Will my credit score go down if I remove myself as an authorized user?

Why did my credit score drop when I was added as an authorized user

If you've added an authorized user to your credit card account, they'll typically get a credit card linked to your account and can use it to make charges, but they're not responsible for paying the balance. Any charges the authorized user makes can increase your credit utilization, which can lower your credit scores.

How long does it take for authorized user to be removed on credit report

Call the issuer and ask to have your name removed as an authorized user. It should take only a few days, and the issuer will cease making reports under your name to credit bureaus. At some point, that account should vanish from your report entirely.

Cached

Can I remove myself as an authorized user credit one

If you are removing yourself as an authorized user

Step 1: Call your credit card company's customer service number (found on the back of your card) and ask to be removed as an authorized user on the account. Depending on the issuer, you may be able to do this through your online account or via the company's mobile app.

Can I remove myself from a joint credit card

Unlike a credit card with an authorized user, you generally cannot simply remove one name from a joint credit card. Most issuers will require you to close the account.

How did my credit score drop 50 points

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Can an authorized user hurt my credit

Does adding an authorized user hurt your credit Adding an authorized user to your credit card account alone shouldn't have a negative impact on your credit. But keep in mind that if that person uses your credit in a way that hurts your financial situation, negative credit impact could follow.

How much will my credit score go up as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

Can you remove an authorized user at any time

The primary cardholder is taking a risk whenever adding someone to an account. Make sure to discuss a spending and payment plan before going forward. If the primary cardholder wants to remove the authorized user for any reason, they can do so at any time, for any reason. Simply log in online or call the issuer.

Can I take my name off of a joint account by myself

Once a person has agreed to become a joint owner or signer on a checking, savings, or credit card, they can't be removed from the account. If you want an account in your name only, you'll need to close the account and apply for a new one.

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Why did my credit score drop 700 points

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why did my credit score drop 70 points after paying off debt

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

How much does removing an authorized user affect their credit

Removing an authorized user will not directly impact your credit score. That is because the number of people that you have authorized to use your credit accounts does not appear anywhere on your credit report.

How much will my credit score increase as an authorized user

Being added as an authorized user will not have a significant impact on your credit score, because you're not responsible for paying the bills.

Do authorized users build credit as well

Being added as an authorized user on another person's card may help you establish a credit history or build your credit. Yet cardholders and authorized users' on-time, late or missed payments will be added to both parties' credit reports, so it's important that cardholders and authorized users see eye to eye.

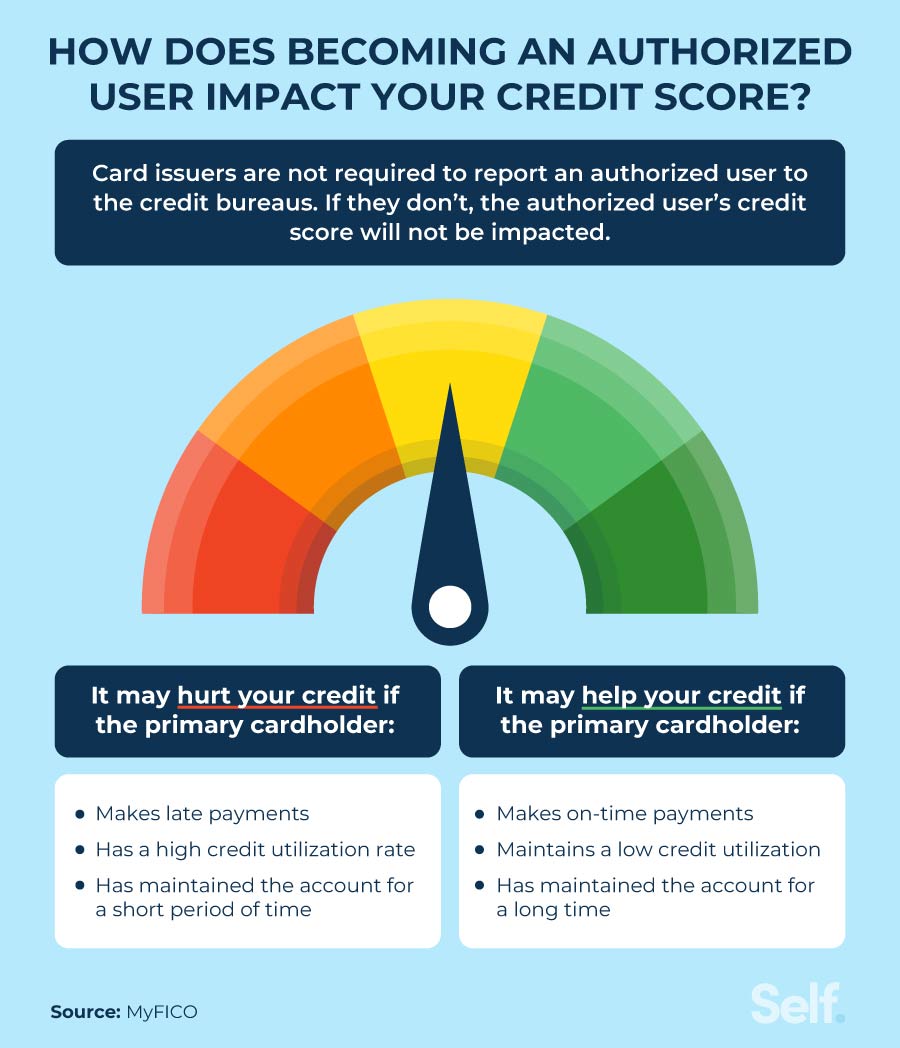

Does being an authorized user hit your credit

Being an authorized user on a credit card could affect your credit positively if the account holder makes on-time payments and keeps the credit utilization rate low. If they don't, your credit could take a hit.

Will removing a credit card hurt my credit score

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Can I take my name off a joint account without the other person

Generally, no. In most cases, either state law or the terms of the account provide that you usually cannot remove a person from a joint checking account without that person's consent, though some banks may offer accounts where they explicitly allow this type of removal.