Will my credit score go down if I add an authorized user?

Why did my credit score drop when I was added as an authorized user

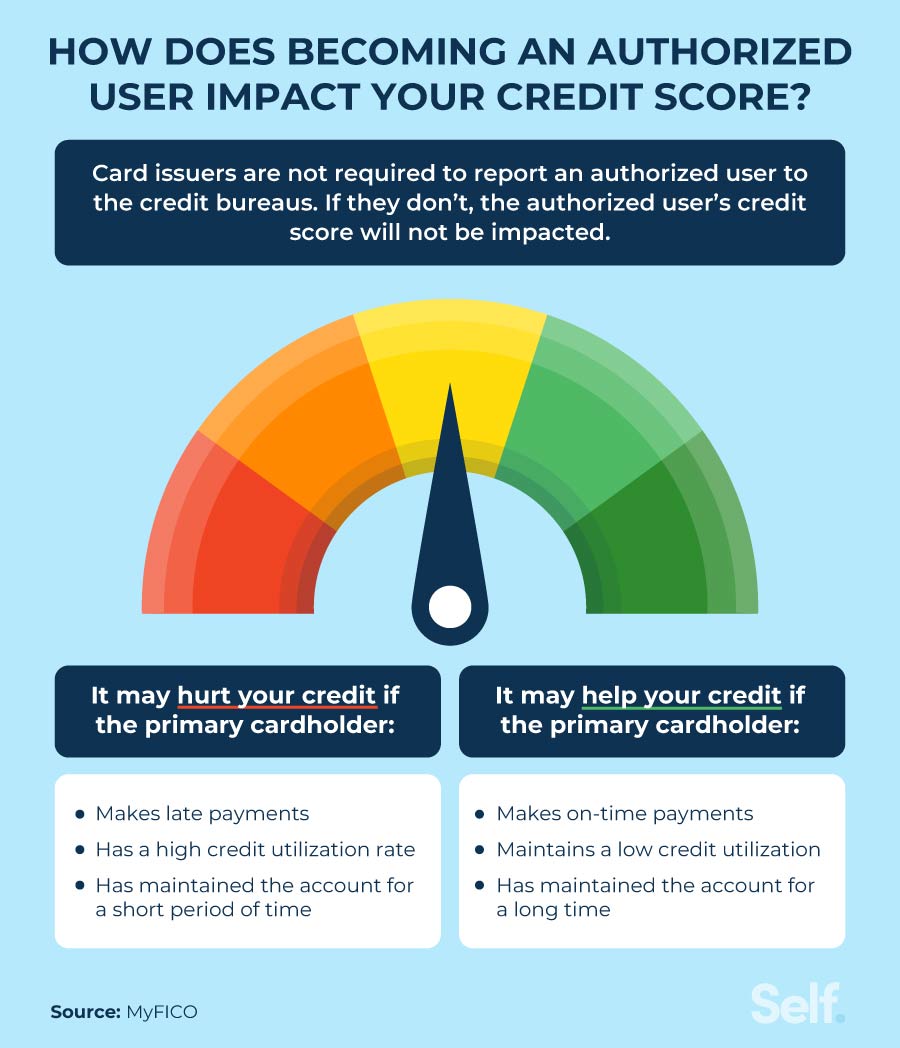

If you've added an authorized user to your credit card account, they'll typically get a credit card linked to your account and can use it to make charges, but they're not responsible for paying the balance. Any charges the authorized user makes can increase your credit utilization, which can lower your credit scores.

Will my score drop if I add an authorized user

If your credit card company doesn't report authorized users, adding them to your account will have no impact on their credit score. If, on the other hand, your credit card company does report authorized users, it can help them start building up credit.

Cached

Will my credit score go down if I add an authorized user with bad credit

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

Cached

How much will my credit score go up if I am added as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

Cached

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

How quickly does adding an authorized user affect their credit

If the card issuer reports to the bureaus, then the account will typically show up on your credit reports within 30 to 45 days. But keep in mind that not all issuers report to all three bureaus — and if they do, the timing of when issuers report to credit bureaus can vary.

How much will piggybacking raise my score

The only good news is that mortgage loans still use the older Fico scoring models. Therefore, piggybacking credit still works to boost your score when applying for a mortgage. Piggybacking credit can be a great tool to use to boost your Fico score by 100 or more points, in just a few days.

Will adding my child as an authorized user help his credit

Will adding my child as an authorized user help his or her credit Yes, adding children as authorized users can help their credit scores. It's up to the primary cardholder to maintain a healthy credit score so the authorized users can reap the benefits.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why did my credit score drop 37 points for no reason

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

How to increase credit score by 400 points

4 tips to boost your credit score fastPay down your revolving credit balances. If you have the funds to pay more than your minimum payment each month, you should do so.Increase your credit limit.Check your credit report for errors.Ask to have negative entries that are paid off removed from your credit report.

Is piggybacking credit illegal

Piggybacking is not illegal. In fact, under the Equal Credit Opportunity Act, Congress determined that authorized users cannot be denied on existing credit accounts. This rule applies even if the person being authorized is a stranger.

Do authorized users build credit as well

Being added as an authorized user on another person's card may help you establish a credit history or build your credit. Yet cardholders and authorized users' on-time, late or missed payments will be added to both parties' credit reports, so it's important that cardholders and authorized users see eye to eye.

Can I add my 3 year old to my credit card

Most credit card issuers allow children under 18 years to be added as authorized users on a credit card and some don't have any age restrictions whatsoever. Adding your kids as authorized users on your credit cards may seem counterintuitive to the concept of financial independence.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How can I raise my credit score 40 points fast

Here are six ways to quickly raise your credit score by 40 points:Check for errors on your credit report.Remove a late payment.Reduce your credit card debt.Become an authorized user on someone else's account.Pay twice a month.Build credit with a credit card.

Why is my credit score going down if I pay everything on time

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

Can I build my credit by being an authorized user on a credit card

Being added as an authorized user on another person's card may help you establish a credit history or build your credit. Yet cardholders and authorized users' on-time, late or missed payments will be added to both parties' credit reports, so it's important that cardholders and authorized users see eye to eye.

Will putting my daughter on my credit card help her credit

Adding your child as an authorized user can help establish their credit history. Once they're added to the account (or once they turn 18, depending on the card issuer), the account's entire history will be added to their credit reports.