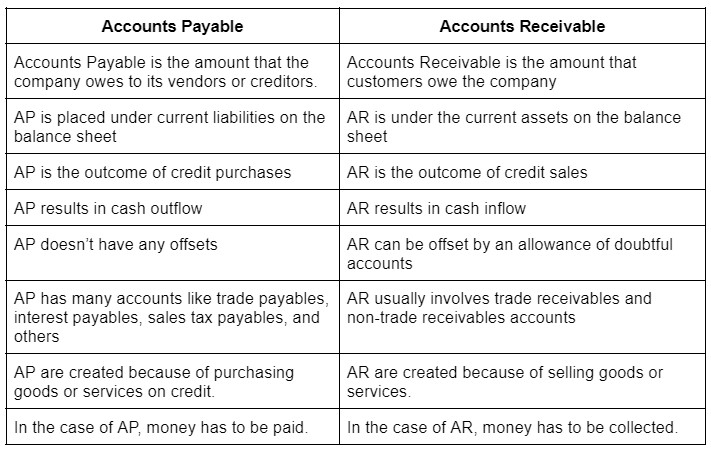

What is the difference between account receivable and account payable?

What is an example of accounts payable and receivable

For example, a distributor may buy a washing machine from a manufacturer, which creates an account payable to the manufacturer. The distributor then sells the washing machine to a customer on credit, which results in an account receivable from the customer.

Cached

What is an example of an account payable

Accounts payable are bills a company must pay. It's the money a business owes suppliers for provided goods and services. Some examples of accounts payable include cleaning services, staff uniforms, software subscriptions, and office supplies. Accounts payable does not include payroll.

What are accounts receivable examples

Some common examples of receivables include sales made on credit, unpaid invoices, and money owed to the company by its customers. Credit card payments are also considered a form of receivable, as it can take a day or two for the payment to be transferred from the customer's account to the company's account.

What is the difference between accounts receivable and accounts payable quizlet

Accounts Payable are the current bills a business owes to suppliers. Money owed a business enterprise for merchandise bought on open account. It is also called "A/R" or just "Receivables". Accounts Receivable are the amounts owed to a company by its customers and/or employees.

What is accounts receivable for dummies

Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. This money is typically collected after a few weeks and is recorded as an asset on your company's balance sheet. You use accounts receivable as part of accrual basis accounting.

Can AP and AR be done by the same person

In most cases small companies start out with AR and AP being done by the same person. That person has all the information at their fingertips so they can make instant cash flow related decisions regarding collections and payments.

What falls under accounts payable

Accounts payable (AP) refer to the obligations incurred by a company during its operations that remain due and must be paid in the short term. As such, AP is listed on the balance sheet as a current liability. Typical payables items include supplier invoices, legal fees, contractor payments, and so on.

Is account payable an asset or liability

current liability

Accounts payable is considered a current liability, not an asset, on the balance sheet. Individual transactions should be kept in the accounts payable subsidiary ledger.

Is accounts payable an asset or liability

Accounts payable is considered a current liability, not an asset, on the balance sheet.

What is the role of accounts payable and receivable

The accounts payable and receivable clerks work in the financial department. They are responsible for recording, computing, and classifying the revenue data to ensure a complete financial record.

What is the difference between receivables and accounts receivable

What's the difference between trade receivables vs accounts receivable The terms 'trade receivables' and 'accounts receivable' generally mean the same. Both represent the amount of money customers owe a business for the goods or services they've received.

Is accounts payable a debit or credit

Is Accounts Payable a Debit or Credit Entry Since accounts payable is a liability, it should have credit entry. This credit balance then indicates the money owed to a supplier. When a company pays their supplier, the company needs to debit accounts payable so that the credit balance can be decreased.

Do I send an invoice to accounts payable or receivable

Is invoicing accounts payable or receivable If your company is paying an invoice to another company (such as in B2B), it will be noted in accounts payable. Invoices collect payment after a company delivers goods or services to its customers.

How do you reconcile AP and AR

The easiest way to reconcile the aging to the control account is to create a transaction report for the AR or AP control account and group it by Account. The accounting period filter should be all accounting periods less than or equal to the current period.

What are the 4 functions of accounts payable

Calculating, posting business transactions, invoice processing, verifying financial data for use in maintaining records.

Is accounts payable a liability or debt

Accounts payable is short-term debt that a company owes to its suppliers for products received before a payment is made. Accounts payable may be abbreviated to “AP” or “A/P.” Accounts payable may also refer to a business department of a company responsible for organizing payments on such accounts to suppliers.

What are the 4 types of account receivable

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

Is accounts receivable a debit or credit

Accounts receivable is a debit, which is an amount that is owed to the business by an individual or entity. In this article, we explore how receivables work in a business, how accounts receivable processes ensure customers pay promptly, and how quicker payments can benefit your business.

Who pays bills accounts payable or receivable

Difference between accounts payable and accounts receivable

Whereas accounts payable represents money that your business owes to suppliers, accounts receivable represents money owed to your business by customers.

Should AR and AP be separated

Segregation of duties is important in both accounts receivable and accounts payable. Also known as separation of duties, using these internal controls helps to mitigate potential errors, reduce the occurrence of fraud, and ensure accuracy.