive approval for the service. Apple Pay Later is technically a lending service, so Apple will need to run a credit check and make a decision on whether or not to offer you the loan that will be used to finance a purchase.

Can Apple Pay by installments

You can choose to pay for a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Monthly Installments — instead of paying all at once — in order to enjoy interest-free, low monthly payments.

Does Apple Pay later work everywhere

Apple Pay Later will work with any merchants who accept Apple Pay. MasterCard Installments, the credit card company's white-label BNPL service, is providing the merchant payments for Apple Pay Later. Apple has created its own financial subsidiary — Apple Financing — that handles loan approvals and credit checks.

Does pay later improve credit score

As long as you repay the amount on time, your credit score will not be impacted. If you clear the amount on time, you credit score is likely to improve. However, if you miss or delay your payments, then you credit score will fall.

Why is Apple Pay asking for my SSN

To verify your identity, Green Dot Bank will request Social Security numbers and other personal information to ensure that customers are eligible to use the service.

What are the requirements to receive Apple Pay

What you needBe at least 18 years old and live in the United States.Have a compatible device with the latest iOS, iPadOS, or watchOS.Set up two-factor authentication for your Apple ID.Sign in to iCloud with the same Apple ID on any device that you want to use to send or receive money.

How do you get Apple Pay later

To use Apple Pay Later, you must have an iPhone or iPad updated to the latest version of iOS or iPadOS. Update to the latest version by going to Settings > General > Software Update. Tap Download and Install.

What is the best pay later app without credit score

Freo Pay offers 0% interest for 30 days. Does Freo Pay check my credit score No, Freo Pay doesn't require a credit score to approve your postpaid limit.