Will my credit score go down if I am no longer an authorized user?

Will my credit score go down if I removed as an authorized user

Your credit score may either improve or drop slightly when you are removed as an authorized user on a credit card. That is because the account history for the credit card will automatically drop off your credit reports upon removal.

Cached

What happens when I stop being an authorized user

The account will no longer appear on your credit report, and its activity will not be factored into your credit scores. That also means that your length of credit history, which constitutes 15% of your FICO® Score, will be affected.

Cached

Does your credit score change if you’re an authorized user

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

Cached

How long does it take for authorized user to be removed on credit report

Call the issuer and ask to have your name removed as an authorized user. It should take only a few days, and the issuer will cease making reports under your name to credit bureaus. At some point, that account should vanish from your report entirely.

Why did my credit score drop when I was added as an authorized user

If you've added an authorized user to your credit card account, they'll typically get a credit card linked to your account and can use it to make charges, but they're not responsible for paying the balance. Any charges the authorized user makes can increase your credit utilization, which can lower your credit scores.

How much will my credit score increase as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

Is there a downside to being an authorized user

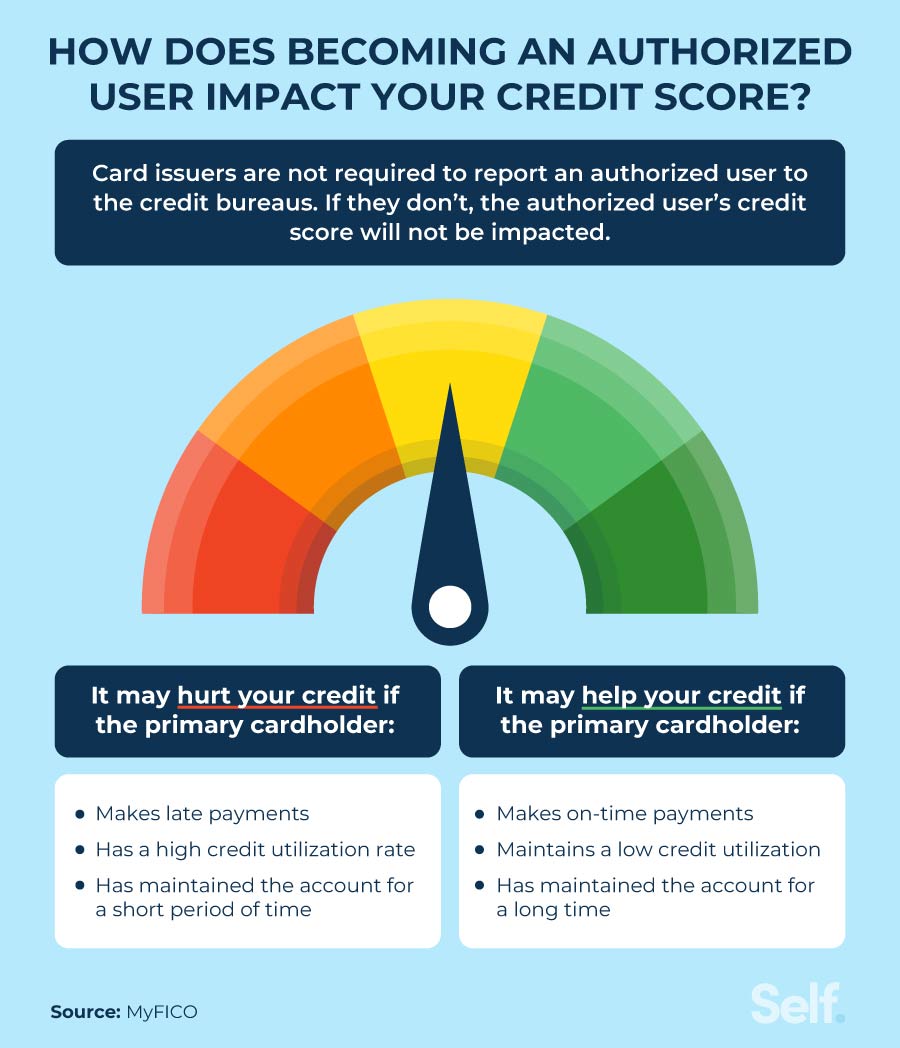

Just know that becoming an authorized user comes with some risk, since you don't control the account. If the primary account holder doesn't pay their bill, has too high of a balance or closes their account altogether, your credit can be negatively impacted.

How many points does your credit score go up as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

Can you remove an authorized user at any time

The primary cardholder is taking a risk whenever adding someone to an account. Make sure to discuss a spending and payment plan before going forward. If the primary cardholder wants to remove the authorized user for any reason, they can do so at any time, for any reason. Simply log in online or call the issuer.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

How did my credit score drop 50 points

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

How much will piggybacking raise my score

The only good news is that mortgage loans still use the older Fico scoring models. Therefore, piggybacking credit still works to boost your score when applying for a mortgage. Piggybacking credit can be a great tool to use to boost your Fico score by 100 or more points, in just a few days.

Is it better to have your own credit card or be an authorized user

Lenders checking your credit history want to see that you've managed your own credit accounts responsibly. Ultimately, being the primary account holder on a credit account will have a bigger impact on your credit score than being an authorized user.

Does a maxed out credit card hurt an authorized user

You can hurt an authorized user's credit score: A primary cardholder's actions can affect the credit score or reports of an authorized user. If you've added a user to your account but have maxed out your credit card or fallen behind on payments, you could hurt their credit score in addition to your own.

Can an authorized user hurt my credit

Does adding an authorized user hurt your credit Adding an authorized user to your credit card account alone shouldn't have a negative impact on your credit. But keep in mind that if that person uses your credit in a way that hurts your financial situation, negative credit impact could follow.

Why did my credit score drop 70 points after paying off debt

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

Why is my credit score dropping if I m paying everything on time

A short credit history gives less to base a judgment on about how you manage your credit, and can cause your credit score to be lower. A combination of these and other issues can add up to high credit risk and poor credit scores even when all of your payments have been on time.

Why did my credit score drop by 60 points

Your credit score may have dropped by 60 points because negative information, like late payments, a collection account, a foreclosure or a repossession, was added to your credit report. Credit scores are based on the contents of your credit report and are adversely impacted by derogatory marks.

What are the cons of piggybacking credit

Pros and cons of for-profit piggybacking

Of course, the major con with the for-profit option is that it costs money. Also, the other person may start with good credit, but that may change once you're added as an authorized user. Additionally, using for-profit piggybacking could increase your risk of identity theft.

Is piggybacking credit illegal

Piggybacking is not illegal. In fact, under the Equal Credit Opportunity Act, Congress determined that authorized users cannot be denied on existing credit accounts. This rule applies even if the person being authorized is a stranger.