Will I lose my benefits if I work 16 hours?

How much can I work before it affects my SSI

Be sure to tell us if your earnings drop, or if you stop working. If your only income is SSI and the money you make from your job, we don't count the first $85 of your monthly gross earnings. Each month, we reduce your SSI benefits 50 cents for every dollar that you earn over $85.

CachedSimilar

What is the most hours you can work on disability

Social Security typically allows up to 45 hours of work per month if you're self-employed and on SSDI. That comes out to around 10 hours per week. The SSA will also see whether or not you're the only person working for your business.

Cached

What would cause me to lose my disability benefits

If you start working, or your medical condition improves, or you change your living situation, your disability benefits could be terminated.

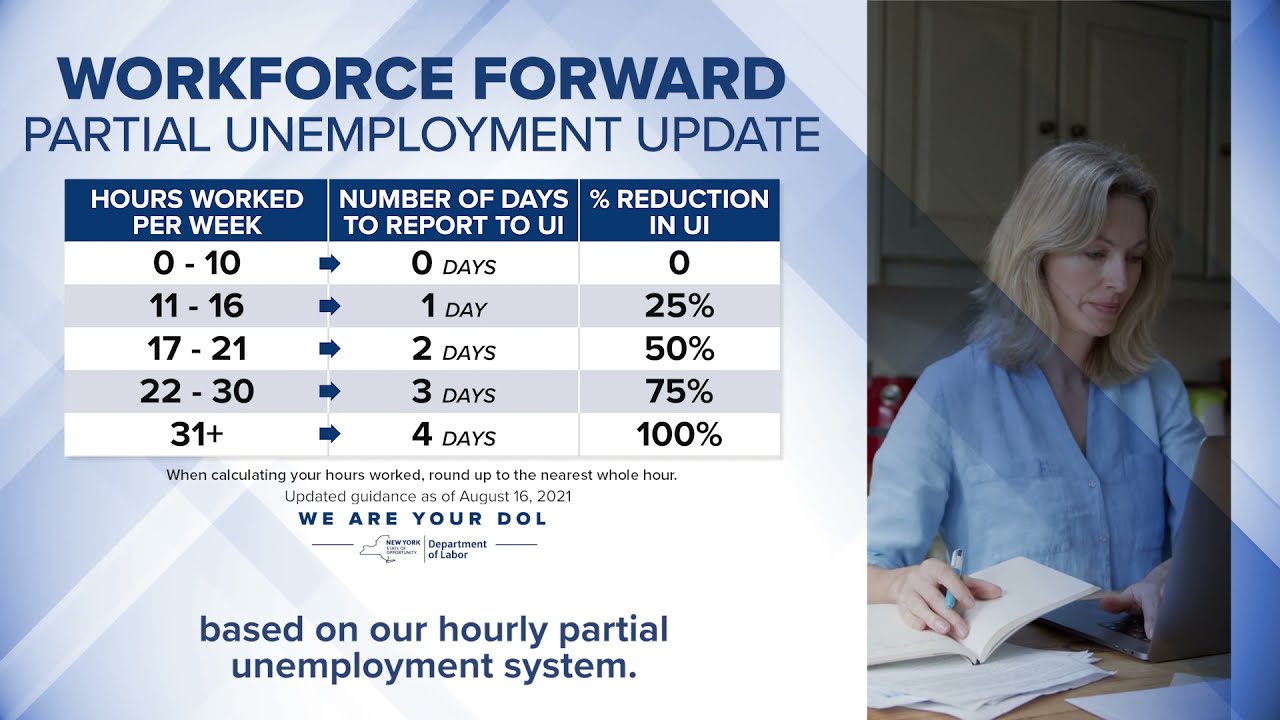

Can I get EDD if my hours are reduced

You may file a claim for UI benefits if you are out of work or your hours have been reduced. To be eligible to receive UI benefits, you must be out of work due to no fault of your own and be physically able to work, ready to accept work, and looking for work.

How much can I earn without affecting my SSI benefits

How much money can you make without it affecting your SSI You can generally make up to $20 in unearned income and/or up to $65 in earned income per month without your SSI benefits being affected.

Can I work and get SSI at the same time

Can You Work While Receiving Supplemental Security Income Yes. If you receive SSI, income from work performed each month will be deducted from your monthly SSI benefits. You should report any earned income to the Social Security Administration.

How many hours can you work and still collect Social Security

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

How do I get the $16728 Social Security bonus

To acquire the full amount, you need to maximize your working life and begin collecting your check until age 70. Another way to maximize your check is by asking for a raise every two or three years. Moving companies throughout your career is another way to prove your worth, and generate more money.

Is it hard to lose your SSDI benefits

Social Security rarely terminates disability benefits due to medical improvement, but you can lose your SSDI or SSI benefits because of other factors, like income. Although it's rare, there are circumstances under which the Social Security Administration (SSA) can end your disability benefits.

How many hours is considered part-time for EDD

The standard definition of full-time hours in California is between 32 and 40 hours per week. However, it's important to note that after the implementation of the ACA, workers are considered part-time if they work less than 30 hours per week, and full-time if they work 30 hours a week or more.

How many hours does EDD consider full-time

Since no standard workweek can be identified, 40 hours will be considered to be full-time work.

Does SSI track your spending

The SSI keeps your bank account in check because they need to monitor the money you carry inside of it constantly. Doing this is necessary because the money in your account can determine your eligibility. So yes, the money inside your bank account may disqualify you from Social Security disability benefits.

How much can I earn in 2023 without affecting my SSI

For 2023, the Supplemental Security Income (SSI) FBR is $914 per month for an eligible individual and $1,371 per month for an eligible couple. For 2023, the amount of earnings that will have no effect on eligibility or benefits for SSI beneficiaries who are students under age 22 is $8,950 a year.

How much can I earn without affecting my SSI

Further SSI Income and Asset Limit Considerations

Individuals can receive a maximum monthly federal SSI payment of $841 as of 2023, or $1,261 for a couple. And again, the income limit for an individual is $1,767, or $2,607 for a couple—if that income comes from wages. 3 Those numbers change annually too.

How much can I make a month without losing SSI

How much money can you make without it affecting your SSI You can generally make up to $20 in unearned income and/or up to $65 in earned income per month without your SSI benefits being affected.

What is the minimum work time for Social Security

10 years

Although you need at least 10 years of work (40 credits) to qualify for Social Security retirement benefits, we base the amount of your benefit on your highest 35 years of earnings.

Can you collect Social Security and work a full time job

You can take Social Security benefits while you're still working. If you're under your full retirement age, however, your benefits will be temporarily reduced. Once you reach full retirement age, there's no limit on how much you can earn while collecting full benefits.

How much can I earn while I’m on Social Security

If you will reach full retirement age in 2023, the limit on your earnings for the months before full retirement age is $56,520. Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits.

Can I work and receive Social Security benefits

You can get Social Security retirement or survivors benefits and work at the same time. But, if you're younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn't truly lost.

Why would Social Security disability benefits be suspended

Benefit suspensions occur when a beneficiary is no longer eligible for SSI benefits. For example, the person has amassed over $2,000 in resources, their work earnings exceed SGA, they are hospitalized for longer than 30 days, or they become incarcerated.