Will mortgage rates stay low through 2023?

Are mortgage interest rates going to go down in 2023

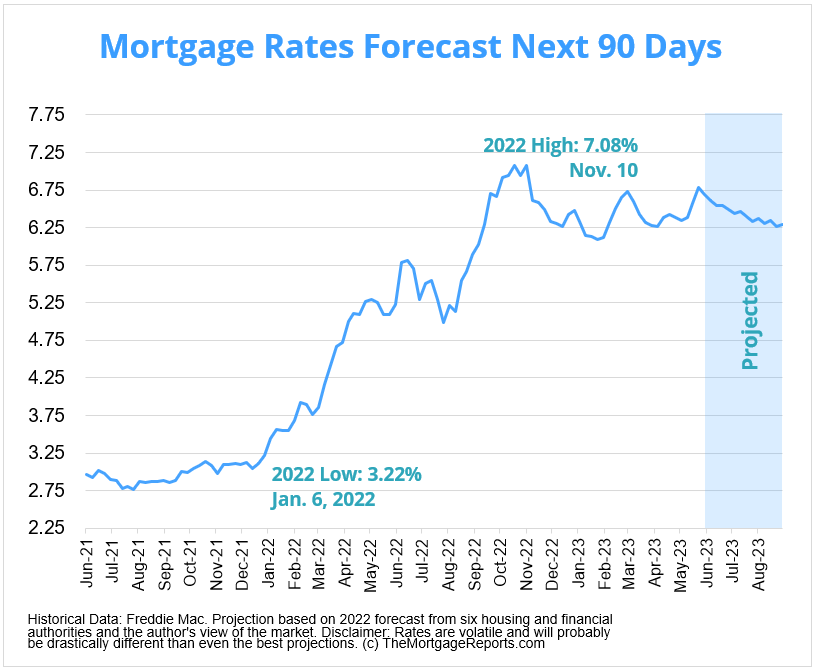

Mortgage rates could decrease next week (June 12-16, 2023) if the mortgage market takes a cautious approach to a possible recession. However, rates could rise if lenders account for the Federal Reserve taking measures to counteract inflation or if a global event brings economic uncertainty.

Cached

What are interest rates expected to be in 2023

The Mortgage Bankers Association predicts rates will fall to 5.5 percent by the end of 2023 as the economy weakens. The group revised its forecast upward a bit — it previously expected rates to fall to 5.3 percent. Meanwhile, Fannie Mae's Duncan expects rates to be in the “high 5s” by the end of 2023.

Cached

Will mortgage rates go down in 2023 or 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.

Cached

What will mortgage interest rates be in 2023 2024

Fannie Mae expects the 30-year fixed to ease to around 6.1% in the second quarter of 2023, before falling to 5.9% in the third quarter and 5.7% in Q4. And it gets even better than that. By the end of 2024, they expect the 30-year fixed to average 5.2%.

Will mortgage rates go down in October 2023

“We expect that 30-year mortgage rates will end 2023 at 5.2%,” the organization noted in its forecast commentary. It since has walked back its forecast slightly but still sees rates dipping below 6%, to 5.6%, by the end of the year.

How long will interest rates stay high

'I believe by the end of 2023 we will see rates start to fall with a target of between 2.5 to 3 per cent in 2024.

How high will mortgage interest rates go in 2023

“[W]ith the rate of inflation decelerating rates should gently decline over the course of 2023.” Fannie Mae. 30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast. National Association of Realtors (NAR).

How high will interest rates rise in 2023

14 months of rate hikes from the Fed

| Date | rate change | target rate |

|---|---|---|

| Dec. 13-14, 2023 | 0.50% | 4.25% – 4.5% |

| Jan. 31-Feb. 1, 2023 | 0.25% | 4.5% – 4.75% |

| March 21-22, 2023 | 0.25% | 4.75% – 5% |

| May 2-3, 2023 | 0.25% | 5% – 5.25% |

What will mortgage rates be by the end of 2023

Fannie Mae.

30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast.

Will mortgage rates ever go back to 3 percent

Even so, Evangelou doesn't expect mortgage rates to go back to 3% anytime soon but notes that even fixed mortgage rates below 6% will still be less than the historical average of roughly 8%. Other experts agree that rates will likely come down in the next few years.

Will interest rates go down to 3 again

In 2025, the bank predicted the rate to decline to 3%. Meanwhile, Scotiabank predicted as of 28 April the US interest rates to stay at 5.25% for 2023, and fall to 3.5% in 2024.

How long until interest rates go back down

"Possibly in 2024, but it will depend on the Fed's decisions about raising rates in the second half of the year," says Fleming. "And even if they do go down, it won't be back to the rates of yesteryear. 6% mortgage rates used to be normal, and that's more reasonable to expect too."

Will mortgage interest rates eventually go down

With U.S. home prices dropping and mortgage rates projected to dip sometime in 2024, homebuyers might be wondering if they should wait until next year to land a more affordable deal.

What is the mortgage rate forecast for the next 5 years

ING predicts rates to range from 5% in the second quarter of 2023, rising to 5.5% in the third quarter, and then falling back to 5% in the final quarter of the year. They also predict interest rates ranging between 3% and 4.25% in 2024, staying at 3% by the end of 2025.

How high will mortgage rates go in 2023

Freddie Mac chief economist Sam Khater. “[W]ith the rate of inflation decelerating rates should gently decline over the course of 2023.” Fannie Mae. 30-year fixed rate mortgage will average 6.4% for Q2 2023, according to the May Housing Forecast.

Will mortgage rates eventually go back down

Homes might be more affordable in 2024, but that doesn't mean you should wait to buy one. With U.S. home prices dropping and mortgage rates projected to dip sometime in 2024, homebuyers might be wondering if they should wait until next year to land a more affordable deal.

Will mortgage rates ever come back down

After home financing costs nearly doubled in 2023, some relief is in sight for potential homebuyers in 2023. The interest rate for a 30-year fixed-rate mortgage in the U.S. is expected to drop to 5.25% by the end of this year, according to a forecast by the financial services website Bankrate.

What year will interest rates go down again

1) Interest-rate forecast.

We project a year-end 2023 federal-funds rate of 4.75%, falling below 2.00% by mid-2025. That will help drive the 10-year Treasury yield down to 2.25% in 2025 from an average of 3.5% in 2023. We expect the 30-year mortgage rate to fall from an average 6.25% in 2025 to 4% in 2025.

Will mortgage rates go back down ever

“Will they go down to the same levels we saw in 2023 and 2023 Probably not. Rates may not go that low again for the foreseeable future.” Backing Helali's prediction is the Mortgage Bankers Association, which forecasts interest rates in the high-4% range at least through 2024.

Will mortgage rates ever go down to 3% again

Rates won't drop to 3%

After roughly two years of record-low mortgage rates, the 30-year rate last year increased at their fastest clip in over 50 years. Most of the rate hikes were due to the Federal Reserve's zealous fight against rampant consumer price growth.