Will Upstart let you skip a payment?

Can you skip an Upstart payment

If a borrower fails to pay the full monthly payment amount within 10 calendar days of its due date, Upstart charges a late fee equal to 5% of the past due amount or $15, whichever is greater.

Cached

Can I defer Upstart

Upstart offers relief options for people experiencing financial difficulty. Utilizing the Grace Period: With every due date, you automatically receive a 15 day grace period.

Cached

Can you skip a month of loan payment

Not all lenders allow payment deferrals. Whether you skip a full payment or make a reduced one, it is important to know that you are still liable for the outstanding balance to your lender. Your lender will add that amount to the end of your loan, during which time your account continues to accrue interest.

Can you make partial payments to Upstart

Yes, you can make your monthly payment in two installments. Recurring: You can schedule two automatic recurring payments per month. Automatic recurring payments will occur on the same day every month.

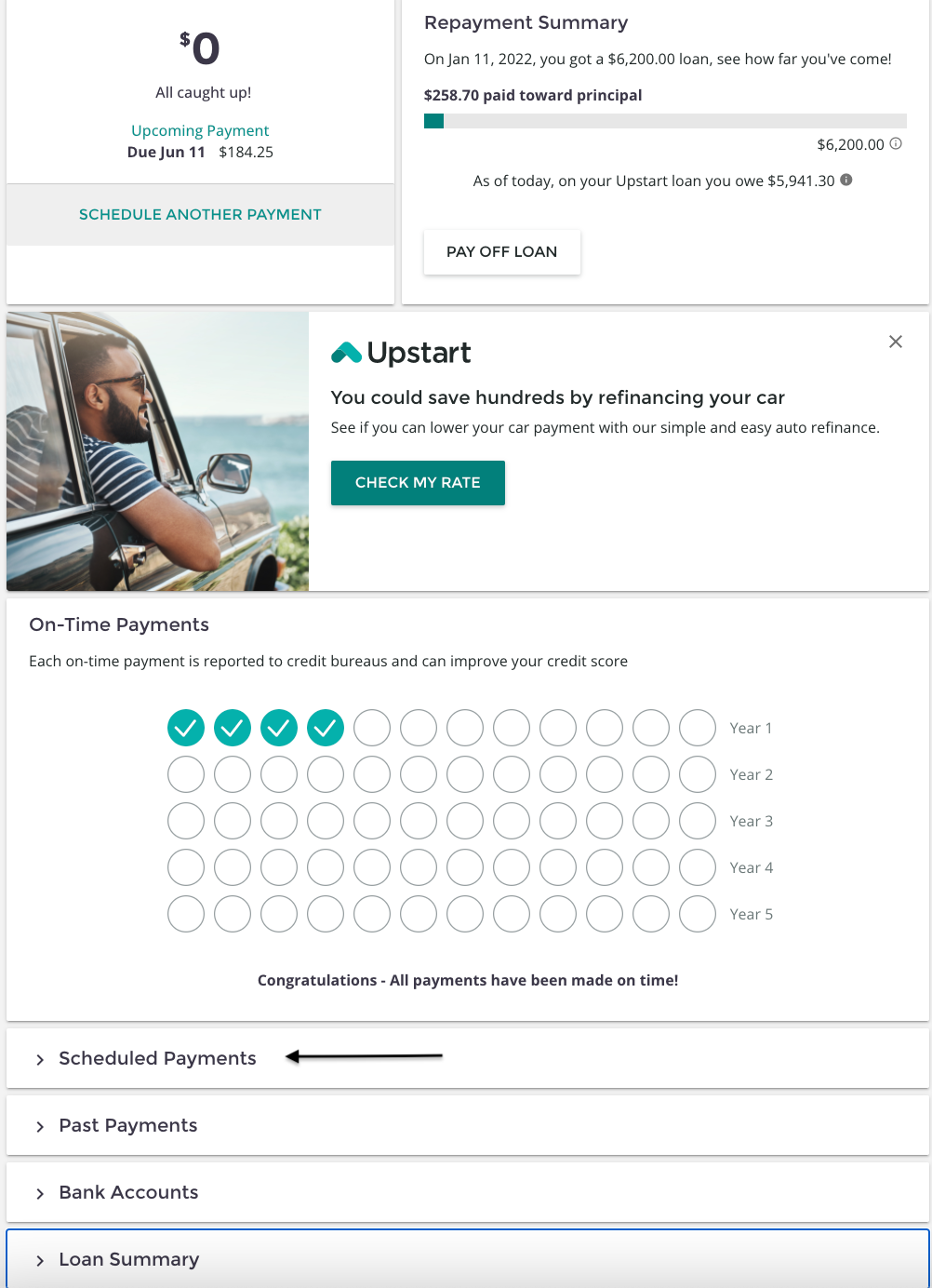

How do I reschedule my Upstart payment

The due date, which is stated in the dashboard and your promissory note, cannot be changed unless you meet the eligibility requirements. However, you can change your monthly payment date by logging into the dashboard, and clicking “Add/Edit Recurring Payments.”

How do I ask my loan to skip a payment

Some lenders offer loan forbearance in times of crisis. A forbearance gives you a temporary pause on payments while you are experiencing hardship. You'll have to contact your lender directly to request a forbearance because in most cases, this is not something that a lender will automatically offer or grant.

Is deferring a loan payment bad

For example, depending on the type of loan, it may continue to accrue interest while it's deferred. That means you'll end up paying more money in the long run. However, if deferring your loans means you will avoid defaulting, paying late fees, and hurting your credit score, the extra interest may still be worth it.

Does deferring a payment hurt credit

Deferments do not hurt your credit score. Unlike simply missing a payment or paying it late, a deferred payment counts as “paid according to agreement,” since you arranged it with your lender ahead of time. That's especially important if you're already in the kind of emergency that would call for a deferment.

What are the payment options for Upstart

You can make payments via one time ACH, recurring ACH, or check. Check instructions are also available in your dashboard under "pay by check". You can also set up one-time or recurring payments through your dashboard as well.

Does Upstart allow principal only payments

After you make your regular payment, you can then apply principal payments. Any principal-only payment on a loan is considered an additional payoff on the balance.

