Will my credit card charge a fee for sending money with Western Union?

Can I send money Western Union using my credit card

If your money is needed within minutes, you can send online using your credit or debit card. Receivers can pick up cash at Western Union locations worldwide, depending on the hours of operation at that location.

Does it cost to send money from credit card

Credit card companies usually charge a fee for balance and money transfers. This is often around 2-4% of the amount you're transferring, which will be added to your outstanding balance.

What is the fee to send $100 through Western Union

To send $100 from your bank account to their bank account still carries a significant fee of $14.00.

CachedSimilar

Can you send someone money with a credit card

Can I send money with a credit card Yes. There are several platforms you can use to send money with a credit card, from PayPal to Venmo. However, these apps and services charge a fee that is typically a percentage of the amount transacted.

Cached

Why won t Western Union accept my credit card

Your bank may decline your payment due to: Insufficient funds in your bank account. Unusually large payment exceeding your bank limits. Your card may not be enrolled for secure authentication.

What credit card accepted by Western Union

westernunion.com, mobile app, and Agent locations

Western Union accepts Visa®, MasterCard®, and Discover® credit cards*.

What is the easiest way to send money with a credit card

Here are the top 4 ways to send money to your friends using a credit card:Cash App.PayPal.Venmo.Amazon Pay.

How can I get cash from my credit card without charges

The following are some of the best ways to do it:Get a Credit Card with No Cash Advance Fees. A few credit cards in the Indian market come with zero cash advance fees.Pay Your Credit Card Bills Soon To Avoid Interest.Try Alternate Methods Rather Than Direct Cash Withdrawals.

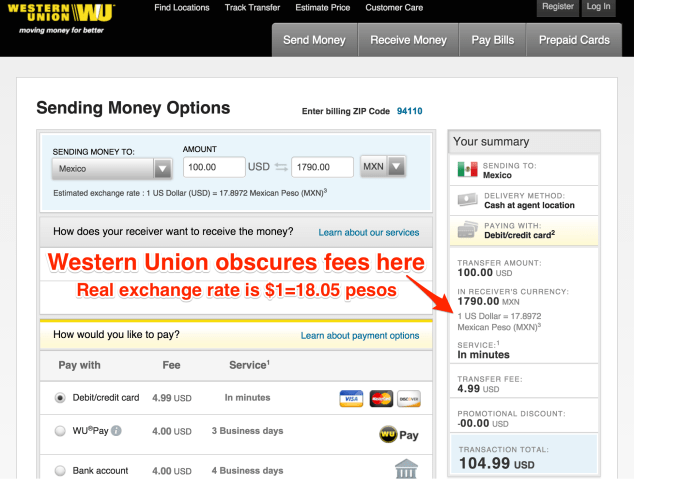

How can I avoid Western Union fees

To avoid these fees or for reduced fees, use a debit card or check other payment methods.

Is there a cheaper way to send money than Western Union

Remitly is a US-based digital remittance app that's very often the fastest and cheapest money transfer app on Monito. Like Western Union, Remitly offers various pay-in and pay-out options and supports currency transfers to over 85 countries worldwide, but unlike Western Union, it's often 2 to 5 times cheaper!

Is using a credit card for Western Union a cash advance

It's worth noting that paying for a Western Union money transfer with a credit card is considered a cash advance, making it a very costly transaction. Your credit card issuer will charge you a cash advance fee and a higher interest rate than normal.

What is the best way to pay someone cash from a credit card

The 3 best options are Venmo, PayPal, and Cash App. All of these charge fees for credit card transactions, but it could be worth it if you are using the card to earn a welcome bonus.

What is the easiest way to get cash from a credit card

If you need to take money out of a credit card at an ATM, here's how to request a cash advance:Insert your credit card into an ATM.Enter your credit card PIN.Select the “cash withdrawal” or “cash advance” option.Select the “credit” option, if necessary (you may be asked to choose between checking, debit or credit)

Can I cash out money from credit card

It's called a cash advance, and it comes with some major downsides and hefty fees. Cardholders can use a credit card at nearly any ATM and withdraw cash as they would when using a debit card, but instead of drawing from a bank account, the cash withdrawal shows up as a charge on a credit card.

How much is Western Union fee per transaction

Up to $30 per transfer for domestic transfers. Varies for international transfers. Up to $16.00 per transfer. Before initiating a transfer, use a bank or transfer service's online calculator (if available) to estimate your money transfer fees and international money transfer fees.

Is it cheaper to send money through bank or Western Union

Western Union is typically cheaper than a bank but is still more expensive than other money transfer providers.

Is it cheaper to send money through Walmart or Western Union

Given its clear pricing structure, you'll definitely save with Walmart2Walmart. But you're limited to in-person store-to-store transfers of $2,500 or less. With Western Union, you'll pay more — though how much more depends on many factors, but you can send money online and worldwide.

What’s the cheapest way to send money to someone

A transfer paid by bank account directly tends to be a much cheaper (and much slower) transfer. If you need money delivered quickly, use a debit card, which will also incur a lower fee than using a credit card.

Is a credit card considered a cash advance

A credit card cash advance is a withdrawal of cash from your credit card account. Essentially, you're borrowing against your credit card to put cash in your pocket. However, there are costs to taking a credit card cash advance and, in some cases, limits on the amount you can withdraw.

Where can you use a credit card to send money

PayPal: For personal transactions, meaning sending money to friends and family, you'll pay a fee of 2.9% of the transfer, plus a fixed fee of 30 cents. Venmo: There's a 3% fee when you send money to others using your credit card. If you use the Venmo Credit Card to send money, that fee is waived through Dec. 31, 2023.