Will I be approved for a Home Depot card?

What do my credit score need to be to get a Home Depot credit card

640 or higher

A FICO® Score of at least 600 is recommended to apply for the Home Depot® Credit Card — ideally, a score of 640 or higher. Applicants who get this card usually have scores in the fair credit or good credit range.

Cached

Do you get instantly approved for Home Depot credit card

Whether you apply online or in person, the approval process usually takes place on the spot, and you will receive your card within 14 days. In the event that Home Depot can't provide an instant credit decision, you'll be notified within 30 days by U.S. mail to advise you of your application status.

Cached

Is it hard to get financing at Home Depot

Is it hard to get financed through Home Depot The APR and credit limit you may qualify for will depend on creditworthiness, but the application process appears to be simple. Shoppers who are interested in Home Depot's financing options can apply online or in store.

Cached

Who does Home Depot go through for their credit card

Citibank

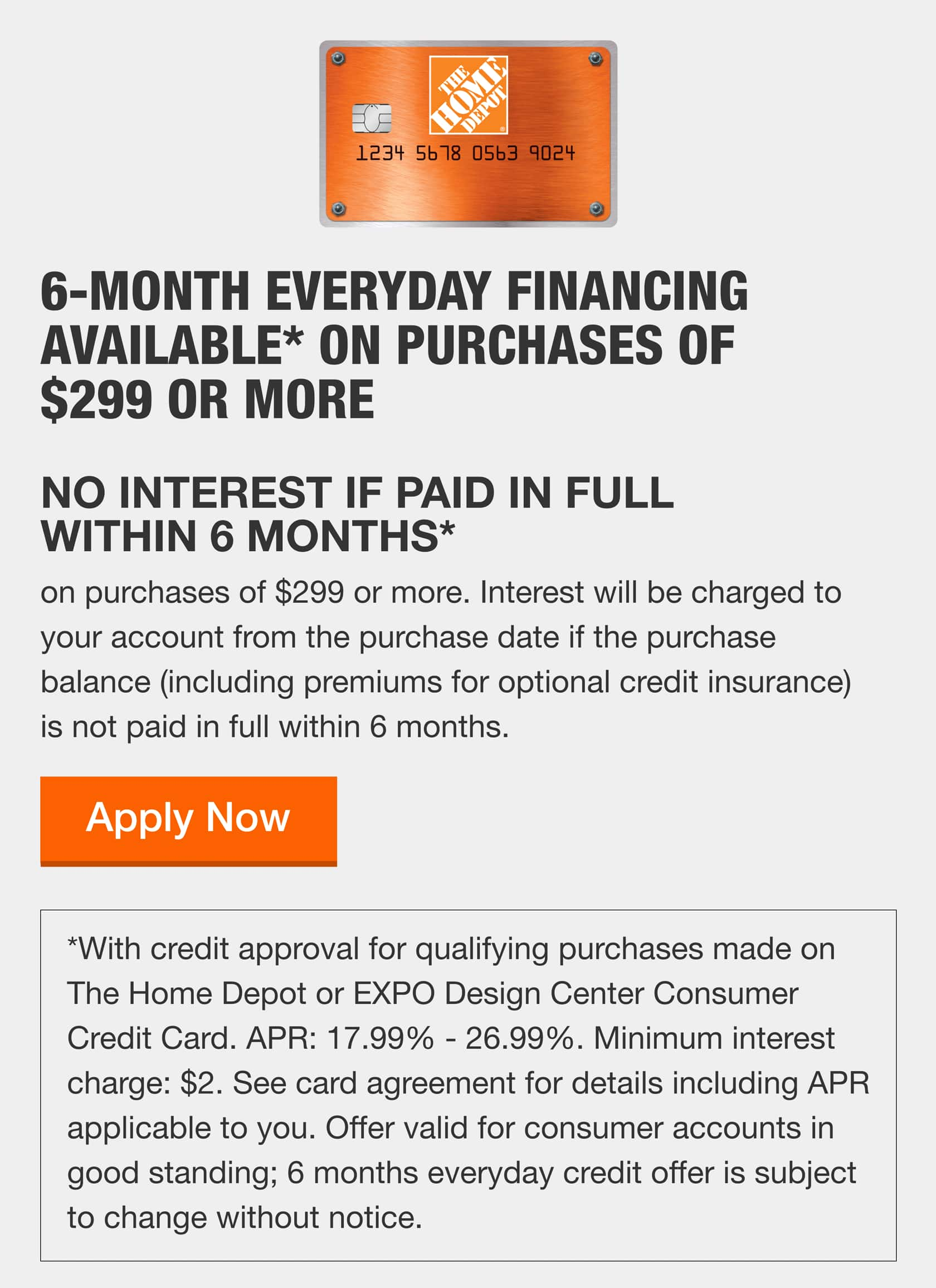

About the card

The Home Depot Consumer Credit Card can only be used on purchases at Home Depot. The card is issued by Citibank and offers different financing options.

Cached

Can you get Home Depot card with 630 credit score

You need a credit score of at least 640 for a Home Depot® Credit Card. This means you should have fair credit or higher for approval.

Does Home Depot do a hard credit check

As with most store cards and most credit cards a hard credit inquiry is run to approve applicants for Home Depot credit services. Applying for any credit product is a decision you always should make carefully, since credit checks often lower your credit score by a few points.

What is the highest credit limit on a Home Depot card

$55,000

Credit Line up to $55,000

Your first step on the application is to request your loan amount, typically the amount you have estimated it will cost to complete your home project. The Home Depot Project Loan allows for loans from $2,500 to $55,000. In general, it's good practice to request only what you think you need.

Does Home Depot do a hard pull for credit card

As with most store cards and most credit cards a hard credit inquiry is run to approve applicants for Home Depot credit services. Applying for any credit product is a decision you always should make carefully, since credit checks often lower your credit score by a few points.

Is Home Depot credit card a hard inquiry

As with most store cards and most credit cards a hard credit inquiry is run to approve applicants for Home Depot credit services. Applying for any credit product is a decision you always should make carefully, since credit checks often lower your credit score by a few points.

Does Home Depot credit card have a limit

The starting Home Depot® Credit Card credit limit is $300 or more. Everyone who gets approved for the Home Depot® Credit Card is guaranteed a credit limit of at least $300. Plus, particularly creditworthy applicants could get limits a lot higher than that.

What credit bureau does Home Depot look at

Home Depot® Credit Card reports the card's credit limit, account balance, payment history, and more to all three of the major credit bureaus: TransUnion, Equifax, and Experian. Citibank may use a specific credit bureau more than another, depending on the applicant's home state, among other factors.

What is the highest limit on Home Depot credit card

Why Is This Card So Popular What Does It Give Me The Home Depot Project Loan gives cardholders an extremely large line of credit (up to $55,000), 6 months to make purchases, and up to 9.5 years to pay it all off.