Can I skip a payment with upgrade

Consequences of Not Paying an Upgrade Personal Loan

If you don't make your monthly payment on time, you will be charged a late fee of $10 (after 15-day grace period). Upgrade does have a 15 day grace period, which means you will not be charged a fee unless your payment is more than 15 days past-due.

Can you reschedule a loan payment

Debt rescheduling refers to restructuring the terms of an existing loan. The debt can be rescheduled as follows: Reduce payment amounts by extending the payment period and increasing the number of payments.

What happens if you arrange with the lender to skip a payment

Skipping a payment doesn't mean skipping out on interest!

The good news is that accepting an offer to skip your payments won't negatively affect your credit. As long as you make any upcoming payments as required by the lender, your credit will show that you're paying as agreed.

Can I put my loan payments on hold

If your lender allows it, a personal loan deferment is one of the best options because it allows you to temporarily stop making payments while you get back on your feet. Personal loan deferment has its limits, though, so it's important to understand how it works so you can use it without getting into deeper trouble.

Is skipping a loan payment a good idea

A skip payment option does not shorten the term of your loan, but rather extends it and could result in you paying more interest over the life of the loan. That is because interest continues to accrue on the unpaid balance during the time period the payment is skipped.

How many times can you defer a payment

They may allow just one deferment or multiple deferments. The amount of times you can defer your car loan largely depends on the language in your loan contract. Your lender could limit how many times you can defer your loan by year, or by the overall loan term.

How many months can you defer a payment

Most lenders allow car loan payment deferment for up to three months. Very few lenders allow you to skip payments for as long as six months.

How do I change my due date on Upstart

The due date, which is stated in the dashboard and your promissory note, cannot be changed unless you meet the eligibility requirements. However, you can change your monthly payment date by logging into the dashboard, and clicking “Add/Edit Recurring Payments.”

How to negotiate with Upstart

Unfortunately, you cannot negotiate the loan terms or the rate you are offered. Your rate is generated based on the details that you entered into your application along with your soft credit pull.

How bad is 30 days late

A late payment can drop your credit score by as much as 180 points and may stay on your credit reports for up to seven years. However, lenders typically report late payments to the credit bureaus once you're 30 days past due, meaning your credit score won't be damaged if you pay within those 30 days.