Will I get accepted for a balance transfer card?

Do balance transfers get denied

If you attempt to transfer a balance from one credit card to another card from the same card issuer, your balance transfer will likely be denied. Most issuers have restrictions on transferring balances between accounts.

Will doing a balance transfer hurt my credit score

In some cases, a balance transfer can positively impact your credit scores and help you pay less interest on your debts in the long run. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run.

Do balance transfers require credit check

Applying for a new credit card to transfer your balance will result in a hard inquiry on your credit report. A hard inquiry will shave a few points off your score initially, and it will stay on your credit report for up to two years.

What is the catch to a balance transfer

But there's a catch: If you transfer a balance and are still carrying a balance when the 0% intro APR period ends, you will have to start paying interest on the remaining balance. If you want to avoid this, make a plan to pay off your credit card balance during the no-interest intro period.

Is it easy to get a balance transfer

Qualifying for a top-rated balance transfer credit card is generally easier if you have a good or excellent credit score (between 670 and 850). You might still be able to find a balance transfer credit card with a credit score below 670, but it will probably have a shorter intro APR period.

What is the downside of a balance transfer credit card

Possible drop in credit score: A balance transfer might hurt your credit score in two ways. If the new card comes with a lower credit limit than your existing card, and if you close your existing card's account after the transfer, you may expect your credit utilization ratio to rise.

What are the dangers in accepting a balance transfer rate

You could end up with a higher interest rate after the promotion. You may not save money after the balance transfer fee is added. Your credit score could be impacted. You risk creating more debt.

Is it bad to have a lot of credit cards with zero balance

It is not bad to have a lot of credit cards with zero balance because positive information will appear on your credit reports each month since all of the accounts are current. Having credit cards with zero balance also results in a low credit utilization ratio, which is good for your credit score, too.

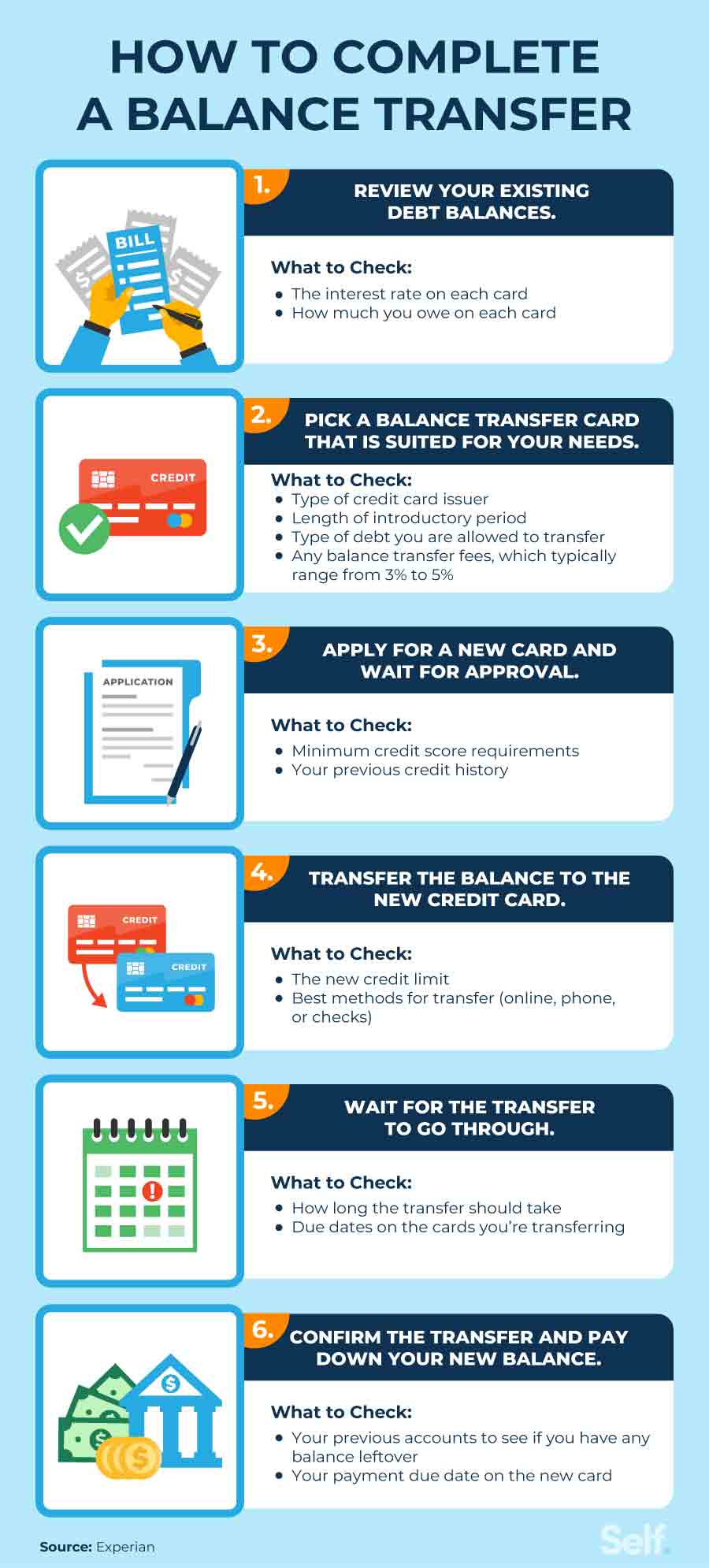

What is needed for a balance transfer credit card

You can apply for a balance transfer card online in a matter of minutes. To apply, you'll need to provide some basic personal and financial data, such as your name, address, Social Security number and income. In some cases, you can begin the process of transferring balances as part of your application.

Can I pay off a credit card with another credit card

You can't pay off one credit card with another. However, you may be able to transfer the balance to a new card, or take a cash advance. While these are two unique options, the balance transfer has far more potential to be a useful financial tool against credit card debt.

How hard is it to get a balance transfer

Balance transfer credit cards typically require good credit or excellent credit (scores 670 and greater) in order to qualify.

How much is too much for a balance transfer

Credit card balance transfers are often limited to an amount equal to the account's credit limit. You typically can't transfer a balance greater than your credit limit—and you won't know your credit limit until you're approved for the account.

Is it better to balance transfer or money transfer

A balance transfer card lets you move debt from your credit cards, whereas a money transfer card lets you move debt from your bank account. So, a money transfer card could be a useful option if you want to either: Pay off something that isn't credit card, such as an overdraft.

How many credit cards is too many to have open

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

How long does a balance transfer take

A balance transfer occurs when you move a balance from one credit card to another, and this process typically takes about five to seven days. But a word of warning: Some credit card issuers can take 14 or even 21 days to complete a balance transfer.

How many credit cards can you have before it hurts your credit

There isn't a set number of credit cards you should have, but having less than five credit accounts total can make it more difficult for scoring models to issue you a score and make you less attractive to lenders.

Is 20 credit cards too many

There's no such thing as a bad number of credit cards to have, but having more cards than you can successfully manage may do more harm than good. On the positive side, having different cards can prevent you from overspending on a single card—and help you save money, earn rewards, and lower your credit utilization.

How do I know if my balance transfer was approved

We recommend checking every couple of days to see if the original card issuer has received the funds. You'll typically see it reflected on your account just like a normal credit card payment.

Does it hurt your credit score to pay a credit card with another credit card

No credit score impact: balance transfers to one or more existing cards. Perhaps you have several credit cards open and are carrying a large balance on one of your cards with a high interest rate. If you move this balance to one or more of your other cards with a lower interest rate, your credit score won't be affected …

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.