Will my credit score go up if I remove myself as an authorized user?

Will removing myself as an authorized user affect my credit score

Summary. Removing yourself as an authorized user can lower your credit utilization ratio and the age of your credit history, both of which can have a negative impact on your credit score.

Cached

What happens to someone’s credit if I remove them as an authorized user

If the card in question has been well maintained with on-time payments and low credit utilization, removing the authorized user from the account will effectively erase that positive payment history from their credit report.

Cached

How long does it take for authorized user to be removed on credit report

Call the issuer and ask to have your name removed as an authorized user. It should take only a few days, and the issuer will cease making reports under your name to credit bureaus. At some point, that account should vanish from your report entirely.

Why did my credit score drop when I was added as an authorized user

If you've added an authorized user to your credit card account, they'll typically get a credit card linked to your account and can use it to make charges, but they're not responsible for paying the balance. Any charges the authorized user makes can increase your credit utilization, which can lower your credit scores.

Does removing an authorized user hurt

Removing an authorized user will not directly impact your credit score. That is because the number of people that you have authorized to use your credit accounts does not appear anywhere on your credit report.

How many points does being an authorized user affect credit

Being an Authorized User Might Not Impact Your Credit

Credit scoring models only consider information that's currently on your credit report—nothing more and nothing less. So, in order for a credit card to affect your scores, it must show up on your credit reports with Equifax, TransUnion and Experian.

Can I remove myself from a joint credit card

Unlike a credit card with an authorized user, you generally cannot simply remove one name from a joint credit card. Most issuers will require you to close the account.

Can you remove an authorized user at any time

The primary cardholder is taking a risk whenever adding someone to an account. Make sure to discuss a spending and payment plan before going forward. If the primary cardholder wants to remove the authorized user for any reason, they can do so at any time, for any reason. Simply log in online or call the issuer.

How fast will my credit score go up as an authorized user

Authorized user accounts must show up on your credit report to affect your credit score. If they do, you might see your score change as soon as the lender starts reporting that information to the credit bureaus, which can take as little as 30 days.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

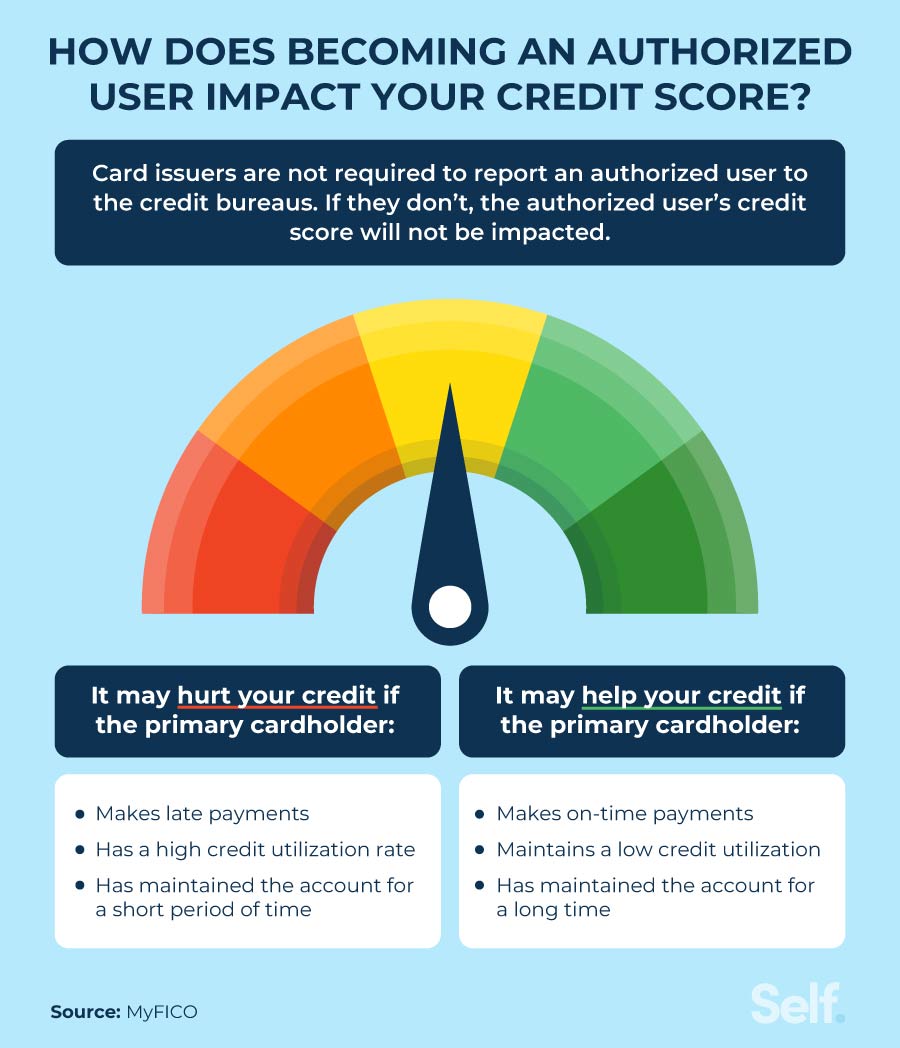

Is there a downside to being an authorized user

Just know that becoming an authorized user comes with some risk, since you don't control the account. If the primary account holder doesn't pay their bill, has too high of a balance or closes their account altogether, your credit can be negatively impacted.

How much will piggybacking raise my score

The only good news is that mortgage loans still use the older Fico scoring models. Therefore, piggybacking credit still works to boost your score when applying for a mortgage. Piggybacking credit can be a great tool to use to boost your Fico score by 100 or more points, in just a few days.

Does a maxed out credit card hurt an authorized user

You can hurt an authorized user's credit score: A primary cardholder's actions can affect the credit score or reports of an authorized user. If you've added a user to your account but have maxed out your credit card or fallen behind on payments, you could hurt their credit score in addition to your own.

Can I take my name off of a joint account by myself

Once a person has agreed to become a joint owner or signer on a checking, savings, or credit card, they can't be removed from the account. If you want an account in your name only, you'll need to close the account and apply for a new one.

Is it better to cancel unused credit cards or keep them

It is better to keep unused credit cards open than to cancel them because even unused credit cards with a $0 balance will still report positive information to the credit bureaus each month. It is especially worthwhile to keep an unused credit card open when the account does not have an annual fee.

Will removing a credit card hurt my credit score

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

How long does piggybacking credit take

How Long Does Piggybacking Credit Take Before I See the Tradelines on My Credit Report The account you are piggybacking on can show up on your credit report in as little as 11 days, depending on several factors relating to the particular tradeline.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

What causes your credit score to drop 100 points

Reasons why your credit score could have dropped include a missing or late payment, a recent application for new credit, running up a large credit card balance or closing a credit card.

When should I stop being an authorized user

There are a few reasons you'd want to be removed as an authorized user. If having the account on your credit report is hurting your credit score and your ability to be approved for other credit cards and loans, removing yourself from the credit card allows you to have the account removed from your credit report.